The S&P 500 ETF (IVV) finished the day up 0.17%

Highlights:

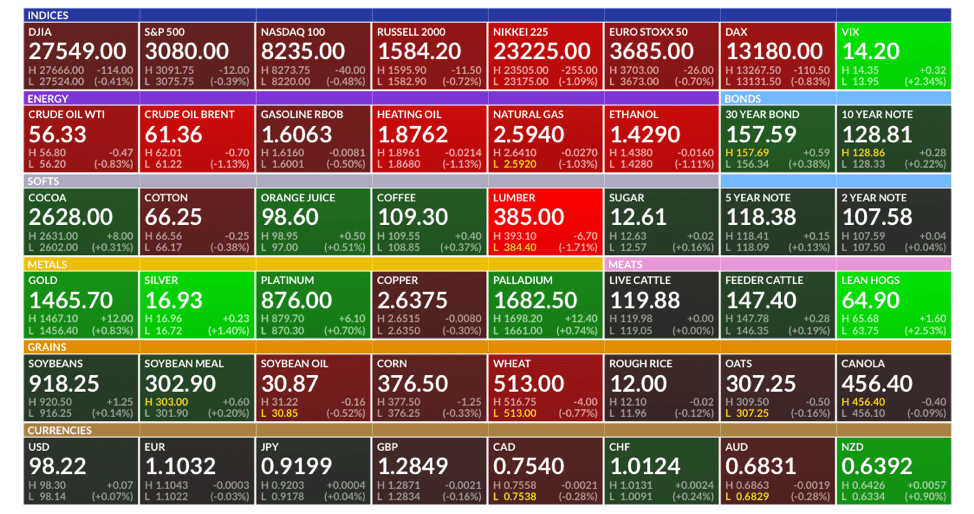

Market Summary: The S&P 500 ETF (IVV) finished the day up 0.17%. Global stocks (VT) closed higher by 0.08%. Interest rates dropped 2 basis points, sending bonds higher. Copper, transportation stocks, and emerging markets were all down more than -0.60%.

Top Three Things:

Transportation Stocks: On a relative basis, transportation stocks have yet to breakout above support and clear the 200-day moving average against the S&P 500. We would expect transportation equities to lead the market higher in an economic expansion scenario. Therefore, we continue to reiterate a positioning in higher quality and more defensive equities.

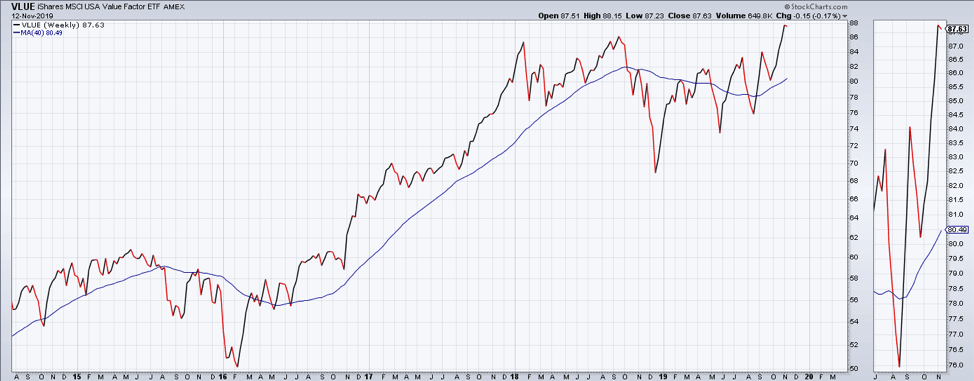

Value: Value has broken out to all-time highs (VLUE). This is encouraging as value has been a long-term market laggard. A rotation into value strategies is typically something we see at a business cycle trough heading into an acceleration. Therefore, we welcome all constructive price action out from value stocks. The move to new-all-time highs by VLUE is not bearish and is one of the many market-based indicators that have us searching for a recovery in economic data.

