- CPI hits 8.5%, core 6.5%, food index rises 8.8%.

- Food, energy and shelter costs set the pace.

- Real wages fall 2.7% on the year, 12th straight monthly decline.

- Initial equity relief fades into losses, Treasury rates slip, dollar gains.

Economists can argue about the cause. Politicians can debate the cure. What no one can dispute is the pain inflation is inflicting on average Americans.

Prices increased at their fastest pace in more than a generation in March, led by surging expenses for life's necessities, food, shelter and gasoline.

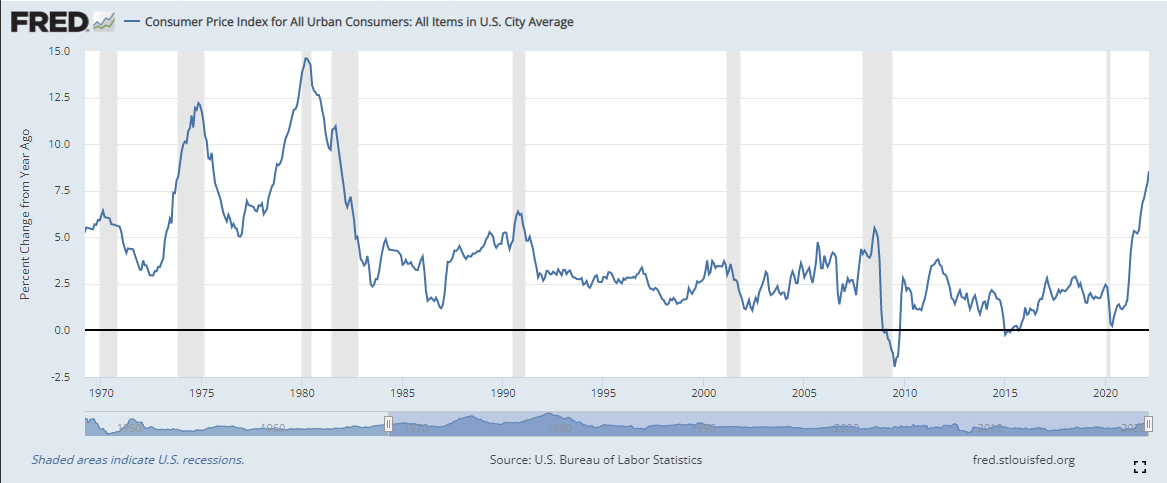

The Consumer Price Index (CPI) has soared 8.5% over the last year, jumping 1.2% last month alone. Core inflation, the somewhat unrealistic measure that excludes food and energy costs, rose 6.5% for the year and 0.3% in March. It was the highest reading for CPI since December 1981 and the hottest core rate since August 1982.

Real inflation-adjusted wages fell 0.8% in March and are down 2.7% for the year, the 12th straight monthly decline. Despite a 5.6% increase in annual hourly earnings in March, the purchasing power of American families has fallen nearly 3%. Wages have been unable to keep up with inflation.

Household inflation and consumption

As bad as the headline number is, the details are even more damaging.

If airline fares are high, people can skip a vacation. If car prices are exorbitant, the old Chevy can probably run another year. Housing, transportation and eating are not optional.

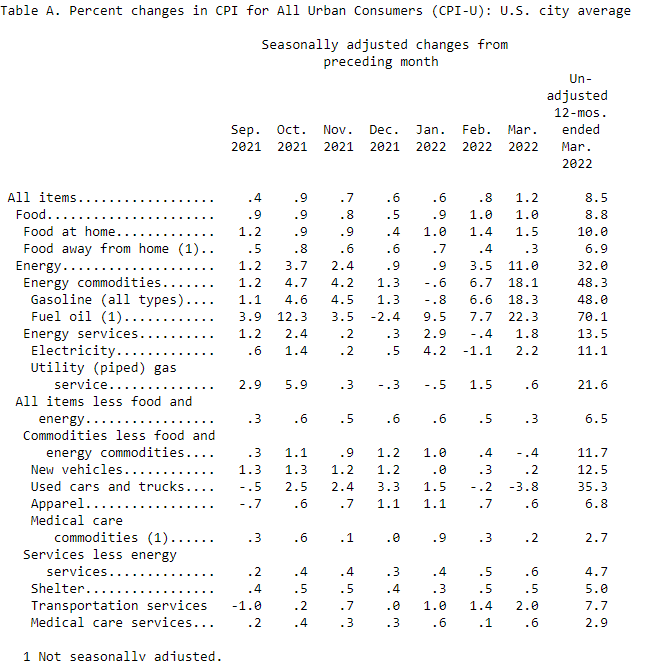

Overall food expenses rose 8.8% for the year but comestibles for use at home, where most people eat most of the time, climbed 10%. Meat, poultry, fish and eggs were up 13.7%, beef 16%, dairy and related products 10.3%. Cereal and bakery products are up 9.4%, fruits and vegetables 8.5%.

US Department of Labor

Driving in the US is not a choice, it is a requirement. Work, school, shopping nearly everyone in the US is behind the wheel every day. Federal government statistics say the average driver logs 1,000 miles a month.

Gasoline prices vaulted 18.3% in March, but it was not solely or even primarily the Russian invasion of Ukraine that was responsible. Over the past year the price of gasoline has rocketed 48%.

Shelter costs, which include renting and home ownership, rose 0.5% on the month and are 5% higher for the year. It was the highest annual rate since 1991. Need to heat your home, fuel oil was up 22.3% in March and 70.1% since last year. Did you switch to natural gas for warmth and cooking, as the US has vast tapped and untapped quantities, prices rose 0.6% for the month and 21.6% since last March. Electricity costs jumped 2.2% and 11.1% for the month and year.

For American families and the huge swath of the middle class that generates consumer spending and votes, the steep increases in the cost of living, steadily outstripping wages and salaries, must soon cut into consumption. For an economy wholly dependent on consumers and only expanding at 1.1% in the first quarter according to the Atlanta Fed, even a small drop in discretionary spending is spelled recession.

Market response and the Fed

The initial US market response was relief that March’s price increases were not worse.

The headline of 8.5% was just 0.1% over the consensus forecast of 6.4% and the core figure of 6.5% was 0.1% lower than the 6.6% estimate. In addition, the monthly rise in CPI of 1.2% was on target and the core rate of 0.3% was barely half the 0.5% prediction.

February’s Producer Price Index (PPI), which feeds into retail for subsequent months, had been 10.5%, much stronger than the 10% forecast.

Equities were higher at first with the Dow adding over 300 points shortly after the open and the S&P rising 58.

Treasury rates also climbed with the 10-year yield reaching 2.836% and the 2-year trading as high as 2.557%.

Neither market retained its early gains. Equities finished with the Dow off 87.72 points to 34,220.36 and the S&P shedding 15.08 points to 4,397.45.

S&P 500

CNBC

The 10-year yield closed at 2.742%, off 4 basis points from Monday and the 2-year dropped 8 points to 2.424%.

10-year Treasury yield

CNBC

The economic reality for both markets is that while March CPI may have provided a tentative hint of easing prices, 8.5% inflation is guaranteed to keep the Federal Reserve on course for much higher interest rates.

Next month the Fed will begin to reduce its $9 trillion balance sheet by $95 billion. After two years of propping up bond prices with its purchases, the first blush of bond sales may drive Treasury rates another leg higher.

The dollar rose against all the majors except the aussie and kiwi which were encouraged by developments in China. Beijing loosened some of the draconian restrictions in Shanghai and other cities that could, if not relaxed, send the economy slipping towards recession.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.