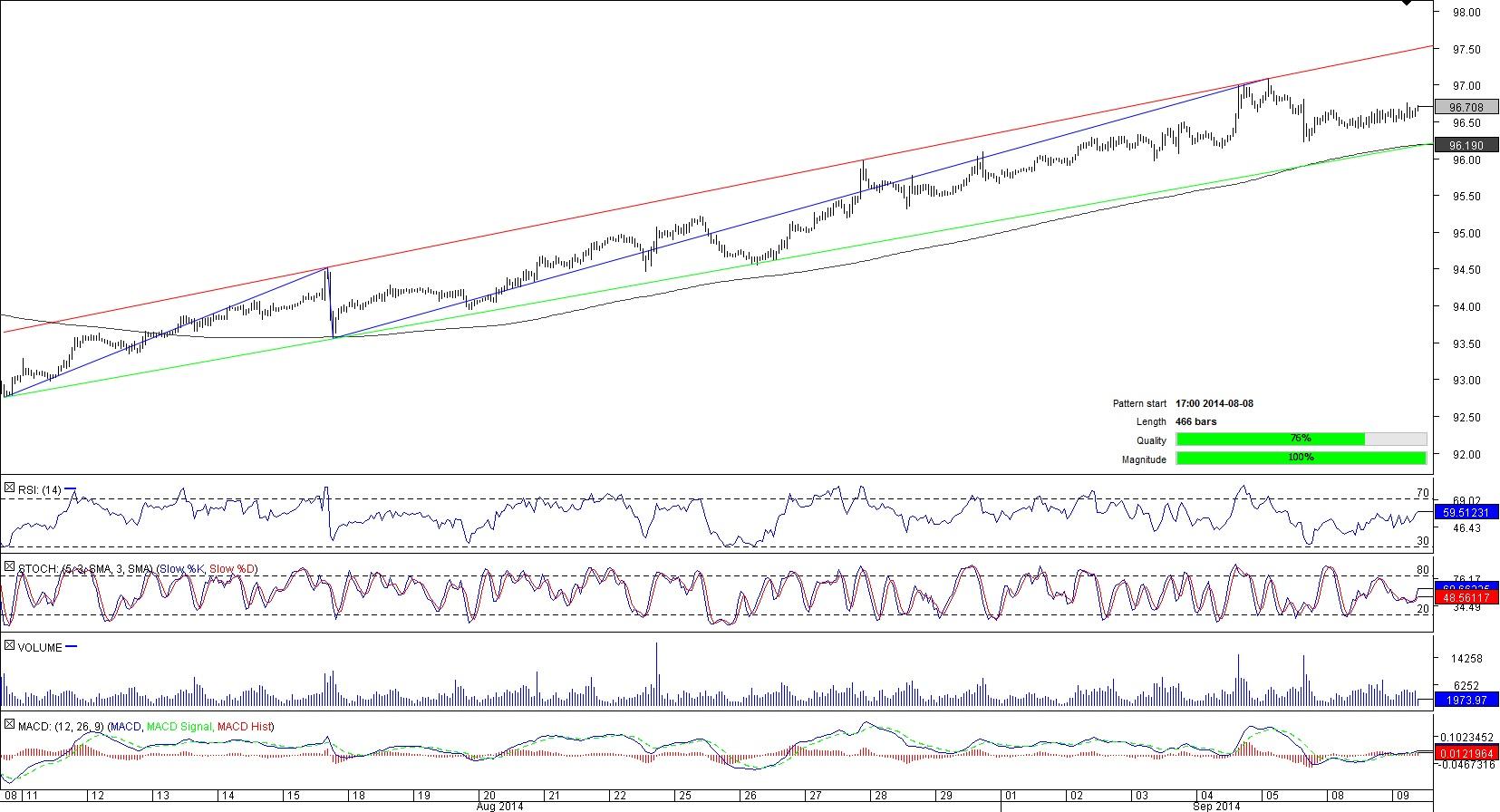

CAD/JPY 1H Chart: Channel Up

Comment: Thanks to the strong support around 92.76 CAD/JPY managed to change the direction of the trend. This is evidenced by the pair forming a bullish channel. At the moment the pair is trading below the 97 mark and it is on its way to approach the pattern’s support; however, for now the 100-period SMA and weekly PP at 96.52/48 seems a legitimate support. The near-term outlook appears to be neutral, as the technical studies point sideways. Nonetheless, the SWFX traders are sceptical on further pair’s appreciation, as 64.33% of them expect a decline to come into play. Thus, we might start to expect a bearish break-out below the 96 level.

XAU/USD 4H Chart: Falling Wedge

Comment: Since the middle of August, XAU/USD has been tilted downwards and the tendency is likely to preserve in the upcoming trading sessions given that the instrument is trapped by the limits of a bearish formation—falling wedge. Currently the pair is trading around the down-trend’s support and weekly S1 at 1,253.14. However, in the foreseeable future, the yellow metal may face additional losses against the Greenback since the daily technical indicators are more to the downside. At the mean time, our traders’ sentiment is bullish; therefore, a rebound towards the 1,270 level is not unrealistic.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.