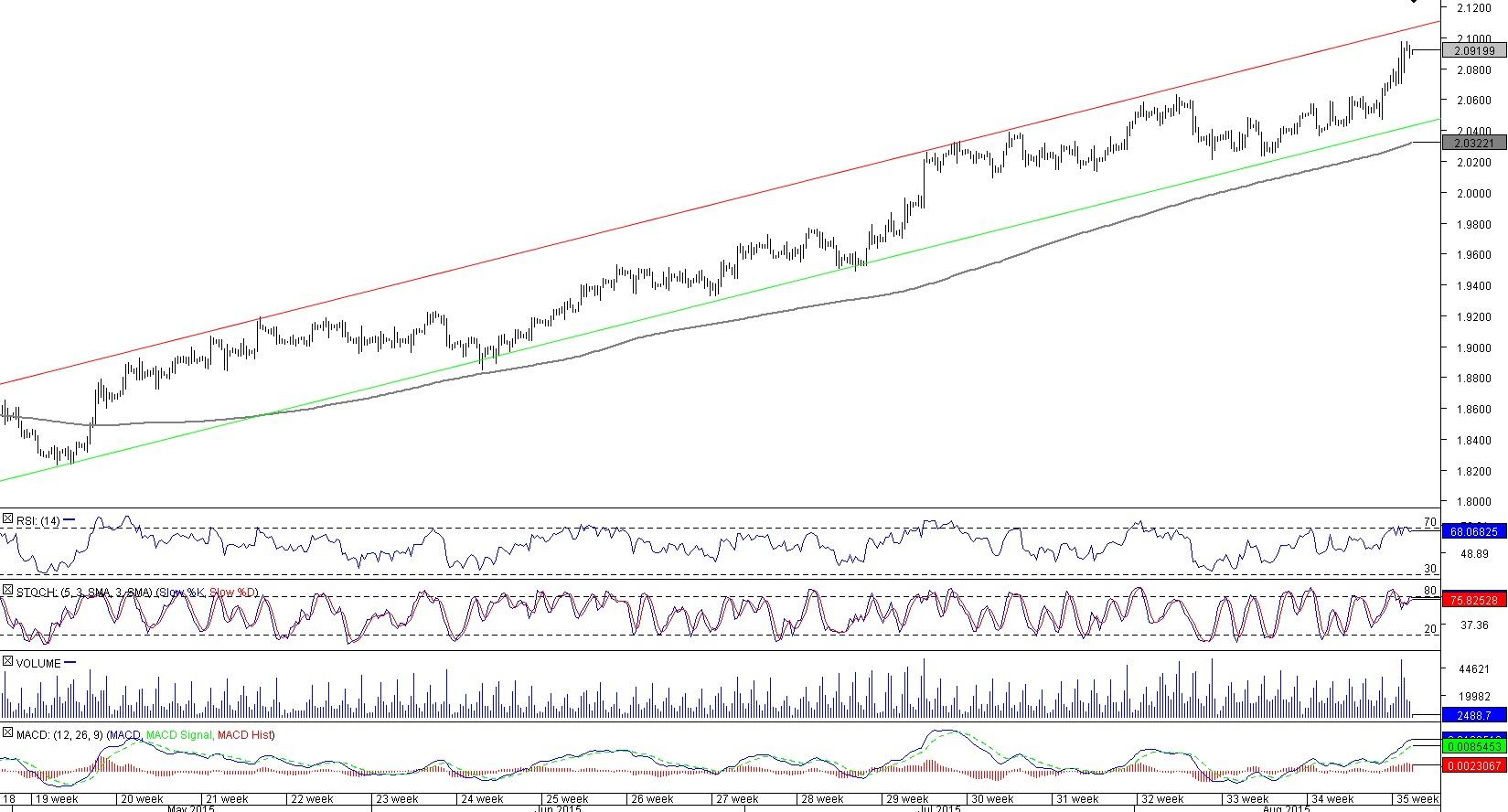

GBP/CAD 4H Chart: Channel Up

Comment: GBP/CAD continues to trade within the bullish channel, and the currency pair has recently confirmed its bullish intentions by gaining a foothold above the 2008 peak. In the near term, however, the bias is to the downside. The price is approaching the upper trend-line of the pattern, and we expect a bearish correction to start around 2.11 dollars. Alternatively, even if the Sterling slips beneath the lower trend-line at 2.05, there will be plenty of supports to attempt to resume the rally. The closest will be the 200-period SMA at 2.0320, followed by demand at 2.0240 and a cluster of supports around 2.01. Meanwhile, the sentiment is bearish: two thirds of open positions are short.

