EUR/SEK 1H Chart: Channel Up

Comment: There is a bullish pattern emerging in the hourly chart of EUR/SEK. However, we do not expect an immediate rally, being that the currency pair is currently trading right at the upper boundary of the pattern. Moreover, there is an additional formidable supply area nearby, namely 9.40, created by the January high, weekly R2, and daily R1. The near-term outlook is therefore bearish, and the price is expected to dip through the weekly R1 level towards the support trend-line at 9.3050, where it is reinforced by the 200-hour SMA and weekly PP. This should be enough to trigger another round of buying. Meanwhile, the sentiment in the SWFX market is negative—69% of positions are short.

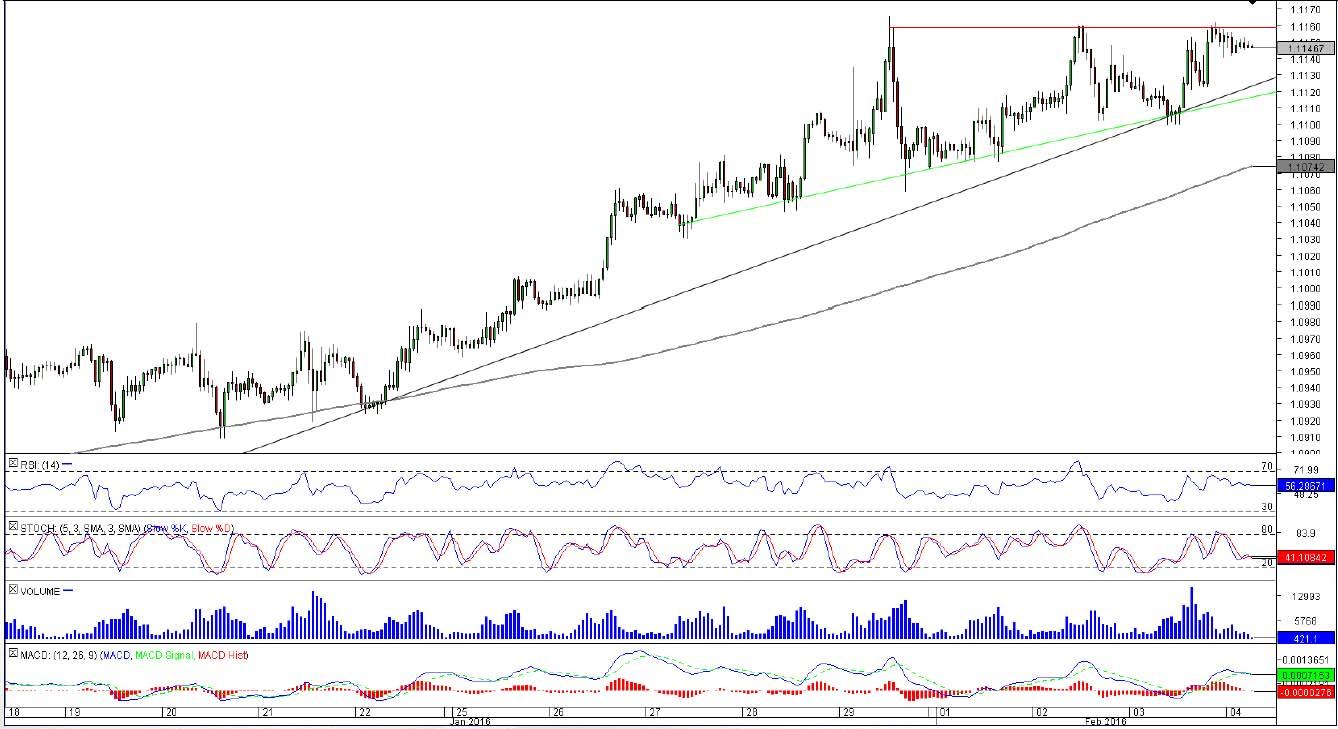

EUR/CHF 1H Chart: Ascending Triangle

Comment: EUR/CHF is in a good position to resume its journey further north, as an ascending triangle implies growing demand for the Euro. In the very short term the price is likely to move away from 1.1160, but the decline should be limited by the up-trend at 1.1115. Eventually, however, resistance at 1.1160 is expected to be broken. Such a scenario is also confirmed by the technical indicators on all three relevant timeframes. The rate should then aim for the weekly R1 level at 1.1180. Next potential target will be only at 1.1277 (weekly R2). On the other hand, if EUR/CHF closes under 1.1115, the pair will probably stabilise near 1.1075/70, where the weekly PP joins forces with the 200-hour SMA.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.