US infrastructure spending seen rising after decade of decline

Global developments

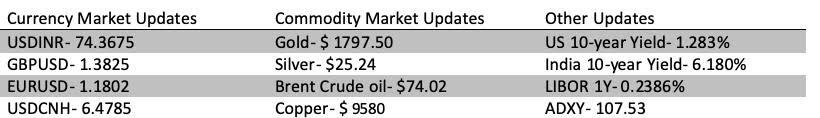

US new home sales fell to a 14 month low. Higher lumber prices and shortage of building materials are keeping supply tight and pushing up prices. US 10y real rates dropped to a record low of -1.12%. The Dollar consequently has weakened across the board. The overall risk sentiment is holding up.

Domestic developments

Equities

US and European equities had ended the session flat yesterday. Asian indices are trading mixed this morning. It will be interesting to see if the Nifty sustains gains above 15900

Bonds

It was a lacklustre day of trading for bonds yesterday. The yield on the 10y benchmark ended almost unchanged at 6.16%. Rates rallied a bit with 3y and 5y OIS ending at 4.65% and 5.18%

USD/INR

USD/INR has been trading in narrow ranges intraday, the last few sessions. 3m vols have dipped to the lowest level since Feb'20 (5.25%). Near-term Forwards continue to get received with normalization in Cash-Tom. 1y forward yield continues to hover around 4.50%. Cash-Tom yield is around 3.45%. Asian currencies are trading stronger against the Dollar.

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks toward 74.90. Importers are advised to cover through options. The 3M range for USDINR is 73.20 – 75.50 and the 6M range is 73.50 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.