EUR/TRY 4H Chart: Rising Wedge

Comment: As EUR/TRY formed a rising wedge, a reversal pattern, the risks are heavily skewed to the downside. After the currency pair approaches a dense supply area at 2.87/86, it is expected to violate the support trend-line, which will confirm the bearish intentions of the Euro. The initial destination in this case will be a cluster of supports at 2.75/74, where the monthly PP merges with the 200-period SMA and Jan 22 high. If this zone does not withstand the selling pressure, the Jan 23 low at 2.6060 may well become the next objective. At the same time, an overwhelming majority (73%) of the SWFX market participants are currently holding short positions.

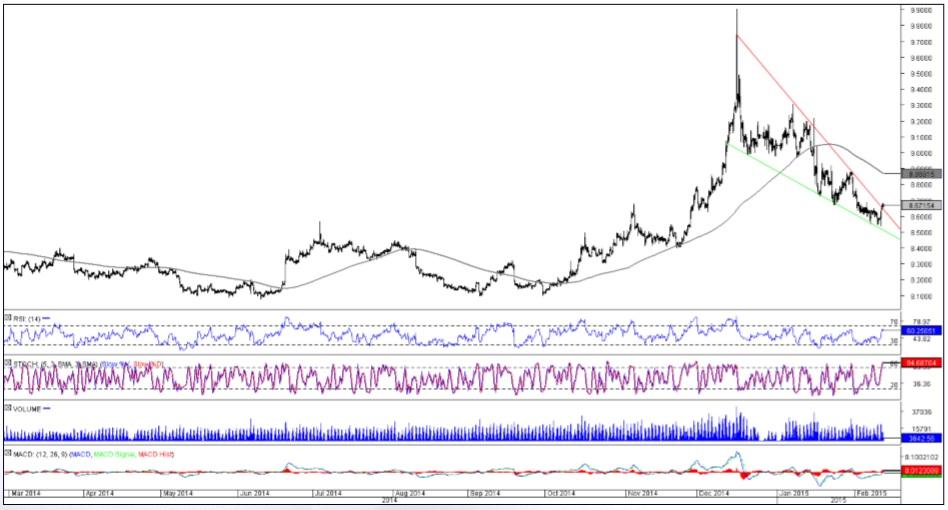

EUR/NOK 4H Chart: Falling Wedge

Comment: A prolonged bearish correction that followed the up-move between September and December seems to have finally come to an end. EUR/NOK has just closed above the resistance trend-line of the falling wedge pattern. If the pair manages to stay above 8.65, the Euro will likely extend the most recent rally to the supply area around 8.80, where the Jan 29 high coincides with the monthly pivot point and the longterm moving average. Should the bulls keep pushing the price even further north, the resistance at 9.23 will be the next potential target. However, the SWFX sentiment is strongly bearish, as 67% of all open positions are presently short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.