AUD/NZD 1H Chart: Channel Up

Comment: The near-term outlook on AUD/NZD is bullish. The currency pair has just formed an ascending triangle, and most of the hourly technical indicators are pointing north. Accordingly, we expect the Aussie to rebound from 1.0650 and re-test last week’s maximum. However, the price lacks the potential to go higher, which is implied by the daily studies. In addition, the Australian Dollar is already overbought, as shown by the SWFX sentiment that is bullish with two thirds of open positions being long. Beneath the weekly pivot point AUD/NZD will have a good chance to stabilise near the 200-hour simple moving average, which at the moment can be found at 1.0632.

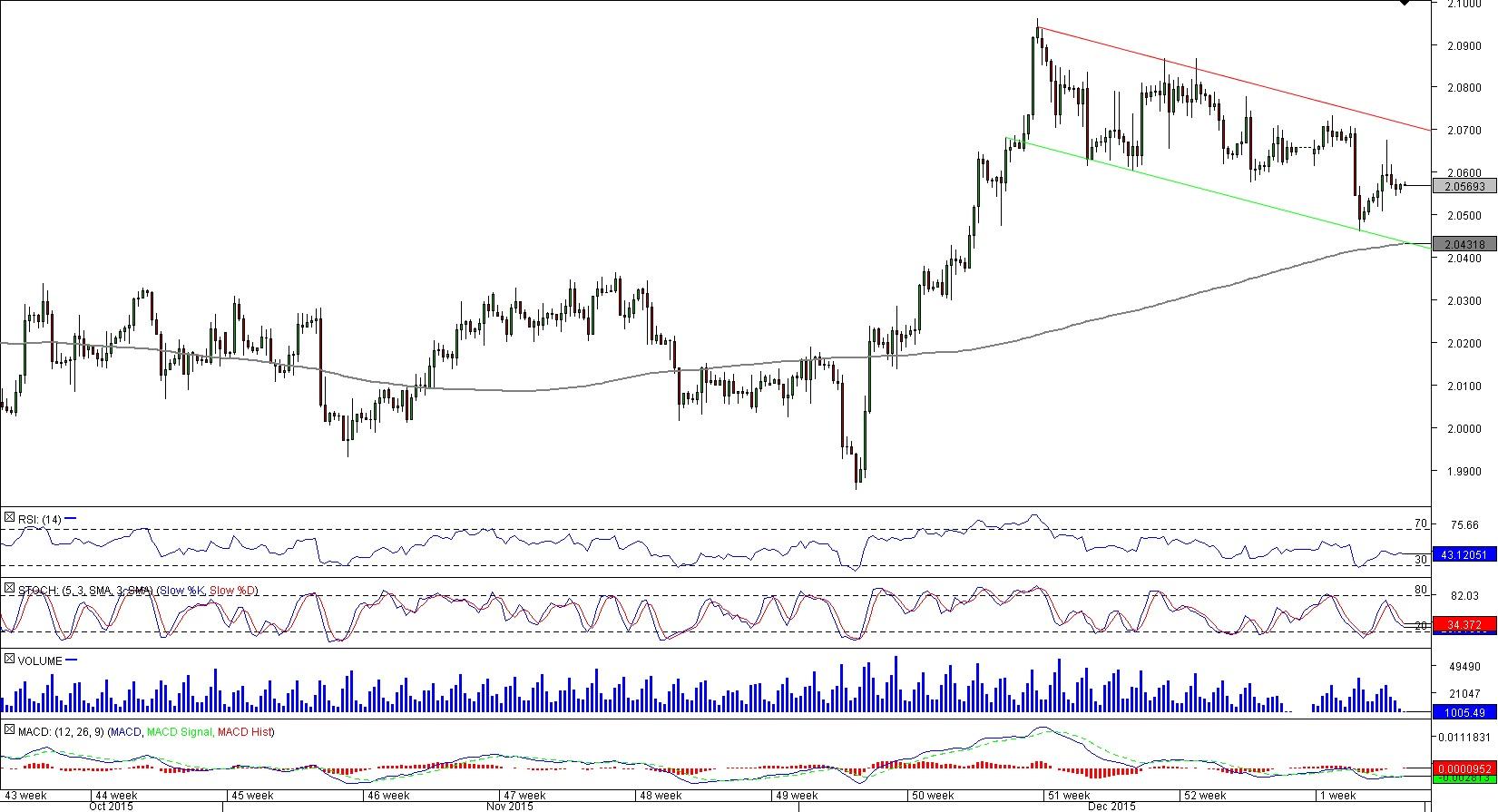

GBP/CAD 4H Chart: Channel Down

Comment: GBP/CAD has recently failed to pass through the resistance at 2.0960, and as a result, the pair entered a down-trend. The perspectives, however, are ambivalent. Even though the four-hour and daily technical indicators are mostly sending ‘sell’ signals, and the SWFX market is overcrowded with bulls (72% of positions are long), we may still be in a correction phase following the Dec 3-11 rally. Moreover, the long-term moving average remains beneath the spot price. Thereafter, if the Sterling breaches the major support at 2.0430/10, the currency’s bearish intentions will be confirmed, and it will likely aim for the December low at 1.9850.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.