The two effects of NFP report on FX: How will impact the market this time?

Outlook: We were mightily impressed by two important Feds calling for tapering in the fall and a rate hike justified in 2022—if the data backs it up. Today’s payrolls is the decisive number for whether more traders jump hew to this view. As we know, Delta and the vaccination problem in the US are a major potential setback.

We wrote yesterday that for the recovery trade to win, payrolls this morning has to be between ADP’s 330,000 and the consensus 880,000, or something like 500,000 (the actual average is 440,000). Or maybe the market will heed St. Louis Fed Bullard’s remark that it’s not easy getting a million jobs per month. Markets are not known for patience but still, we can safely guess that once schools are open and we have more vaccinations, a goodly portion of the workforce can get out of the house.

The payrolls report has two effects on FX—if it disappoints, the dollar falls (fairly reliably), and vice versa. Traders jump on positions that gain in the first minute or two. This causes a spike and explains why the price jumped right over your stop. Savvy statisticians can measure the average move in the first hour and other metrics. This is pure opportunism and while there’s nothing wrong with it, chartists note it puts blips on charts that are not helpful, to be polite. It also brings up the second point—it’s only the first hour that counts. By noon on payrolls day, the charts look normal again. The jumpers have left the building.

This time the payrolls number could have more lasting meaning. A high number (like 700-800,000) validates the recovery story, if only on the grounds of those losing government benefits sighed and went back to work. That’s a big cynical but does contain a germ of truth. Even August’s number on the first Friday in September is not going to put all the recovery on full display, because of the women/children/schools. Many schools opened already but it’s not until the first Friday in October that we will have the true story.

So, a high number this time presages high numbers the next few times, if the creek doesn’t rise (i.e., Delta is contained). We imagine the anti-vaxxers are as stubborn as can be and Delta will NOT be contained and employers/governments will still be fighting this ridiculous fight at Christmas. But it’s literally the jobs number that counts, not the pandemic cases or deaths. We can get a revival even in the midst of a pandemic surge.

A lousy number this time (like the ADP’s private-sector forecast), however, can pour cold water on the recovery scenario even if we expect later months to deliver better numbers. Traders lack patience and want to trade on data, not forecasts.

It seems to be a black and white choice but in practice, it's more like a dozen shades of gray.

Still on the stove is how to interpret the BoE yesterday. The policy statement was so brief that it opened to door to any old interpretation you like. The BoE said inflationary pressures are transitory and also said tightening will be needed as persistent inflation goes up. The outlook was not changed at all. Some say the BoE won’t act until after the Fed takes the lead; actually, the lead will be New Zealand next week. Does the Fed give a fig who goes first?

In fact, now that we have had a whole day to read the BoE statement again, it’s dawning that the outlook was changed, after all. For one thing, as Gittler at BD Swiss points out, the wording changed mightily from “not budging until hard evidence is in hand” to “The Committee judges that, should the economy evolve broadly in line with the central projections in the August Monetary Policy Report, some modest tightening of monetary policy over the forecast period is likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term.” This still means action depends on upcoming data, but the tone is entirely different.

In addition—and this was confusing to everyone, including us—the BoE will hike before it tapers. Remember that phrase about reversing the QE program when rates rise over 0.5%? That means not rolling over existing holdings when they mature, with outright selling to begin when rates reach 1.5%. That could be years away. The point is that what started out looking dovish was quickly interpreted as not dovish and therefore hawkish—giving sterling a big boost—and today looking less hawkish.

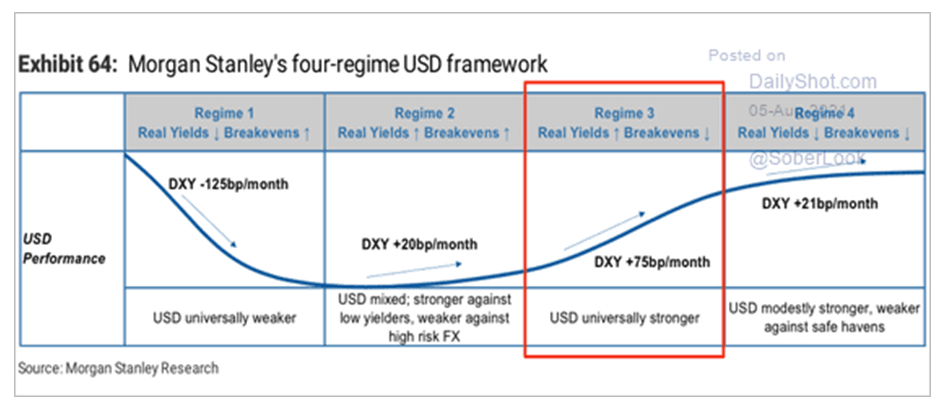

We continue to think rising economic activity will be stronger than the headwinds from Delta. We are happy that Morgan Stanley agrees, on the whole, and the WSJ’s Daily Shot newsletter picked it up and offered this chart. The path is hardly going to be so smooth and you can still lose your shirt on the zigzags. Today is a day to avoid a zag.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat