US ADP Employment Change: Caution surfaces in manufacturing

- Largest addition to private payrolls since September expected.

- Nonfarm Payrolls forecast to add nearly one million jobs, with upside risk.

- Manufacturing PMIs slip unexpectedly, citing production constraints.

- Dollar falls modestly on weaker manufacturing optimism.

- ADP leads the Friday NFP report but not normally a market mover.

Hiring in the US labor market is so hot that only a shortage of workers might prevent companies from signing up the most new employees in seven months.

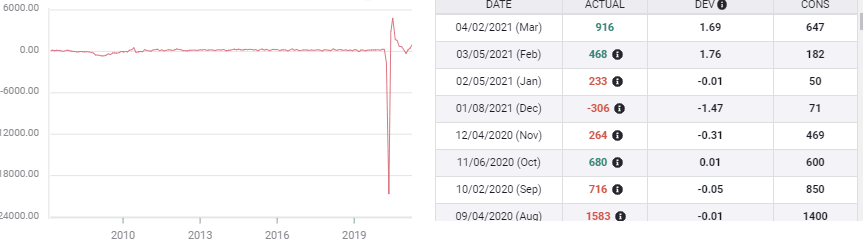

The private payroll company Automatic Data Processing (ADP) is forecast to report that firms using its services filled 800,000 positions in April, more than half again as many as the 517,000 in March. These companies hired 889,000 new employees in the first quarter.

The pandemic may be waning in the US, but the damage to the American and global economies is far from over. The year-long and in many areas still active impact has disrupted supply chains and component manufacturing at all levels of production.

Nonfarm Payrolls

Payrolls added 1.617 million jobs in the first three months of the year, the best performance since the immediate aftermath of last spring’s lockdown. Even with that aid American employers have rehired only 62% of the 22.362 million people laid off in March and April, 8.403 million by the payroll count remain unemployed.

The April Employment Situation Report, the official name of the Bureau of Labor Statistics release that contains the monthly change in Nonfarm Payrolls, the Unemployment Rates, Average Hourly Earnings and other data, is forecast to see 988,000 more hires.

ISM Purchasing Managers’ Index

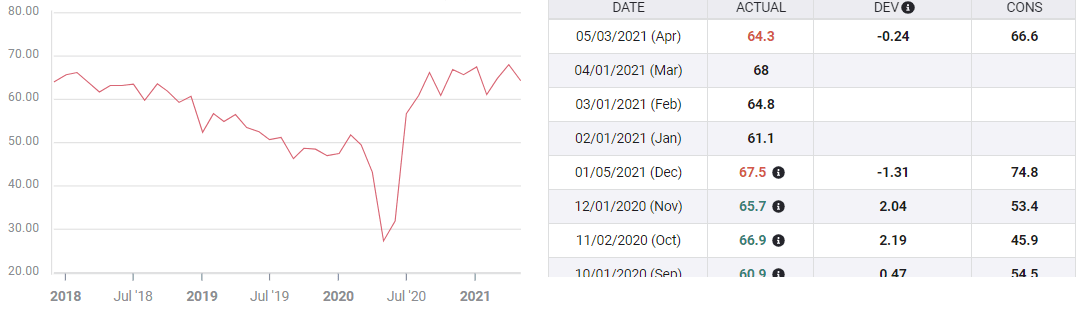

Business optimism has been on a tear over the last six month as executives in the manufacturing and service sectors note the general expectation that the US economy will expand more than 6% this year.

The Manufacturing Purchasing Managers’ Index (PMI) from the Institute for Supply Management (ISM) averaged 61.2 for the four months from December through March, which was the highest since March 1984. The New Orders Index average of 64.7 over the nine months to March was the highest three-quarters of a year since August 2004. The March Employment Index rating of 59.6 was the best score since March 2018.

Manufacturing New Orders Index

FXStreet

In April, the overall index had been expected to move up to 65 from 64.7 and employment was predicted to edge to 61.5 from 59.6. The New Orders Index was projected to fall slightly from 68 to 66.6, as parts and raw material supply constraints cut into manufacturing output.

In the event all three fell. The headline index dropped to 60.7, the New Orders Index slipped to 64.3 and the Employment Index fell to 55.1.

Each of these measures remains well above the 50 division between expansion and contraction. Though the expectations were overstated in no sense have the indexes reversed.

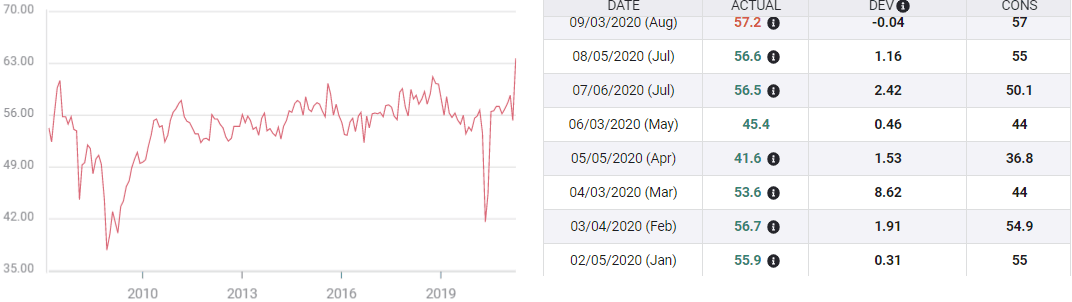

Services Purchasing Managers' Indexes

The failure of the manufacturing indexes to improve has reduced prospects for the service sector PMIs that will be reported on Wednesday at 10:00 am EDT.

The overall index is expected to rise to 64.3 from 63.7. Employment is forecast to fall to 55 from 57.2 and new orders is projected to plunge from 67.2, its all-time record, to 56.6.

Services PMI

FXStreet

As with the manufacturing indexes, the estimates remain solidly in expansion and are comparable or better than their readings immediately before the pandemic hit last March.

Conclusion

The restraints on manufacturing optimism may be duplicated in the much larger service sector.

While American and UK pandemic rates are vastly improved, and Brazil seems to have peaked, India is the grip of a virulent outbreak and the potential for the virus to move to other ill-prepared parts of the globe is very real.

In the globalized manufacturing sector, no one country is isolated when another large economy is crippled by lockdowns.

The lingering impact of the pandemic on supplies and components in manufacturing was noted by the ISM on Monday.

“Survey Committee Members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials. Recent record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential,” said the statement accompanying the release of the survey.

While the optimistic skew of the results increased to 11-to-1 from 8-to-1 in March, reflecting the continuing strength in the order book, consumption measures indicated some cooling, recorded the survey.

It is probably too soon for supply and material considerations to have a negative impact on hiring. Many employers, particularly in manufacturing, report difficulty in finding skilled workers but the overall economy has millions of unemployed. Service employers are still filling roles emptied by the pandemic lockdowns.

Employment should continue its rapid expansion in April, but the horizon is not yet clear.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.