EUR/NOK 1H Chart: Falling Wedge

Comment: After EUR/NOK formed a rising wedge at the end of the previous week, the currency pair is now approaching the apex of the falling wedge. Accordingly, while the near-term bias is negative, which is also confirmed by the hourly and four-hour technical indicators, we should be wary of a potential reversal. The outlook will be changed to bullish once the price crosses the declining trend-line at 9.4740. The initial target in this case will be the supply area at 9.4964/20, but the rally will probably extend higher, up to 9.5409/9.5335, where the January 26 high is joined by the weekly pivot point. Alternatively, should the rate slip under 9.40, there is likely to be sell-off down to 9.34 (weekly S1).

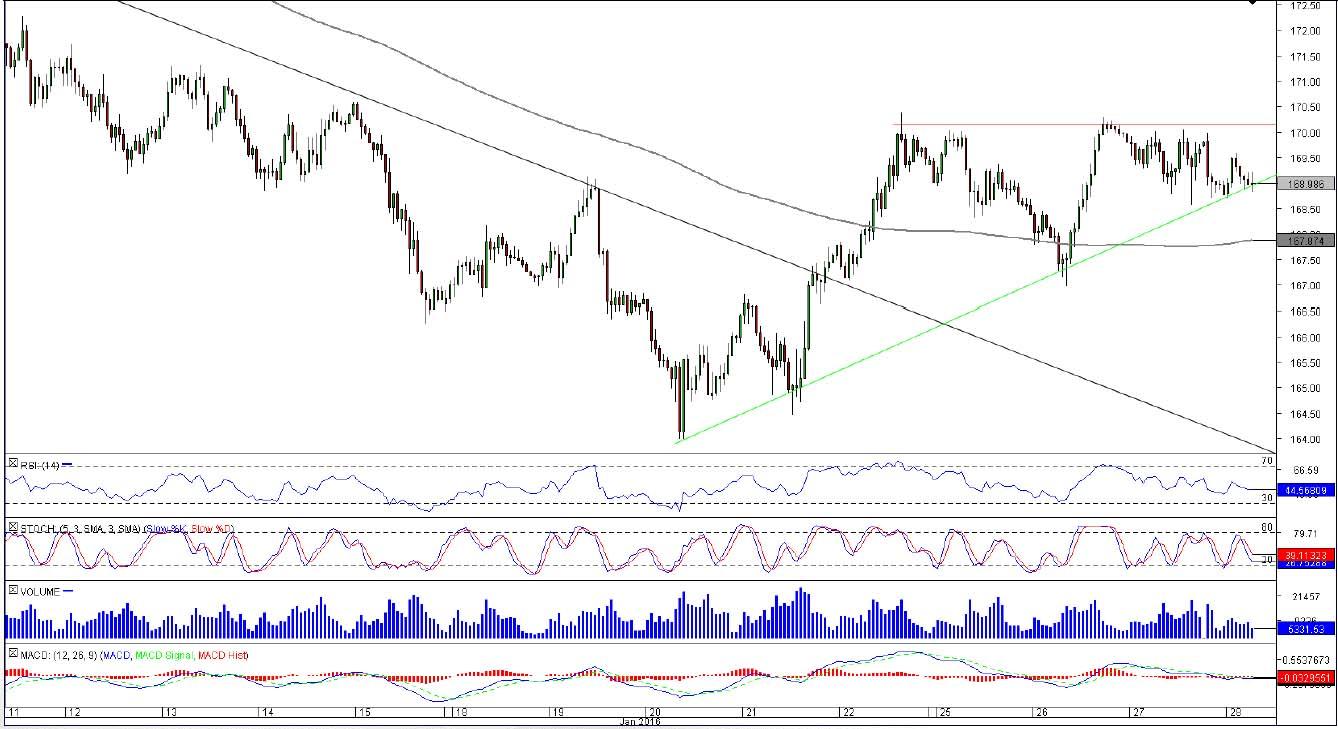

GBP/JPY 1H Chart: Ascending Triangle

Comment: GBP/JPY appears to be in a good position to advance north. First of all, the pair has recently broken the downward-sloping trend-line to the upside. Secondly, right now it is forming an ascending channel, which implies increasing demand for the Pound. Our base case scenario is a close above 170.15. This will pave the way for a rally to 171.91 yen, namely the weekly R1 level. The next target could be the weekly R2 at 174.33. However, if this scenario does not materialise and the price falls through 169, there is still a dense demand zone just below 168 yen, where the weekly PP merges with the 200-hour SMA and daily S2. Additional support is at 167, created by the daily S3 and January 26 low.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.