- Economists expect the United States to report only a modest increase in Retail Sales in December.

- Producer Price Index has extended decline according to the latest projections.

- These estimates may be too low, triggering an upside move in the US Dollar.

The US consumer never misses a good bargain – expecting modest Christmas shopping while prices down seem misguided. That creates an opportunity. The US Dollar has room to rise – at least against vulnerable currencies.

Here is my preview for the simultaneous releases of the US Retail Sales and the Producer Price Index (PPI) for the month of December, to be published on Wednesday, January 18 at 13.30 GMT.

US Retail Sales expectations may be too low

Why are Retail Sales significant? Roughly 70% of the United States economy is centered around consumption, despite the drive to bring manufacturing back to American shores. Retail Sales is always a market-mover, and even more so when it shapes growth expectations. This upcoming consumption report for December feeds into next week's Gross Domestic Product (GDP) data for the fourth quarter of 2022.

What is expected? The economic calendar points to a meager 0.1% increase in sales after a drop of 0.6% in November. It is hard to imagine Americans maintaining low levels of expenditure in a month affected by Black Friday discounts and ahead of the holidays, but stormy weather around Christmas undoubtedly contributed to lower estimates. Economists may have gone too far.

A significant chunk of shopping is done online, and consumers still have excess savings from the pandemic era. Investors will likely react more to the Retail Sales Control Group – aka "core of the core" – rather than the headline, influenced by falling oil prices. Also here, expectations are for a second consecutive drop of 0.2%. I see it as too cautious.

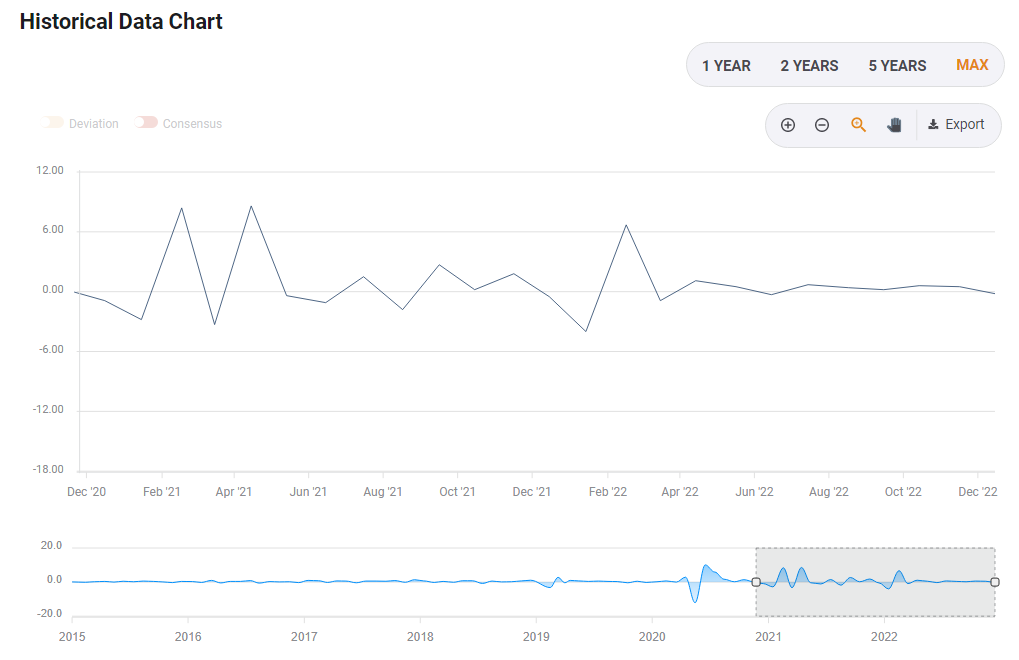

The Control Group does not fall too often:

Source: FXStreet

US Producer Price Index to keep decelerating

While Retail Sales is the main release, the Producer Price Index report for December is also of interest. The Federal Reserve (Fed) is focused on inflation, and every price-related data point matters. Headline PPI is set to decelerate from 7.4% to 6.8%, while Core PPI carries expectations for a slide from 6.2% to 5.9%.

Contrary to the Retail Sales projections, PPI estimates make sense – especially in light of Consumer Price Index (CPI) data already published. Economists were correct in their CPI assessments.

Nevertheless, markets have gotten used to expecting weak inflation data and might have priced in even lower numbers.

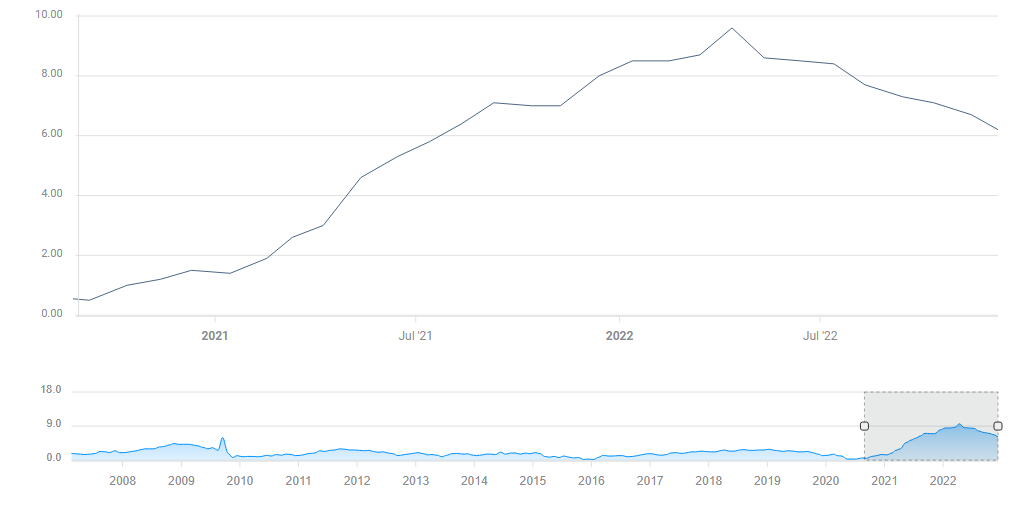

Core Producer Prices are coming down:

Source: FXStreet

US Dollar can react positively to Retail Sales beat

Low Retail Sales expectations from economists and downbeat PPI habits from markets imply the US Dollar will react positively to the release. That is my baseline scenario. Stock markets maintain the "good news is bad news" mentality and thus would decline in response to the bulk data dump.

A less likely scenario is that the accumulation of price rises over 2022 pushed the consumer toward caution, despite slowing price rises. In that case, a downbeat figure in Retail Sales would add to speculation that the Federal Reserve would settle for a standard 25 bps hike in February and end its tightening cycle earlier than usual.

A third scenario would be that markets shrug off the publications and wait for speeches from several Fed officials. However, investors have become sensitive to data, so this is an implausible scenario.

All in all, I expect an upside surprise in Retail Sales, sending the US Dollar up and stocks down. Will such a move last? So far in 2023, the trend has been adverse for the Greenback and positive for equities, so any such counter-trend could serve as an opportunity to "buy the dip" in stocks, and sell the US Dollar rally.

Final thoughts

It is essential to note that the release comes after the Bank of Japan (BoJ)'s closely watched decision, making a trade in USD/JPY less appealing. If the BoJ abandons its ultra-loose policy, the Japanese Yen would strengthen and going long USD/JPY would be risky. This pair tends to reflect US data best – but this time is different.

A more neutral pair would be USD/CHF, which is less affected by China's reopening, the weather, or other issues.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.