One of the hottest topics during this election could be the future of the UK’s position in the EU. The rise of UKIP, an anti-EU party, has focused minds on whether the UK should stay in the European Union. The Conservatives, which has a powerful anti-EU faction, has promised to hold an in-out EU referendum in 2017 if it wins power. However, if it was to join a coalition with UKIP, a potential referendum could be pushed forward. The Labour party has not committed to a referendum on UK EU membership, so this may only be an issue if we see a Tory government or a Tory-led coalition.

This could be the biggest concern for the FX market in the aftermath of the election. Since a referendum is unlikely to be scheduled for a few years, it could lead to a protracted period of weakness for sterling.

Our concerns for the pound that may arise from the uncertainty around the UK’s EU membership is:

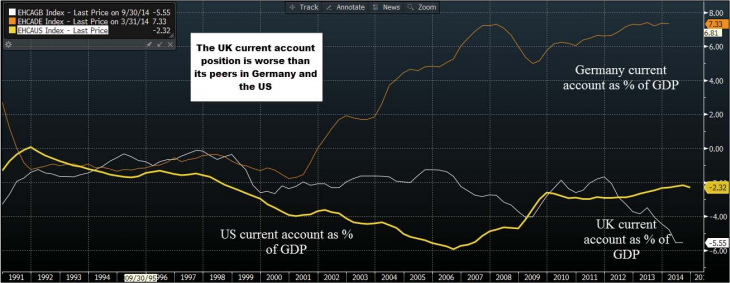

- Its large UK current account leaves it vulnerable to a shift in international sentiment towards the pound and UK debt. Right now the international market is happy to fund the UK’s defi cit, but this may not be the case if it looks like it is going to leave the EU.

- The FTSE 100 is also a major hub for international companies to list. Part of the UK’s attractiveness is its proximity to Europe and membership of the EU. If it leaves the EU this could reduce the desire of foreign fi rms to list in the UK and others could try and move to a different index, which could weigh on UK stock markets.

But this does not mean that a Labour victory would trigger a rally for UK assets. Instead, we think that a Conservative/Lib Dem coalition or a Labour/Lib Dem coalition would be the best outcome for UK asset prices. The Lib Dems could keep UK politics fairly centrist which may avoid any lurches to the left or right.

If there is uncertainty around the UK’s EU membership then we may see UK risk premia rise, which could push up UK bond yields. A rise in bond yields, even from historic lows, is unlikely to benefi t the pound, which would also come under pressure from uncertainty about the UK’s position in Europe.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.