Today’s trading activity will be disrupted as usual by payrolls

Outlook:

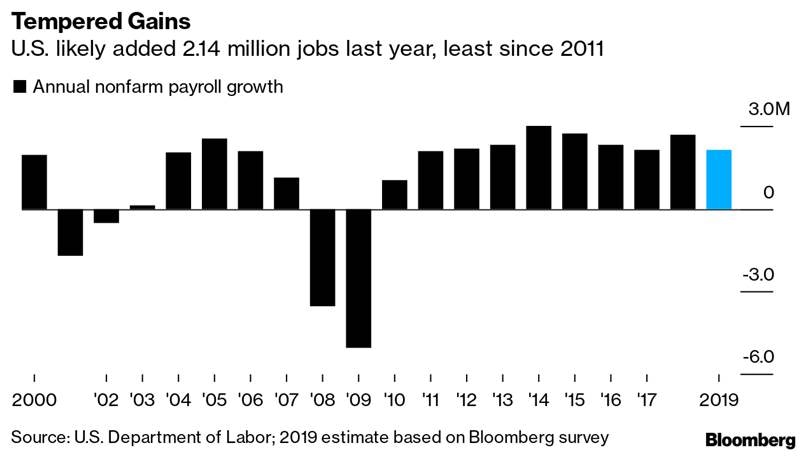

Today's trading activity will be disrupted as usual by payrolls at 8:30 am ET. The consensus forecast is 160,000, with special attention on average hourly earnings, forecast up the same 0.3% m/m and 3.1% y/y. Lately the press has made some noise about the rise in the minimum wage in some twenty states that will deliver an earnings bump, but it won't be visible until next month. Bloomberg, out of anti-Trump sentiment, strains to find something negative in payrolls, saying the gain will be bigger than forecast at 205,000 for a 2019 year total of 2.14 million, which will be the least since 2011 and less than 2.68 million in 2018. It's not a "tempered" gain. It's a normal gain.

This is one of those times when it would take a shocking departure from payrolls expectations to get a lasting change in the yields or currencies, but you never know. In FX, we almost always get a two-way spike, one of which ruins plans by hitting stops. We, along with most others, usually take a loss in our positions on payrolls. Sometimes Rule 3 comes to the rescue—buy/sell again if the original entry is hit a second time in the same session—but not always. We had two Rule 3 re-entries yesterday and both resulted in losses, which is fairly rare for Rule 3. We may have lower volatility in the FX market than usual, but we still have tremendous choppiness. We don't expect that this time, but again, you never know. Sometimes trader drive outsized moves out of sheer boredom to see what will happen. We like to think FX is the pinnacle of high finance but tend to forget that many traders have an adolescent, game-playing mindset. If there is a surprise in the payrolls report, expect a spike.

After payrolls, then what? Markets want to embrace risk. Investors crave real returns. One or two are keeping an eye on inflation in the background, although a greater number expect the end of negative rates and central bank QE. Just about the only central bank still talking about going lower is the Bank of England (the BoJ is in denial). Will 2020 be the year we emerge from crisis conditions at last? It's too soon to say, but if so, it will be an unwinding that will take months. When it gets a grip and is acknowledged, the dollar reign will be ending, but that's not in view just yet. We can see it out of the corner of the eye, though.

Notice we have hardly anything to say pertaining to US political conditions. That's because we are in a state of suspended animation until Nancy delivers the articles of impeachment to the Senate. Whereupon the Senate will refuse to take any action that reels in the Orange Menace. It's going to take the November election to do that. Until then, the equity market can run wild, almost regardless of what the economy is doing. The horse has the bit in its teeth. We have to accept it without forgetting that momentum never lasts forever.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat