NZD/USD 1H Chart: Channel Down

Comment: NZD/USD was advancing during two months ended April 2 when it touched a three-year high of 0.8746. Since then, the instrument has been forming a broad channel down pattern that now is almost a hundred-bar long.

At the moment, the currency couple is sitting at the 50-hour SMA at 0.8624 but it is likely to bounce off this mark as over 60% of market players are bullish on the pair. To make this happen, the currency pair has to approach 0.8633/42 (four-hour PP, R1) that if overcome will send NZD/USD to the next bunch of resistances that beset the pattern’s upper boundary , lying at 0.8652/74 (daily R1, R2; 200-hour SMA and four-hour R2, R3).

GBP/USD 1H Chart: Broadening Rising Wedge

Comment: Being a subject to a strong bullish pressure, GBP/USD managed to attain a five-year high of 1.6839, close to which it is meandering now. According to the SWFX data, market players believe the pair has not exhausted its potential yet and may continue ascending in the hours to come; around two thirds of traders bet on appreciation of the currency couple. If these expectations materialize, the GBP/USD may reach a cluster of resistance lines at 1.6840/60 (daily R1; four-hour R1, R2) and may even try to near 1.6878/82 (daily R2; four-hour R3) that represent the last defence from a surge to the wedge’s upper limit.

USD/NOK 1H Chart: Rising Wedge

Comment: After a long-term depreciation that lasted for almost two months started early February, the U.S. Dollar gained some ground versus the Norwegian Krone. A drop to a one-month low of 5.9127 in the second week of April marked the commencement of the bullish formation-rising wedge.

Currently, USD/NOK is trading within the pattern’s limits and demonstrates no intention to exit this area. In the foreseeable future, the currency couple is likely to move closer to the short-and long-term SMAs as market sentiment is strongly bearish. The SWFX data shows almost 80% of traders bet on depreciation of the instrument.

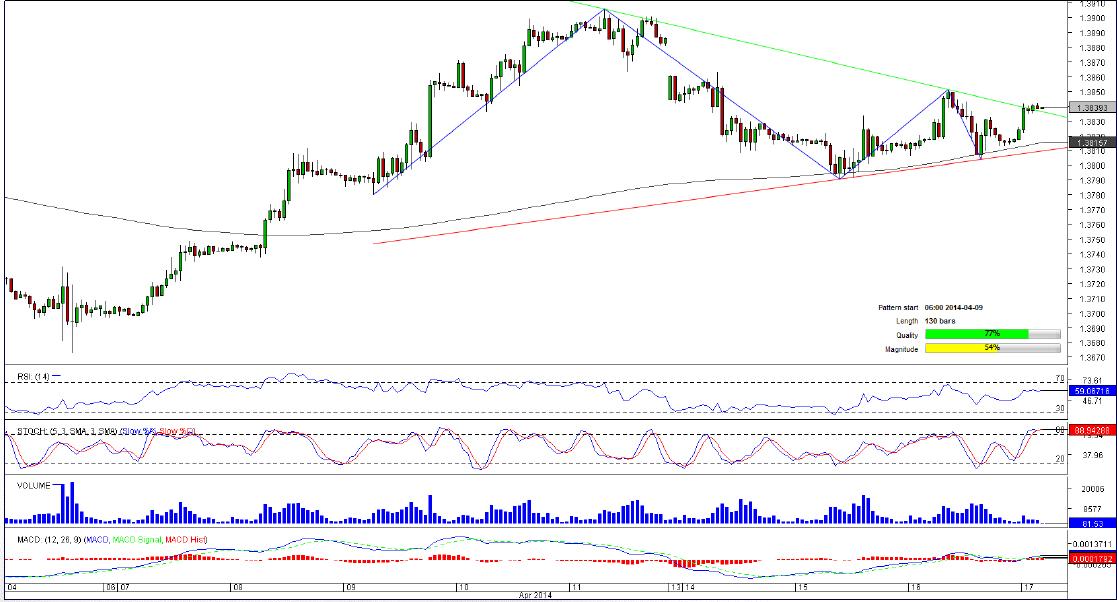

EUR/USD 1H Chart: Triangle

Comment: The most traded currency couple has been forming a triangle pattern since April 9, the time when EUR/USD was on the rise after a plunge to a two-month low of 1.3673 in the very beginning of April.

At the moment, the currency couple is on the brink of a bullish breakout as it has already surpassed the upper boundary of the triangle. If the pair manages to consolidate above this formidable resistance, we may expect an accelerating advancement before long. This is further supported by the SWFX numbers, indicating that almost 60% of all orders are placed to buy the pair.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.