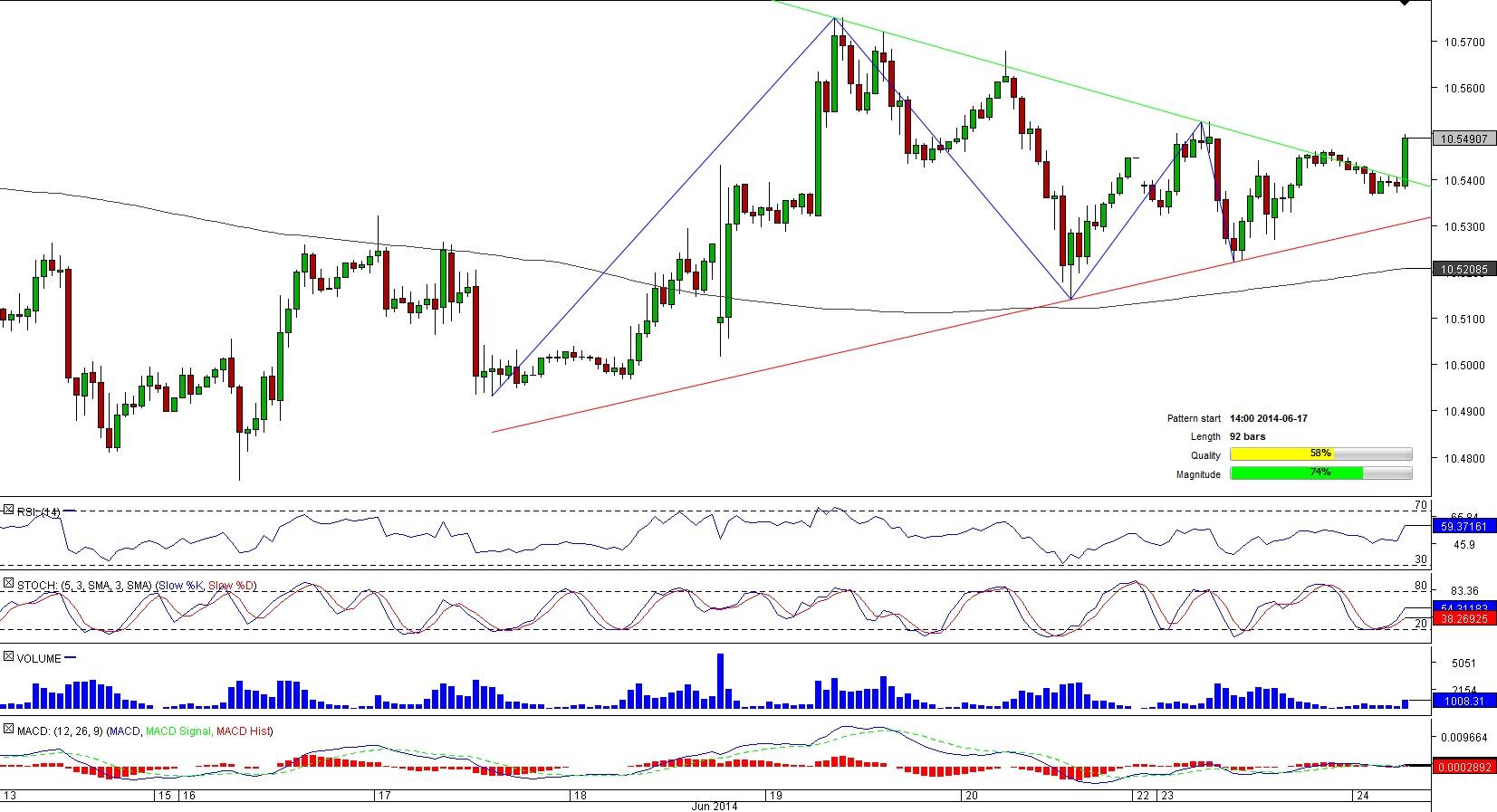

EUR/HKD 1H Chart: Triangle

Comment: Throughout the past week EUR/HKD has been forming a symmetrical triangle, consistently respecting two converging trend-lines. But now the currency pair seems to be ready to exit the boundaries of the pattern by breaking out to the upside.

Once the resistance at 10.54 is out of the way, the rate will be expected to target the daily R1 at 10.5557 first, then the daily R2 and Jun 19 high at 10.57. And while the hourly technical indicators are in favour of a rally, the daily studies are against such a development. Nevertheless, most of the SWFX market participants are currently holding long positions on the single European currency, namely 67% of them.

CHF/JPY 1H Chart: Channel Up

Comment: Right now CHF/JPY is recovering after a plunge seen earlier this month, from 115 down to 113. Considering the pair is currently fluctuating between two parallel trend-lines and it has recently gained a foothold above the 200-hour SMA, the Franc is likely to negate the recent losses eventually. However, judging by the indicators, the pair’s prospects are not as bright and it may initially seem—the ‘sell’ signals dominate on all of the most relevant time-frames. Still, given the current context, a breach of the resistance at 114.27 and a subsequent test of the upper trend-line at 114.51 appears to be a more likely course of events than a dip beneath a cluster of supports at 113.65.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.