GBP/AUD 1H Chart: Triangle

Comment: From the most recent developments in GBP/AUD it follows that the currency pair is inclined to keep advancing north. The emerging triangle is expected to be broken to the upside, and in this case the target will be a supply area between 2.0930 and 2.0960, where the weekly R1 is joined by the Nov 27 high. However, we should note that there are several counter-arguments. First, the daily technical indicators are bearish; and secondly, the Sterling is overbought in the SWFX market, as 61% of open positions are currently long. If the up-trend at 2.0765 is breached, there will likely be a decline to 2.0717/00, but it could also extend down to 2.0638/27, where the daily S2 merges with the monthly PP.

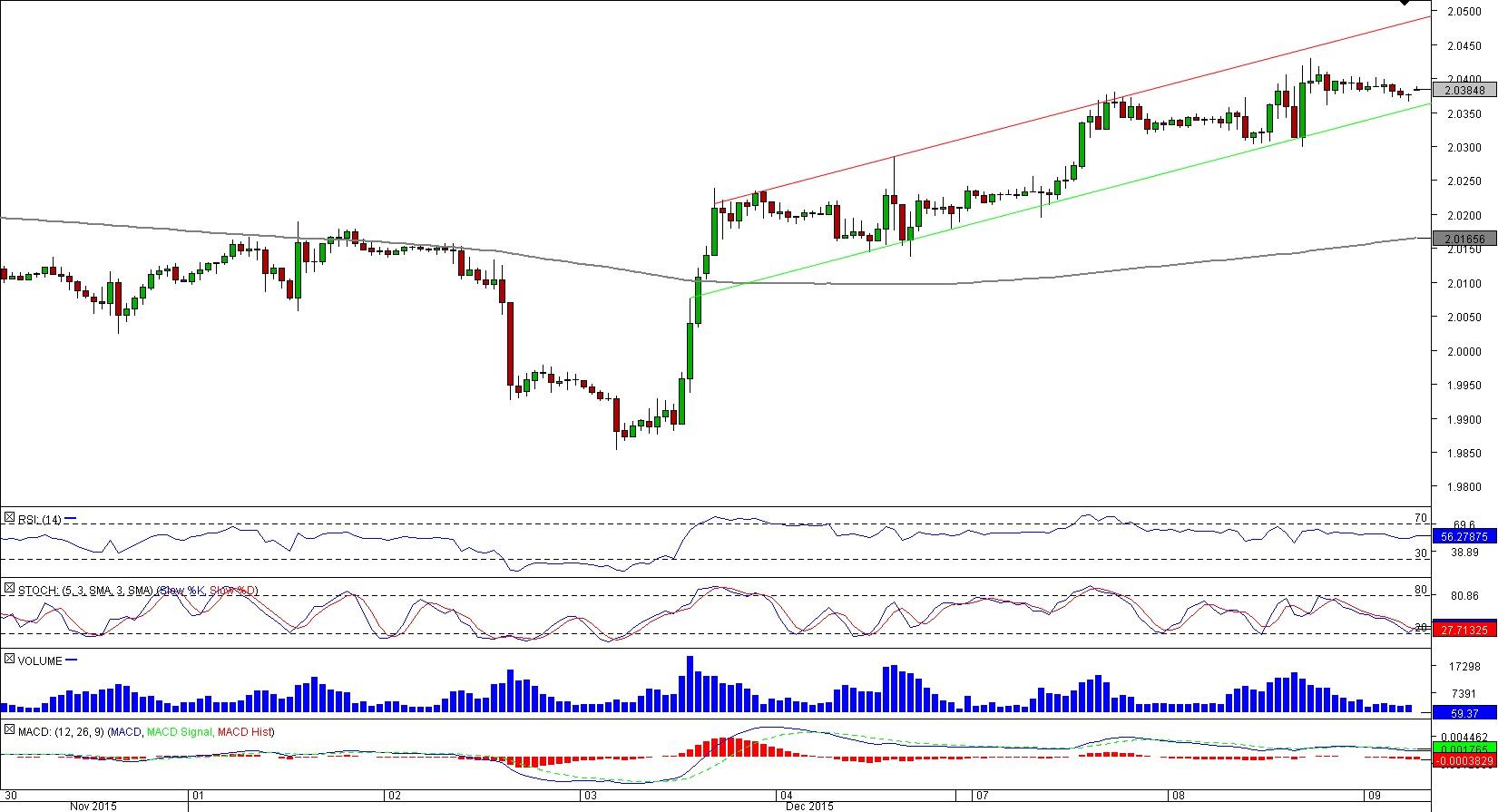

GBP/CAD 1H Chart: Channel Up

Comment: The near-term outlook on GBP/CAD is strongly bullish. Not only does the majority of technical indicators point upwards, but the price is also right at the lower boundary of the ascending channel. Additionally, the Sterling is oversold against the Canadian Dollar: only 28% of open positions in the SWFX market are long. We expect the Pound to rebound from the weekly R1 and up-trend at 2.0370 and rally towards 2.05, where it should commence a bearish correction. Alternatively, a dip beneath 2.0370 will change the outlook to negative and expose Dec 8 low at 2.03, while the next major support will be only at 2.0165, represented by the 200-hour simple moving average.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.