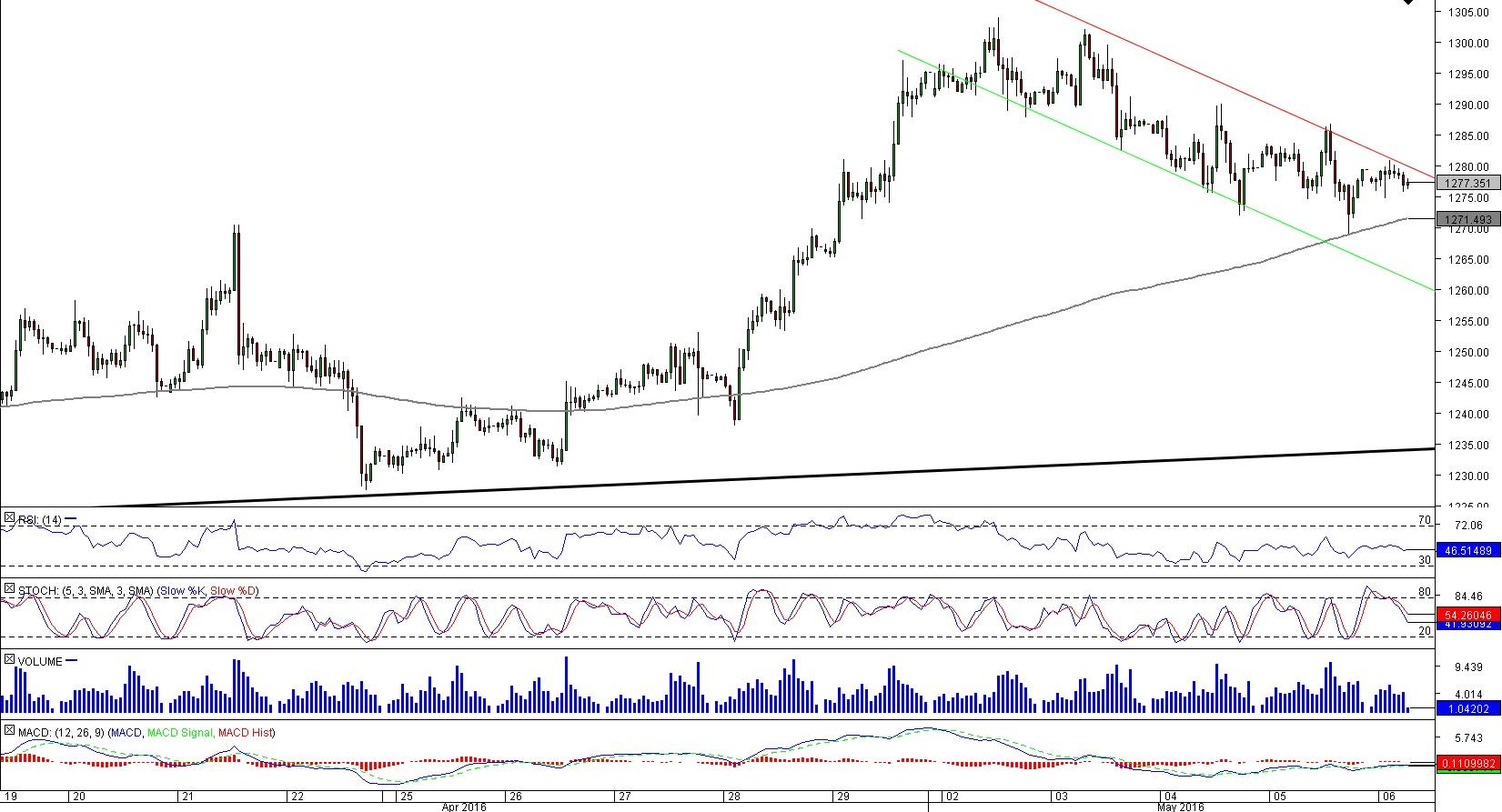

XAU/USD 1H Chart: Channel Down

Comment: Gold failed to carry bullish momentum beyond 1,300 dollars because of the 2015 high after the price had broken out of the triangle. As a result, the precious metal is now trading within the distinct boundaries of a bearish channel. The pattern implies a sell-off from 1,280 down to 1,260, but we should be wary of strong nearby supports, such as the weekly pivot point at 1,274 and a cluster circa 1,270, created by the yesterday’s low, daily S1 and most importantly by the 200-hour SMA. Meanwhile, the bullion is close to being oversold, since 67% of open positions are short. If resistance at 1,280 is violated, the next bullish target should be the daily R1 and May 5 high at 1,287.

EUR/AUD 1H Chart: Channel Up

Comment: The latest recovery from 1.4440 is the result of EUR/AUD probing and confirming the 45-month up-trend. Accordingly, our outlook on the pair is bullish, and we expect the Euro to keep appreciating against the Australian Dollar. The current distribution between the longs and shorts also favours a rally, being that as many as three fourths of all traders are short the single currency, and there is little room for new sellers to enter the market. However, the upside is limited by a falling resistance line that connects 2008 and 2015 highs, meaning we are highly unlikely to see the exchange rate above 1.58 any time in the foreseeable future. In the meantime, the technical indicators are mixed and support neither scenario.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.