UK GDP Preview: How calamitous was the initial coronavirus carnage? Three scenarios for GBP/USD

- First-quarter growth figures for the UK are set to show the worst quarter since the financial crisis.

- Coronavirus probably had an impact before the lockdown.

- Surpassing the 2008-2009 crisis levels already in Q1 could add pressure to the pound.

- The March figure will likely serve as a benchmark for the next updates.

"I am asking you to stay at home," said Prime Minister Boris Johnson – only late on March 23, around a week before the first quarter ended. Is that worth a fall of 7% in output in March? Gross Domestic Product figures for both March and the full first quarter – which carries estimates of -2% – will provide initial answers and also serve as a benchmark going forward.

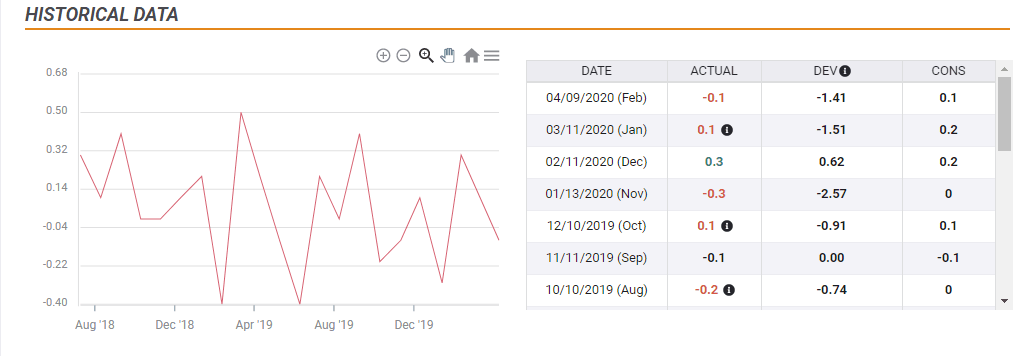

Monthly GDP chart. The worst drop on record was -0.40%. Expectations stand at -7%.

Economists base their Gross Domestic Product consensus on two assumptions. First, Brits probably hunkered down earlier in March, seeing what was going on in Italy and Spain. The government's initial lax approach was partially based on the notion that the public would be reluctant to cooperate with fewer liberties. Poll has since shown that among 14 nations, Brits are supportive of staying low for longer.

The second assumption is that the shuttering had a substantial impact, bringing the economy to a halt. The Office for Budget responsibility's scenario foresaw the UK economy crashing by 35% in the second quarter and nearly 13% in 2020. The Bank of England's "illustrative scenario" pointed to a fall of 14% in GDP during this year.

Pound reaction

The BOE has the most significant impact on the pound and will base its next decision on the lockdown situation in May and June, Nevertheless, the backward-looking data for the initial impact of the virus provides an estimate on how this shuttering influenced the economy moving forward.

Monthly GDP will set the stage for April's GDP figures, but these are due out only in a month. For the immediate reaction, the quarterly figure may prove a more significant mover, especially due to the headlines it creates. Projections stand at -2% while the worst of the financial crisis – the first quarter of 2009 – saw a fall of -2.4%.

Three GBP/USD scenarios

1) As expected: As the COVID-19 pandemic is an extraordinary event, a wide range of -1.6% to -2.4% can be considered within estimates. In this scenario, GBP/USD will likely trade choppily but remain within known ranges. Investors will return to focusing on lockdown-related topics.

2) Worse than expected: A quarterly contraction of -2.5% or worse would already trigger headlines screaming "worst than the crisis" alongside "this is only the beginning." Such depressing figures early on could send sterling tumbling down. It would also reset forecasts for Q2.

3) Better than expected: A slide of -1.5% or less may provide hope that the damage from the virus – while only at its beginning – could be more moderate than projected. In this case, the pound could advance.

Conclusion

First-quarter growth figures are set to provide initial insights into the coronavirus calamity and set future expectations. A drop of more than 2.5% in Britian's output will probably weigh on sterling, while other outcomes could be more poound-positive.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.