The EURUSD pair is still capped below 1.0900. One of the reasons is definitely opposite fundamental reasoning between ECB and FED. Draghi implied that the next round of QE could come in December while Yellen gave a possible hint for a rate hike in December. Market is expecting good NFP numbers but we can never be sure about the exact number until we see the actual result.

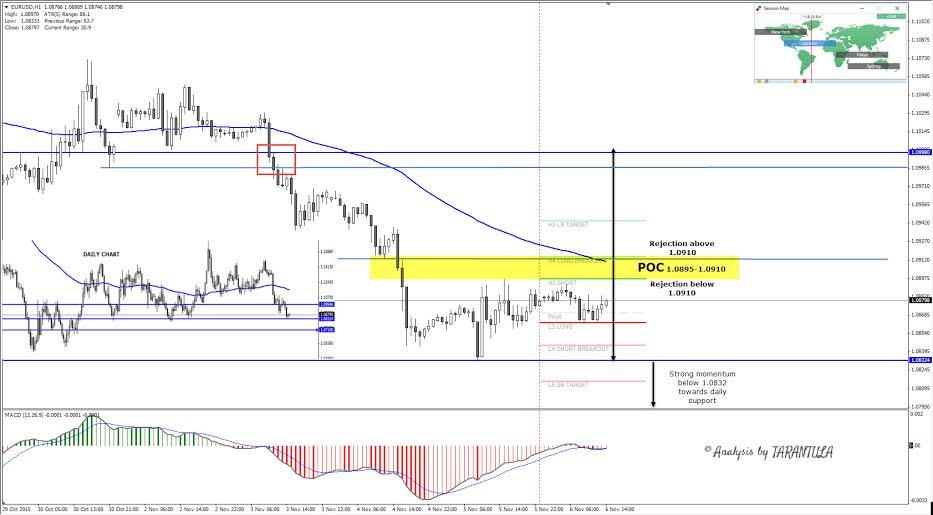

We need to pay attention to technical, that is why I have included an overlay of daily chart. Typically for PRE NFP movement, volatility dries off and pairs are ranging. Due to low ATR (88 pips –last 5 days) Daily Pivot points are very close so we need to pay attention to Daily Price Support and Resistance (manually drawn horizontal levels of support and resistance/historical buyers and sellers). POC comes in 1.0895-1.0910 zone (H3/H4 , EMA 89, now moment sellers) and strong rejection above 1.0910 (or T-89 pattern) will propel the pair up to 1.0945 and 1.0985-1.0998 where we see historical sellers and RETEST point (red rectangle). I expect sellers to show in the zone if the pair rallies.

While EURUSD is capped below 1.0910 the POC should reject the pair towards 1.0830 IMPORTANT daily support. If EURUSD proceeds below 1.0830 with a strong momentum next target is 1.0815 and 1.0710. 1.0710 is DAILY historical support and it could be reached if EURUSD drops below 1.0830 and 1.0815. Pay attention to NFP Friday but also NFP Monday as the price usually follows up.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.