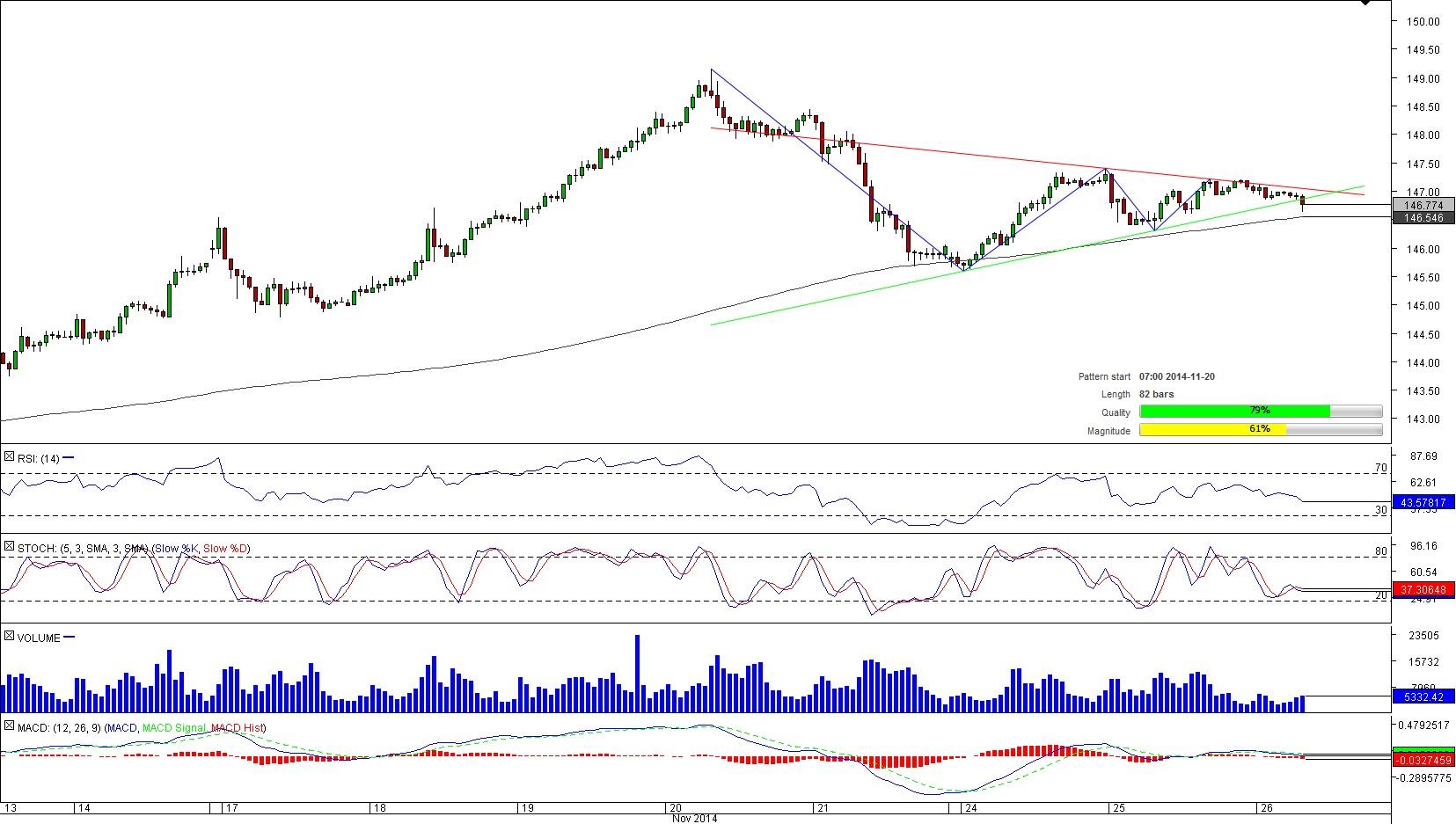

EUR/JPY 1H Chart: Triangle

Comment: Just recently the pair reached the highest level this year at 149.14; however, the Euro did not manage to hold its positions this high. From this point onwards a correction phase started, which also created a triangle pattern.

EUR/JPY is trading at the very apex of the triangle; therefore, a break-out might be anticipated. The shorter-term technical indicators are to the downside; although, there is a considerably strong supports ahead that could protect the pair from falling lower. The SWFX traders’ expect a bearish break-out, as 66% of them have shorted the pair. Now, if the pair’s bears drag the pair below the weekly PP and 200-period SMA then the weekly S2 is the target.

AUD/NZD 4H Chart: Channel Down

Comment: The Aussie has been targeting the 1.13 level for most of the second part of this year; however, unsuccessfully. A failure at that level has sent the pair lower and it has formed a bearish channel.

The current channel down pattern could be a part of a longer–term triple bottom pattern. Nevertheless, at the moment the pair is approaching a cluster of support levels (daily, weekly and monthly S2) located at 1.0886/68. With the negative technical indicators this level most likely will be breached, while in longer term a rebound and a bullish break-out could be expected. Moreover, the SWFX market participants are strongly bullish on the pair.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 after German GDP data

EUR/USD is keeping the red near 1.0700 as investors await inflation and growth data for the Eurozone. The data from Germany showed that the GDP contracted at an annual rate of 0.2% in Q1 as expected, not allowing the Euro to attract investors.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.