US Retail Sales September Preview: It's about employment

- Retail sales expected to rise 0.5% in September.

- Control group sales expected to gain 0.5% after August's -0.1%.

- Initial Jobless Claims rise 53,000 to 898,000 in the week of October 9.

- Dollar remains hostage to stimulus negotiation in Washington.

The crosscurrents in the American economy intensified in September and October as employment slowed, jobless claims stalled and then jumped, businesses reported near-record orders and third-quarter GDP prepared to set an all-time growth rate.

Given the employment situation with at least 11 million out of work, it is remarkable that retail sales have recovered as quickly and fully from the pandemic collapse as they have. September's expected 0.7% increase after August's 0.6% gain would be a second vote for normality.

Retail Sales

The GDP component Retail Sales Control Group is forecast to climb 0.2% in September following August's surprise drop of 0.1%. It had been predicted to rise 0.5%. Sales ex-autos is projected to add 0.5% in September after rising 0.7% in August.

Retail Sales and the GDP component Control Group averaged increases of 0.87% and 1.28% monthly for the six months from March to August.

Nonfarm Payrolls and Initial Jobless Claims

Nonfarm Payrolls gained 661,000 jobs in September, the smallest increase of the COVID-19 era and the first month to have missed forecasts since the recovery began in May. With the four-week moving average for claims at 870,250 in the final week of September, 2.8 million more people will have been laid off than found jobs last month.

Claims jumped unexpectedly to 898,000 in the latest week, October 9th. They had been forecast to drop to 825,000 from 845,000. This is not the first or even the largest reversal in the last five months. A surprise increase of 133,000 to 1.104 million in the second week of August prompted much speculation that the US recovery was stalling, until claims fell, again unexpectedly, 127,000 to 884,000 two weeks later.

Initial claims are layoffs. Though unemployment insurance helps to mitigate the immediate impact on consumer spending, the continuing high rate of job losses will inevitably impact consumption and the 70% of US GDP it fuels.

Unless the economy begins to generate more jobs and relaxation of economic restrictions permits the return of the many service positions lost or in abeyance, the potential for a slowdown in spending and fourth-quarter GDP is very real.

Purchasing Managers' Indexes

The overall manufacturing and services indexes from the Institute for Supply Management (ISM) have been expanding for four months. The manufacturing New Orders Index averaged 63.1 over the last three months, the services index 62 and both are indications of a revival in business.

New Orders

But despite the positive sentiment, the employment indexes are moribund. In services, the 51.8 score in September was the first positive in seven months. For the much smaller manufacturing sector last month's 49.6 may have been the highest in 13 months but it remained below the 50 division between expansion and contraction.

Business executive have been cheered by the volume of returning sales but unless that optimism turns into employment there could soon be insufficient consumer spending to maintain the recovery.

GDP, Q2 and Q3

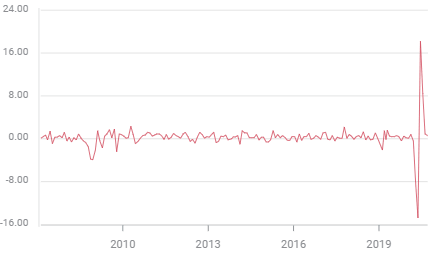

The US economy contracted at a 31.4% annual rate in the second quarter, the largest and fastest drop on record.

Growth in the third quarter was estimated at 35.3% by the Atlanta Fed GDPNow model on October 9th. The next estimate will be on October 16th after Retail Sales and the final on October 28th.

The sharp rebound in economic activity in the third quarter follows consumer spending. Retail Sales collapsed 22.9% in March and April and recovered 27.5% in May, July and July. The bulk of that restoration was due to the volume of purchases deferred by the near-total lockdown of the US economy for two months. August's 0.6% increase and September's projection of 0.7% are a return to a normal consumption patterns.

Conclusion and the dollar

With 11 million workers unemployed, according to the payroll accounting, and far more working part-time and represented by the 12.8% underemployment rate, with jobless benefits for many set to expire and Congress unable to agree on a new stimulus and spending package, it may be only a matter of time before unemployment begins to curtail consumer spending.

Markets remain fixated on the Congressional negotiations, selling and buying the safety trade in the greenback and largely ignoring economic data. Despite COVID, lockdowns, record layoffs and rehires and a bitter election the consumer remains the central fact of the US economy. It Retail Sales misses or beats its estimate traders will quickly remember.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.