Lumber: Lumber fell against gold yesterday and is back below its 200-day moving average. The lumber to gold ratio has been a reliable leading indicator for equity market volatility over recent history. The ratio started to rally and held important support prior to the stock market making its most recent run. However, the ratio has failed to even take out its most recent intermediate term highs. If this ratio starts to fall, it could imply that equity market volatility is poised for a rally. With record short positions in the VIX, this could mean some painful times ahead for traders. Hopefully this is a pullback before a continued move higher in lumber.

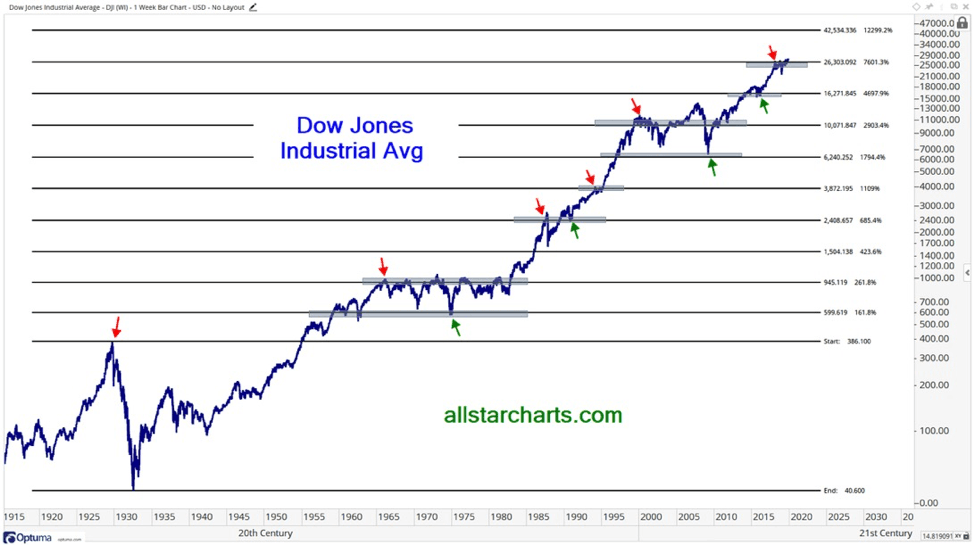

Chart of the Day: Breakout! Today's chart of the week comes from our friend JC Parets of All Star Charts. He takes an extra long-term view of the Dow Jones Industrial Average back to the early 1900's and shows Fibonacci extensions and support and resistance levels. What is interesting is that the recent breakout from the Dow, if it continues, could imply that the next

Futures Summary:

News from Bloomberg:

Impeachment hearings are scheduled to begin at 10 a.m. with statements from Intelligence Committee head Adam Schiff and Devin Nunes, the top Republican on the panel. Top envoy to Ukraine William Taylor and State Department official George Kent will testify. The public hearings set off a process that's almost certain to make Donald Trump the third president to be impeached. Here's a guide to watching the hearings, and everything you need to know about Trump, Ukraine and impeachment.

Fed chair Jerome Powell may try to steer markets on the rate path when he addresses the Joint Economic Committee of Congress today. His assessment of the Fed's policy stance and the state of the economy probably haven't changed much since his Oct. 30 press conference, but investor expectations certainly have, with the easing cycle seen as done and dusted in the near term.

Trump meets President Erdogan at the White House today in their first meeting since the diplomatic spat over Turkey's offensive in northern Syria. Trump may try to pressure Erdogan to change his mind about buying a Russian anti-aircraft missile system. There'll be a news conference that may distract attention from the impeachment hearings.

Treasury yields fell with U.S. stock futures as Washington geared up for its big day. Traders may keep one eye on the impeachment inquiry public hearings, though what matters most right now for bonds is Powell's address. Shares in Europe and Asia also declined. The dollar nudged up. Gold rose and oil slid.

Google denied misusing data from one of the biggest health care providers. It said it only accesses the data to build a new internal search tool for Ascension's hospital network. The Health Department opened an inquiry, the WSJ reported. Google said its contract is governed by health privacy law.

Author

Clint Sorenson, CFA, CMT

WealthShield