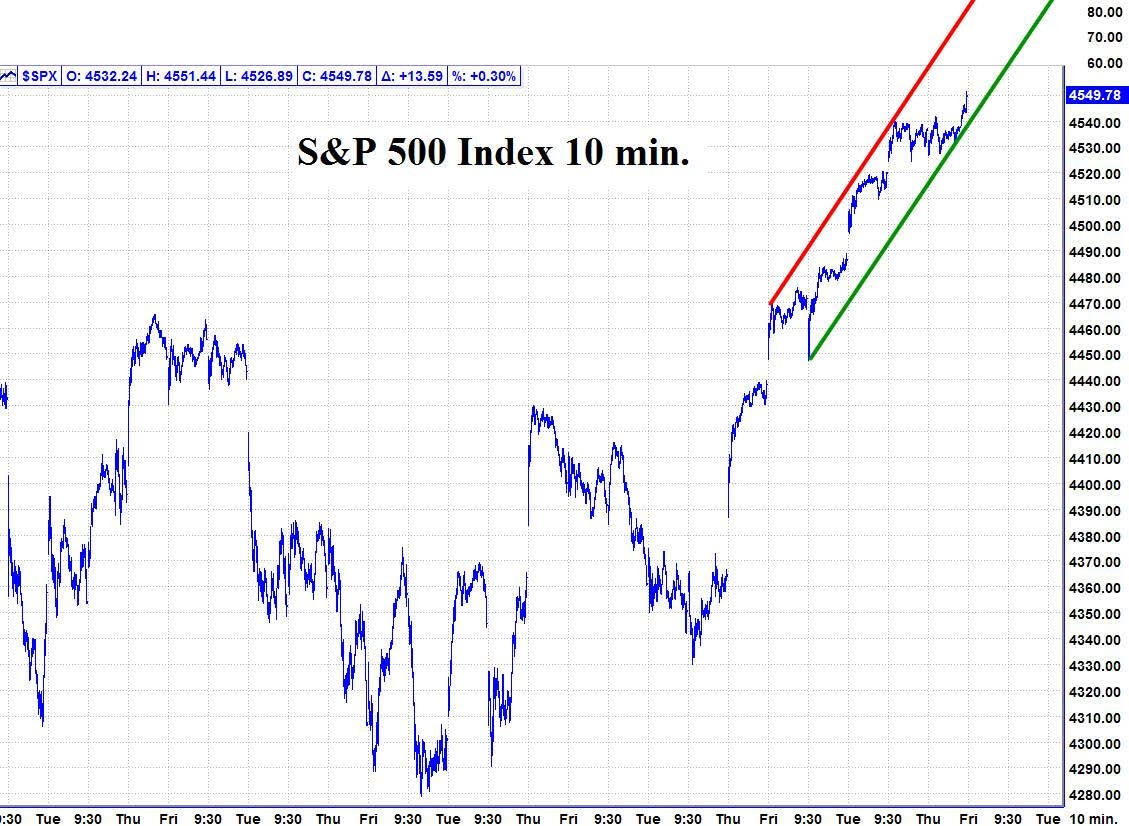

The S&P 500 made a new all-time high at 4551.44

10//21 – The DJIA had a small down day while the S&P and Nasdaq had a moderate up day with the following closes:

The DJIA – 6.26; S&P 500 + 13.59; and the Nasdaq Composite + 94.02. The S&P 500 made a new all-time high at 4551.44.

Looking ahead – The market had a good AM dip but then rallied to a new high into the close. Bottom line is that the market is not behaving the way we expected. Therefore, I recommend moving to the sidelines for a day and wait to see what the market does into our weekend change in trend window.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

4. A. 10/22 AC – Mercury Greatest Elongation West. Major change in trend Corn, Oats, Soybeans, Wheat.

B. 10/22 AC – Jupiter 150 US Neptune. Moderate change in trend US Stocks, T-Bonds, US Dollar, & Oil.

C. 10/22 AC – Uranus 90 US MC. Major change in trend US Stocks, T-Bonds, US Dollar.

Stock market key dates

Fibonacci – 10/29.

Astro – 10/25, 10/29 AC.

Please see below the S&P 500 10 minute chart.

Support - 4540, Resistance – 4580.

Please see below the S&P 500 Daily chart.

Please see below the Planetary Index charts with S&P 500 10 minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com