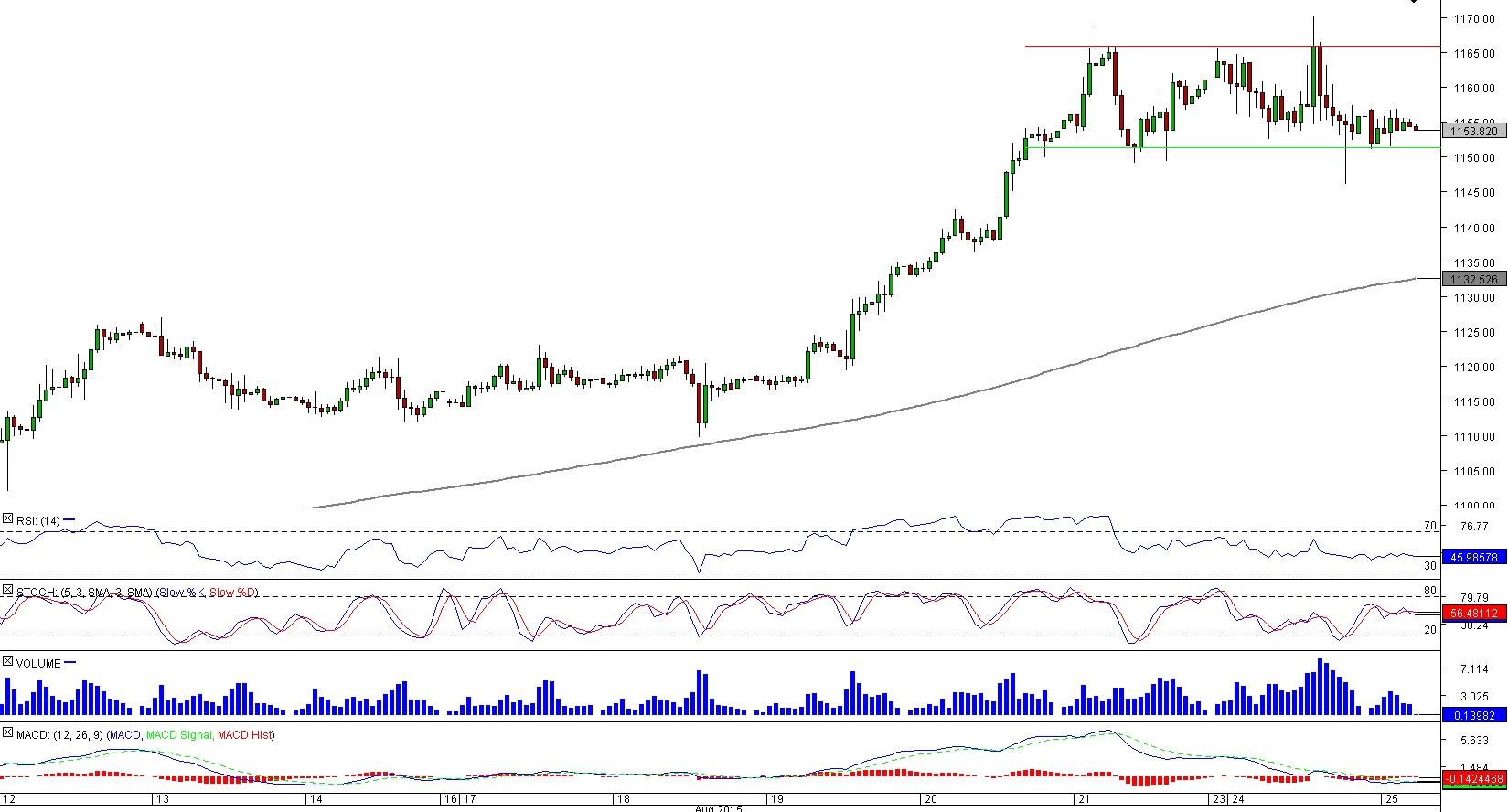

XAU/USD 1H Chart: Rectangle

Comment: Considering that a rectangle is a continuation pattern and before the consolidation started the trend had been bullish, the base scenario is a break-out through 1,166. In this case the target will be a combination of the daily R2 and weekly R1 at 1,182. Beyond this lies the June high and weekly R2 at 1,206. On the other hand, if support at the mark of 1,151 fails to underpin the price and allows the exchange rate to fall, there is likely to be a sell-off through the weekly pivot point down to 1,132 dollars, the current location of the 200-hour SMA. The sentiment among the SWFX traders is only slightly bullish: 57% of positions are long and 43% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.