Heading into the elections, the FTSE is looking strong from a technical point of view. After all, it has breached the psychologically important level of 7000 for the fi rst time ever. It has therefore also cleared the 6900 hurdle which had provided stiff resistance for the best part of two years. With these levels fi nally broken, the FTSE could be gearing up for a major rally as fresh would-be buyers may decide now is the time to come into the market. As the FTSE is trading in unchartered territories, there are no prior reference points for traders to keep an eye on. This is where Fibonacci extension levels come handy. On the chart we have plotted the Fibonacci extension levels of the last three notable price swings, from point X to A, B to C, and D to E. These extension levels could potentially turn into resistance as some speculators would use them as their long profi t targets or short entry points. Our short-term view would turn bearish on the FTSE upon a potential break below 6900 or the bullish trend line. Should that happen then the index may make a move towards support at 6715 before deciding on its next move.

FTSE’s performance one year after past elections

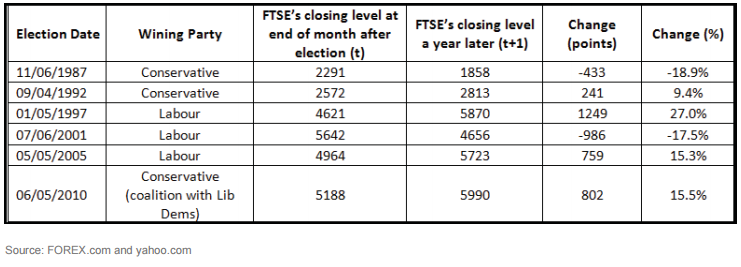

The table below shows the FTSE’s performance a year after each of the past six elections.

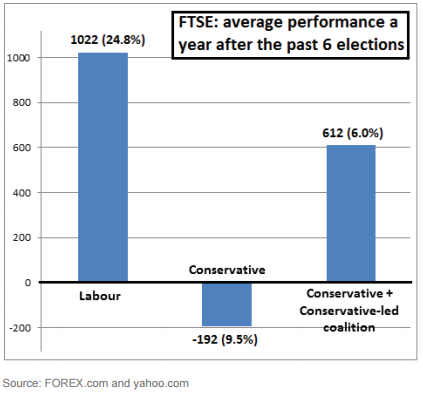

At first sight, it is diffi cult to draw any conclusions from the table above. But looking at the average performance of the FTSE a year after the elections, the data shows a surprising result:

Despite the perception that the UK markets would perform well under the Conservatives, which is deemed a more business-friendly party, the FTSE has actually performed much better in the fi rst year under a Labour party. In the past six elections, the FTSE has gained an average of 1022 points in the fi rst year after a Labour win. In contrast, it has fallen by an average of 192 points during the fi rst 12 months under a Conservative government. Though the FTSE’s gains under the Conservatives improves when you take into account their current coalition with the Lib Dems, the overall average gain of 6% at the party’s one-year anniversary in power is still well below Labour’s 24.8%. Thus, if this trend continues then a Labour win, all else being equal, would be better for the FTSE – at least in the party’s fi rst year anyway. However, the above fi ndings have not taken anything else into account. Even if the UK elections do play a big part in the FTSE’s direction, it could be that the outcome was already fully or partially priced in. What’s more, the FTSE’s components have changed over these years and not only that but the companies themselves have become more internationally focused and less dependent on the UK economy, let alone politics. That being said, the biggest risk for the FTSE could be if we get a hung parliament. Even if this potential outcome has no economic impact, the uncertainty that comes with it may well undermine the appetite for risk.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.