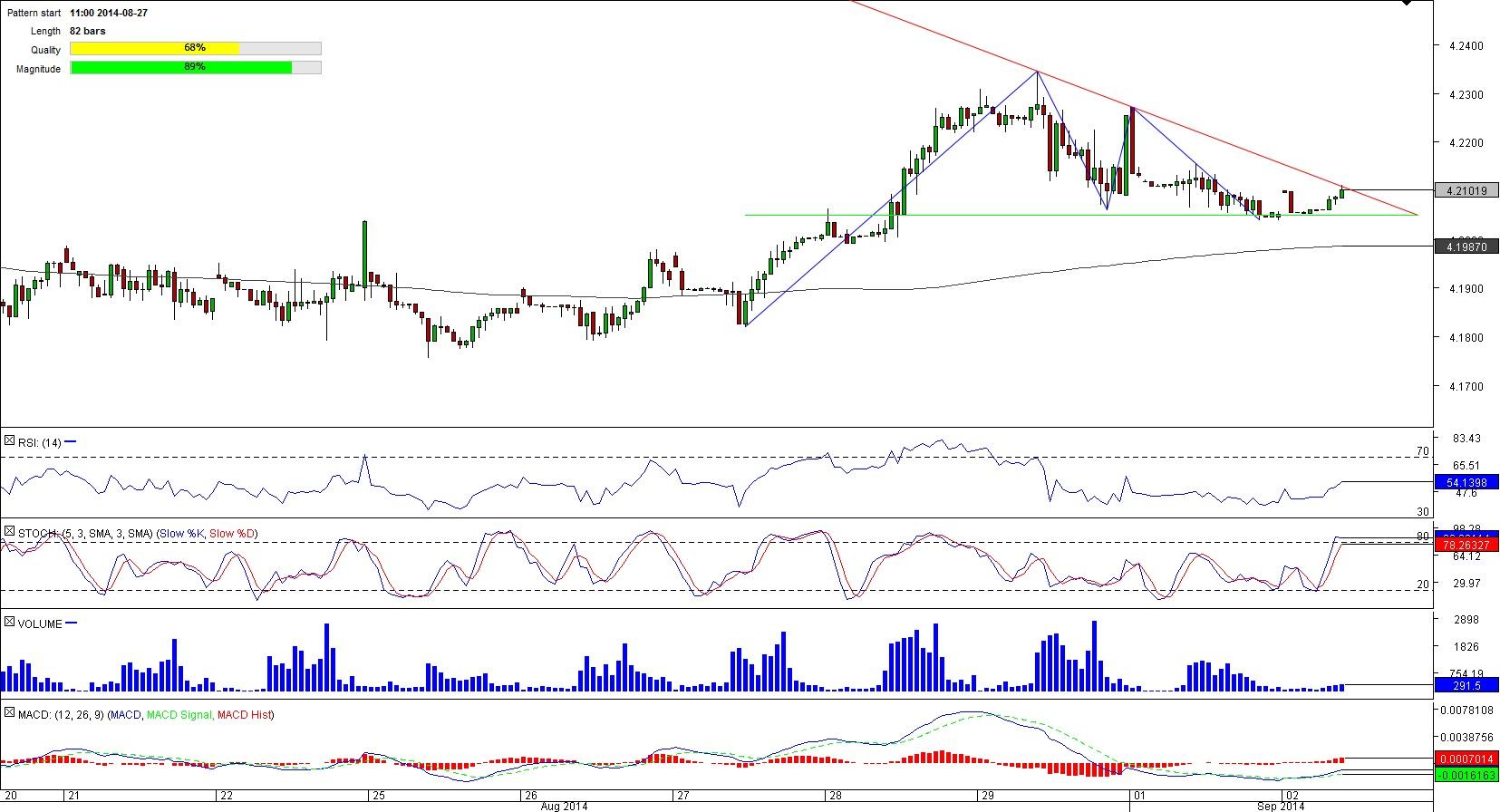

EUR/PLN 1H Chart: Descending Triangle

Comment: The pair failed to reach the 4.24 level at the end of August, as it entered consolidation phase , being supported around the 4.2050 mark. Even though the pair is trading near the triangle’s apex the technical indicators are not giving clear signals, as they are neutral. Although, an overwhelming majority (70.75%) of the traders expect the pair to decline. At the same time there are substantial resistance levels (weekly and monthly PPs) near the pattern’s support around 4.2050. Thus, if the pair manages to slide below the previously mentioned cluster of resistances then there are no major obstacles in front to reach the 4.1900 level.GBP/USD 4H Chart: Channel Down

Comment: GBP/USD remains bearish since the second week of July and is likely to stay that way for foreseeable future, given that it is trading between two parallel downward-sloping lines. At the moment, the currency pair is hovering above the major level at 1.6500, which has not been breached since March 2014. That, of course, makes this level significant. And if the pair’s bears fail to drag the Pound below this level then a rebound towards 1.66 might be expected. Moreover, since the bulls are in majority (56.02%) this scenario is rather likely. However, if the pair slides below the 1.65 level then the bearish channel is likely to stay in effect.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.