Top Trade Setups in Forex –PPI Reports In Focus

The U.S. official data showed that the Consumer Price Index (CPI) grew 0.2% on month in December, slower than +0.3% expected. On Wednesday, the Producer Price Index (PPI) for December (+0.2% on month expected) and the Empire Manufacturing for January (3.6 expected) will be reported. European stocks were steady, with the Stoxx Europe 600 Index rising 0.3%. All of Germany's DAX, France's CAC and the U.K.'s FTSE 100 edged up less than 0.1%.

The U.S. government bond prices firmed up as consumer prices increased less than expected. The benchmark U.S. 10-year Treasury yield eased to 1.817% from 1.846% Monday.

Gold edged down one dollar to $1,546 an ounce. Whereas, the U.S. Nymex crude oil futures rebounded 0.3% to $58.23 a barrel, halting a five-session losing streak. Brent was up 0.5% to $64.49 a barrel.

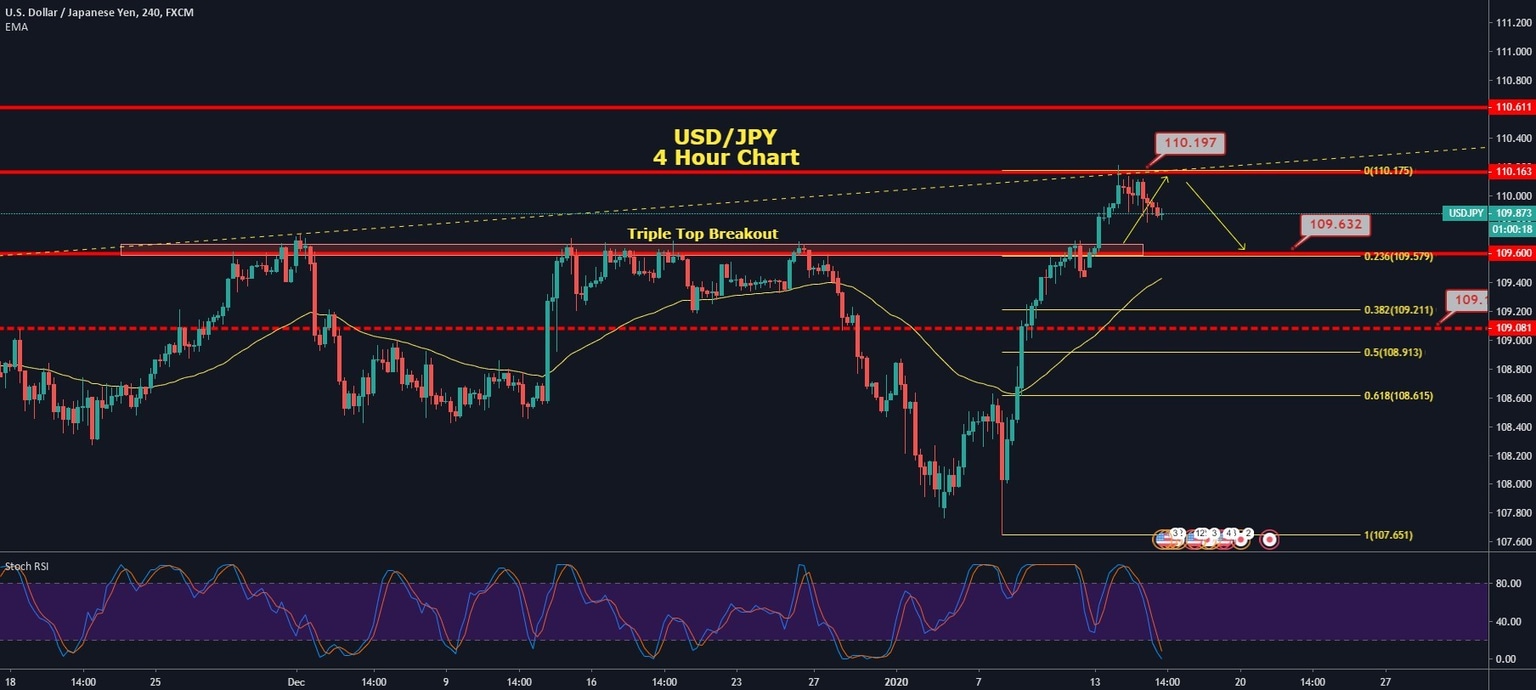

USD/JPY - Potential Setup for Bearish Retracement

The USD/JPY closed at 109.982 after placing a high of 110.212 and a low of 109.850. Overall the movement of the USD/JPY pair remained bullish throughout the day.

Traders were selling in Yen on the back of trade optimism from the upcoming signing ceremony of the US-China Phase one deal. The increased risk sentiment and decreased safe-haven appeal gave a push to USD/JPY prices above 110.00 level since May 2019.

The U.S. Treasury removed China from the list of currency manipulator on the back of risk-on sentiment on Tuesday. This development raised the equity markets and U.S. stocks to their record highs.

On the data front, at 4:50 GMT, the yearly Bank Lending in December from Japan dropped to 1.8% against the expectations of 2.1% and weighed on Japanese Yen. The Current Account Balance for November showed a minor increase from expectations of 1.78T to 1.79T.

At 10:00 GMT, the Economy Watchers Sentiment for December also dropped to 39.8 from the forecasted 40.9 and weighed on Japanese Yen. The weaker than anticipated macroeconomic data from Japan gave a push to USD/JPY pair prices on Tuesday.

