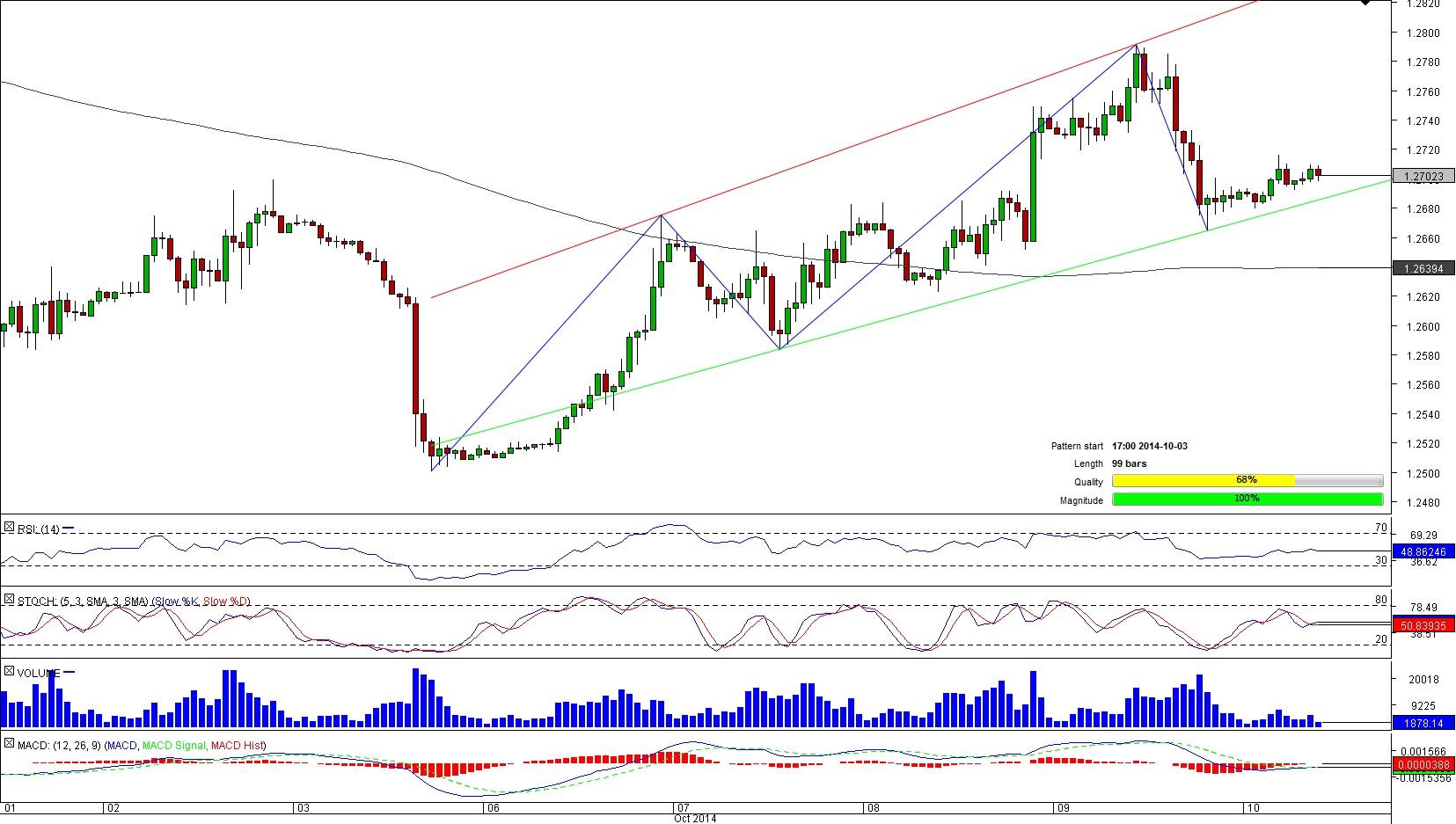

EUR/USD 1H Chart: Broadening Rising Wedge

Comment: After a sharp decline on the 3rd of October, EUR/USD found a support at the major level at 1.25. Since then the pair has formed a broadening rising wedge pattern.

At the moment, the currency pair is trading around the lower boundary of the pattern. If the lower trend-line will hold the pair’s bears back then a repeated test of the 1.28 level is possible. However, there are certainly down-side risks. The hourly and daily technical studies are pointing downwards, therefore increasing the bearish risks. At the same time the traders’ sentiment is more or less neutral with 53.29% of them expecting a rebound. For bullish traders the monthly PP and weekly R2 is the target.

AUD/NZD 1H Chart: Double Top

Comment: At the second part of September AUD/NZD reached the lowest trading level since July at 1.0920. However, at these levels the pair received a bullish impetus that pushed the pair towards the 1.13 level, forming a double top pattern.

Currently, the pair is hovering slightly above the pattern’s neckline at 1.1121. Since this is a bearish pattern in the base scenario, we should see a drop below the neckline towards the 1.10 level. However, the market participants disagree with this argument, as 69.42% of them are bullish on the pair. Very important gauge will be around the weekly S1 and daily S2. If these supports holds then we might see a bullish movements in the near-term.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.