EUR/CHF 4H Chart: Channel Up

Comment: Although the quality of the pattern is poor, there is a high chance of EUR/CHF developing the ascending channel further. First, the currency pair is facing a solid demand area around 1.0840, created by the weekly S1, monthly PP, up-trend, and 200-period SMA. Secondly, the single currency is oversold, being that 72% of open positions are short, and therefore there is not much room for new bears to enter the market. At the same time, even though the signals are weak, the daily and weekly indicators are mostly pointing north. Accordingly, the base scenario is a rally from 1.0840 up to the October’s high at 1.0950. In case of a dip beneath the key support there should be a sell-off at least to 1.0770/55.

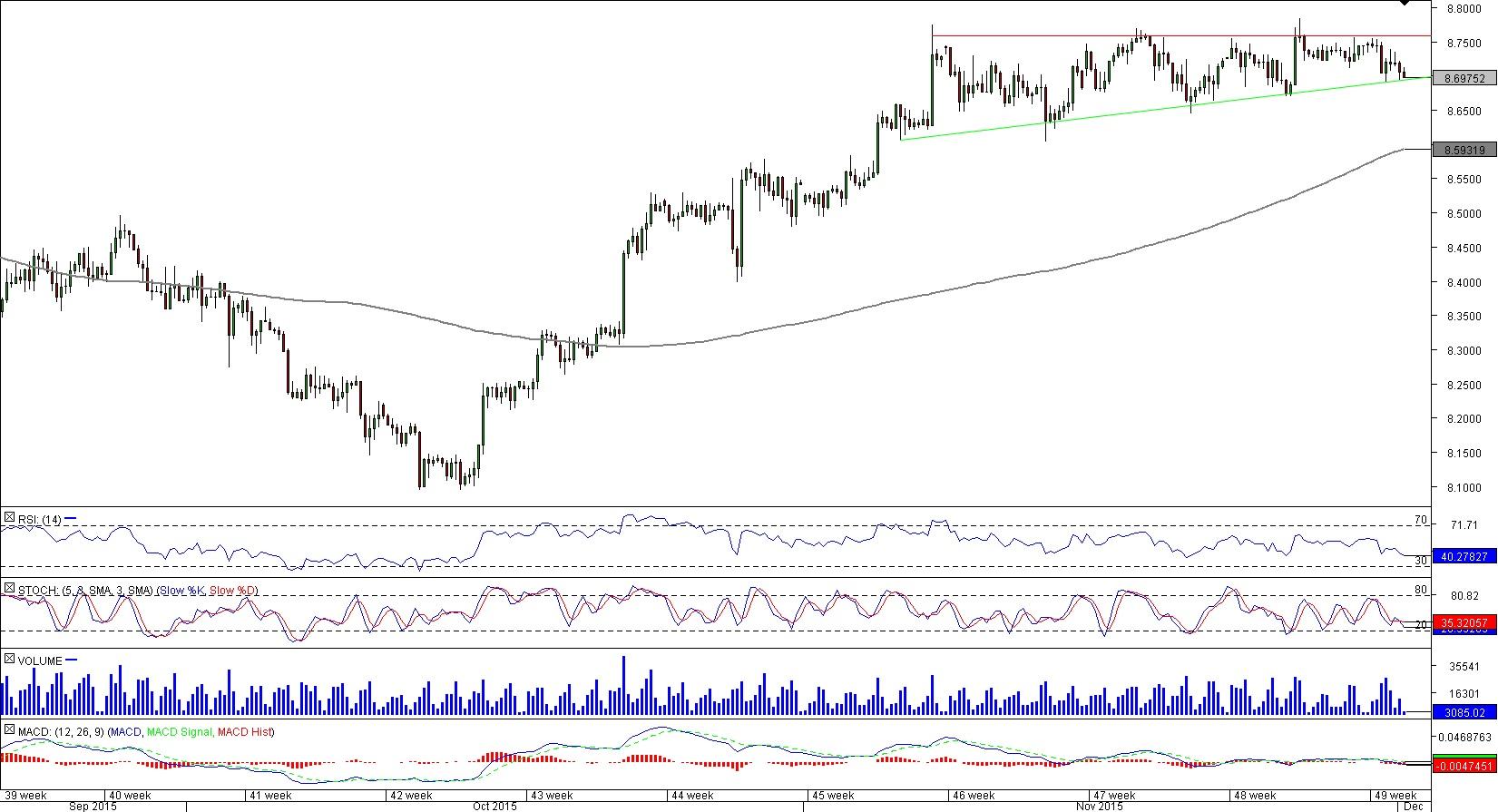

USD/SEK 4H Chart: Ascending Triangle

Comment: USD/SEK is currently struggling at 8.76, but eventually the bulls should be able to push through this resistance. The ascending triangle the pair is forming suggests that demand is building up, and a break-out to the upside is the likely resolution to the pattern, which developed after the Oct 15-Nov 6 advancement.

We therefore expect the price to close above 8.76 this week and start its journey towards 8.84, where the rate should meet the monthly R1 and August high. In the meantime, the main support is between 8.70 and 8.67, violation of which will expose the 200-period SMA and monthly S1 at 8.5800/8.5550.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.