USD/JPY - Daily Technical Levels

| Support | Pivot Point: | Resistance |

| 109.71 | 109.96 | 110.10 |

| 109.57 | 110.35 | |

| 109.32 | 110.49 |

USD/JPY - Daily Trade Sentiment

On Wednesday, the USDJPY has traded slightly bearish at 109.950 after falling from 110.060 level. The pair seems to hold below 110.250 resistance area as the USD/JPY has formed a series of bearish candles, which is likely to keep the USD/JPY prices on a bearish mode.

On the downside, the USD/JPY may find support near 109.600, which marks the 23.6% Fibonacci retracement level. An upward breakout of 110.200 can stretch bullish trend until 110.600; however, under 110.200, the pair has the potential to fall until 109.700.

USD/CAD - Bullish Channel In-Play

The USD/CAD prices closed at 1.30607 after placing a high of 1.30791 and a low of 1.30467. Overall the movement of USD/CAD remained bullish throughout the day.

The USD/CAD pair surged above 1.307 level in the early session of Tuesday but started to fall in late session on the back of recovering crude oil prices and broad weakness of the U.S. dollar.

The Russian news agency TASS reported on Tuesday that OPEC+ would postpone its meeting of March to June, and the output cut, which was expected to announce in that meeting, will also be postponed until June. This news gave strength to WTI crude oil prices on Tuesday after falling for the last seven days.

The Crude oil prices rose almost 0.7% on Tuesday to the level near $58.50 per barrel and gave strength to the commodity-related Canadian Dollar. The strong Canadian Dollar then weighed on USD/CAD prices and dragged them from their highest level of the day.

On the other hand, the U.S. Dollar Index also reversed its direction after surging near 97.50 level and started to drop and remained flat near 97.40 level. The 10-year U.S. Treasury bond yield fell more than 1% on Tuesday and hurt the greenback.

The weak U.S. dollar also restrained the USD/CAD prices from rising to 1.30800 level when the U.S. Core Consumer Price Index (CPI) for December showed a decline to 0.1% from forecasted 0.2%.

However, the weakness of the U.S. dollar and the strength of the Canadian Dollar failed to end Tuesday's trading session with a bearish candle. Overall the USD/CAD pair posted gains on that day amid increased trade optimism around the globe with U.S. & China signing phase-one trade deal on the next day.

USD/CAD- Daily Technical Levels

| Support | Pivot Point: | Resistance |

| 1.3029 | 1.3053 | 1.3076 |

| 1.3006 | 1.3099 | |

| 1.2959 | 1.3146 |

USD/CAD- Daily Trade Sentiment

The USD/CAD is trading at 1.3072, in between the sideways trading range of 1.3095 - 1.3042. Violation of this range can extend bullish bias until 1.3140. Whereas, the bearish trend can be extended until 1.3000.

The 50 periods EMA holds around 1.3035, and it's keeping the USD/CAD in a bullish zone while the RSI holds in the selling zone. On the lower front, the USD/CAD pair is expected to drop unto 1.2975 and 1.2950. I would consider taking the sell trade under 1.3035 and buying above the same level today.

AUD/USD – Choppy Session Continues

The AUD/USD closed at 0.68997 after placing a high of 0.69094 and a low of 0.68847. Overall the movement of AUD/USD prices remained bearish that day. Ahead US-China trade deal, the Australian Dollar remained range-bound on Tuesday between 0.688 and 0.6909.

The AUD/USD pair remained under pressure on Tuesday amid the soured risk sentiment after the reports that the U.S. would continue to impose existing tariffs on China after the singing of the phase-one deal, and this situation will be maintained beyond the U.S. presidential elections in November.

The pair started to fall, but the Chinese data helped to minimize the losses on Tuesday. The Australian Dollar, as a proxy of the Chinese Yuan, found support after the release of USD-Denominated Trade Balance forms China at 8:24 GMT, which showed a surplus of 46.8B against the expected 45.8B. The Trade Balance in Yuan was 329B against the expected 315B.

The demand for local currency Chinese Yuan surged, giving support to Australian Dollar, its most significant economic partner, on the increasing hopes that trade relations after the phase-one trade deal signing will spark a recovery in global financial performance.

On Tuesday, the attention of the market remained on the US-China phase-one trade deal, and in the absence of economic data from Australia, the focus of traders shifted towards the U.S. dollar movement.

The U.S. Dollar Index rose to 97.5 level on Tuesday and gave pressure on AUD/USD pair. The economic data from the United States also came mixed, and hence the pair ended its day with a bearish candle. The CPI data from the U.S. came in line with the expectations of 0.2%.

However, the Core CPI came short of expectations as 0.1% and weighed on the U.S. dollar. The fed Budget Balance from the U.S. supported the U.S. dollar when it came in as -13.3B against the forecasted 5.03B. AUD/USD pair will be moved on Wednesday, following the details of the US-China phase-one trade deal details. Traders will be watching them whether they would fall short or over the market expectations and will further invest accordingly.

AUD/USD - Technical Levels

| Support | Pivot Point: | Resistance |

| 0.6885 | 0.6897 | 0.6909 |

| 0.6873 | 0.6921 | |

| 0.6860 | 0.6934 |

AUD/USD - Daily Trade Sentiment

The Aussie has finished a bearish engulfing candle under a 38.2% Fibonacci retracement mark of 0.6920. Ever since the pair is working as a solid resistance for the AUD/USD pair.

Presently, the pair is attempting to present a bearish crossover on the 50 periods EMA which may prompt additional selling in the AUD/USD unto 0.6880 level. I would be looking for sell trades below 0.6897 today with a target of 0.6860.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and