EUR/TRY 1H Chart: Channel Down

Comment: EUR/TRY keeps trading within a well-defined descending channel we found last week, which implies that the overall outlook remains bearish. We expect a decline in the near term as well, considering that the currency pair is right at the upper boundary of the pattern. The gains are to be limited by the falling resistance line at 3.0350, while the target is 2.9880, where the lower trend-line merges with the daily S3 and weekly S1 levels. At the same time, the technical indicators in all time-frames are mixed, and we should not exclude the possibility of a rally through 3.0350, which will likely mean a recovery: first to 3.0440, then up to the earlier highs and 200-hour SMA circa 3.0650.

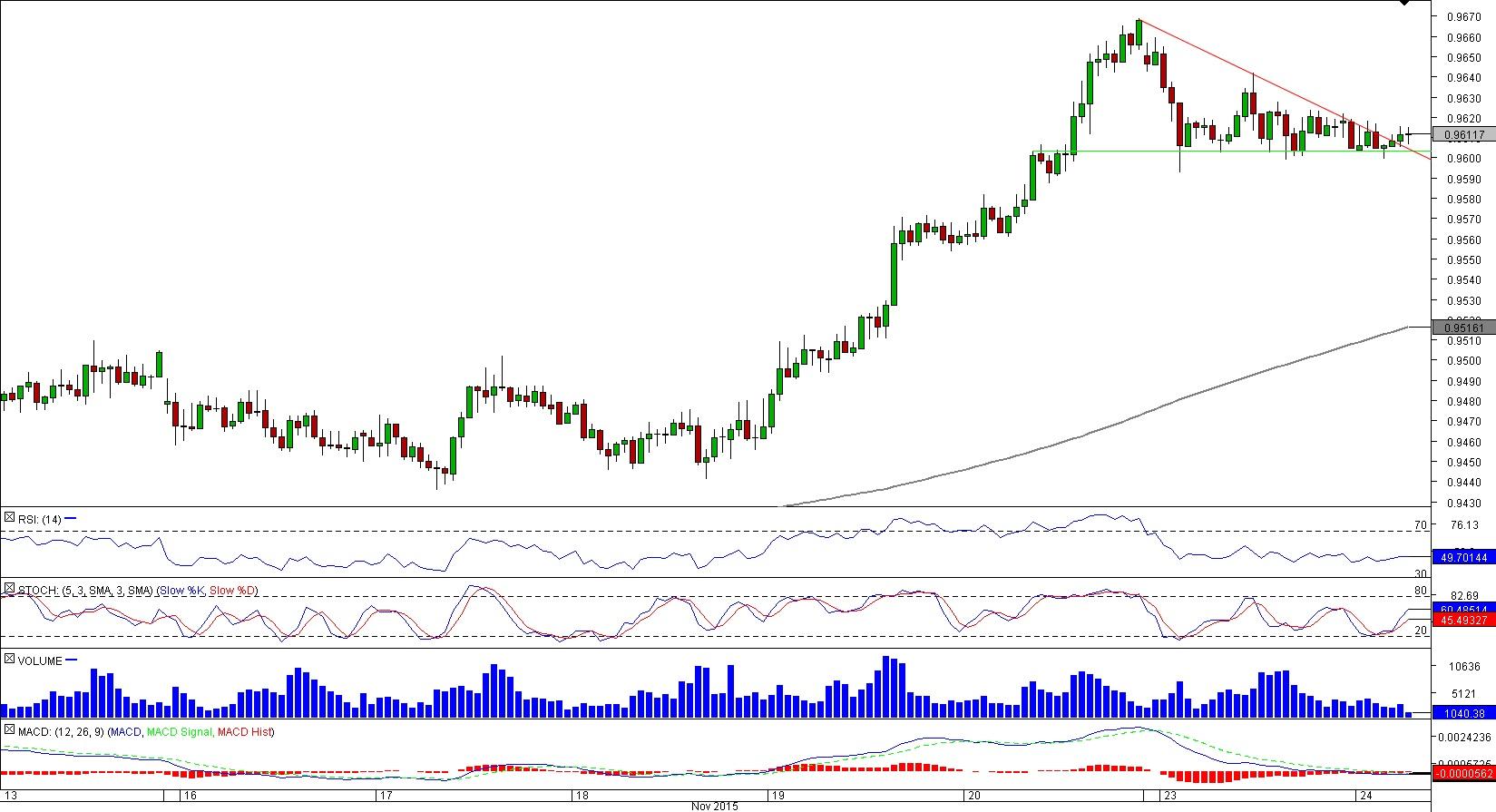

AUD/CAD 1H Chart: Descending Triangle

Comment: Although AUD/CAD has recently formed a descending triangle, which usually portends a sell-off, the pair resumed the rally from 0.9440, and it is now headed towards the Nov 20 high at 0.9668. If the latter resistance is broken as well, the next target could be 0.9750, namely the May high and weekly R1. On the other hand, violation of 0.96 will mean a change in the outlook. The next support will then be at 0.9590, but the price will likely decline deeper, down to a dense demand area around 0.9515, created by the daily S3, weekly S1 and 200-hour SMA. As for the sentiment, the SWFX market participants seem to be undecided: 48% of open positions are long and 52% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.