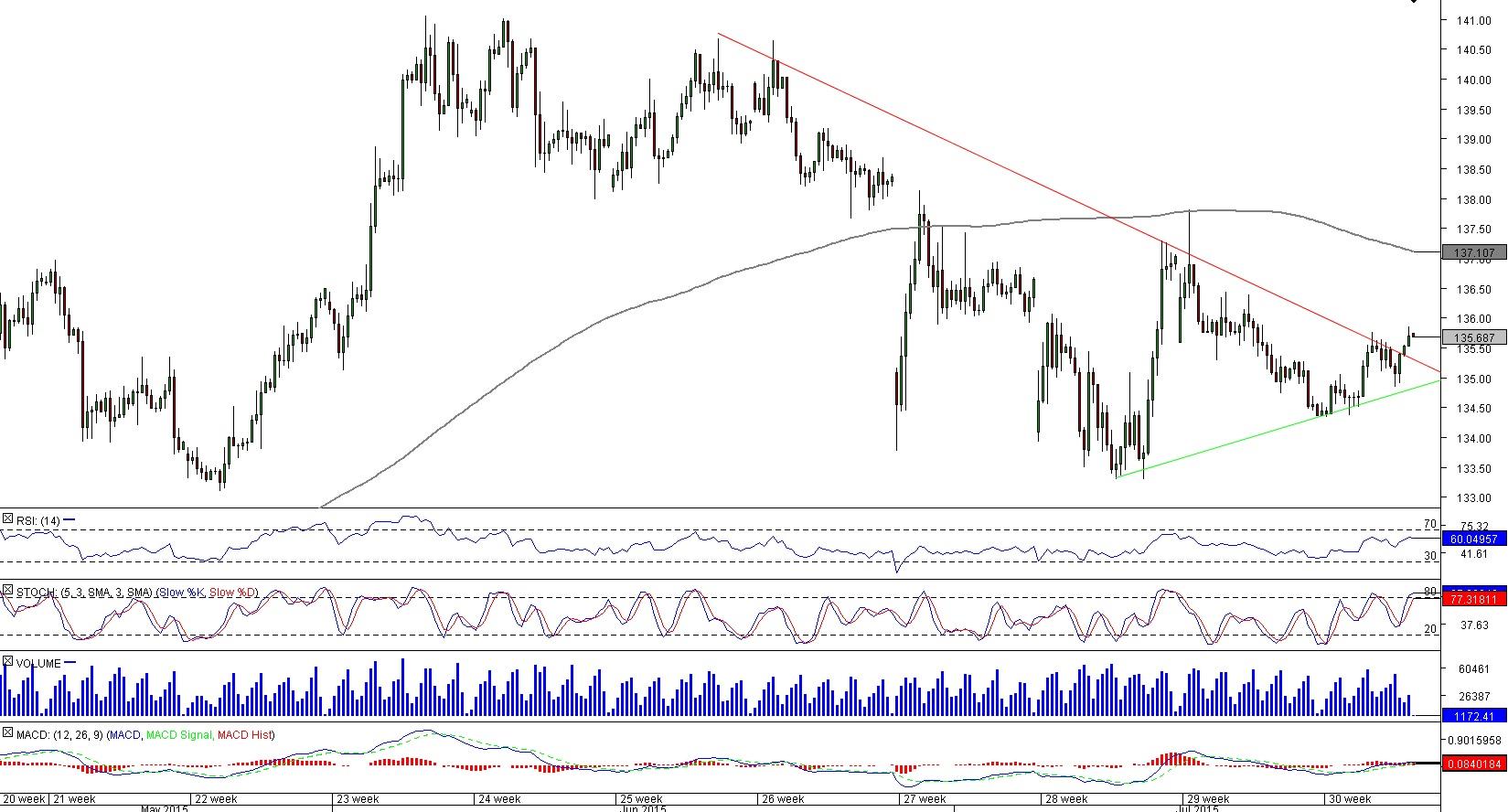

EUR/JPY 4H Chart: Triangle

Comment: The outlook is strongly bullish on EUR/JPY, as the currency pair has just broken out of the pattern to the upside. Considering the height of the pattern, which is 750 pips, the price has the potential to rise up to 143 yen. But the Euro will have to overcome a number of tough resistances. The first barrier is around 137 yen, where the monthly pivot point merges with the long-term SMA and some of the recent highs, followed by the monthly R1 and weekly R3 just above 140 yen. And while the technical indicators mostly reinforce the positive bias, the SWFX traders are not entirely convinced that the Euro is going to outperform the Yen. At the moment only 53% of positions are long.

GBP/CAD 4H Chart: Channel Up

Comment: GBP/CAD has been in a clear up-trend since the very beginning of May, and the bullish momentum is likely to persist. Concerning the shorter-term perspective however, we expect a correction. The Sterling should be sold-off down to the lower edge of the channel and the monthly R1 at 1.99 before demand overpower supply. If the price does not bottom out here and dives deeper, additional supports are at 1.96 and at 1.95 represented by the 200-period SMA and Jul 9 low, respectively. As for the market participants, they are divided in two almost equal camps: 53.5% of open positions are long and 46.5% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.