Janet Yellen, Chair of the Board of Governors of the Fed, and U.S. President-elect Donald Trump have not exactly had an auspicious start to their relationship. This article will address how this important relationship might shape up and broadly speaking what impact it may have.

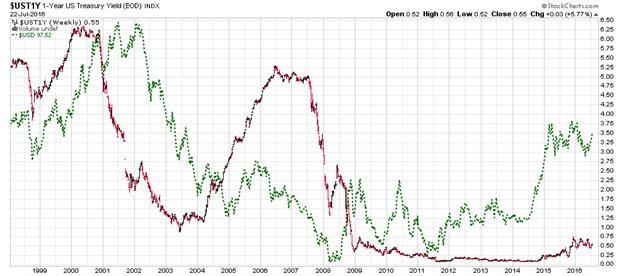

From an investment perspective it will also be seen that the dollar is likely to gain steadily in value over the coming years, with U.S. Treasury bonds falling correlatively. U.S. shares are also likely to see upward trends broadly continue, with “home” based exporters the main losers.

While on the campaign trail, Trump consistently lambasted the Fed, and its Chair. According to the President-elect, Yellen is 'very political and to a certain extent, I think she should be ashamed of herself.' She has been accused of being 'more political than Hillary Clinton', and of being part of a political establishment that has 'bled our country [the U.S.] dry.' The Fed itself has also been described as 'not doing their job.' Yet whilst such an aggressive tone might seem to preclude any kind of working relationship, you don't get to lead institutions such as the Fed and the U.S. Government without being able to cut deals with people you wouldn't normally break bread with.

"Never before have we had an incoming president not just criticize how Fed policy has been executed [...] but accuse the Fed chair of undermining the institution by being in political cahoots with his opponent and the White House [...] We're off the grid into uncharted territory".

James Pethokoukis, economic policy analyst at the AEI, a conservative Washington think tank. Source: LA Times

Six months ago the tone of the conversation was of course somewhat different. Then, Trump didn't think Yellen was doing a bad job. Recently, now that Trump is in office, there have been some conciliatory noises. Judy Shelton, senior fellow at Atlas Network and a Trump advisor, suggests that 'he’s [Trump] not urging her to resign at all [...] [H]e’s saying he’d want someone whose thinking is more in keeping with his own.'

In light of such softening, Yellen is likely to see out her term. This prognosis seems likely to hold, especially since markets tend to dislike the idea of a simultaneous change in leadership in both the Fed and the White House. Such dislike previously helped to keep both Ben Bernanke and Paul Volcker in their positions after an electoral handover. What most analysts now think is that Yellen will keep her position until her term ends in 2018, with a new person then being appointed. It might even be possible that Yellen will serve a second term should she and Trump surprise analysts and turn discord into concord.

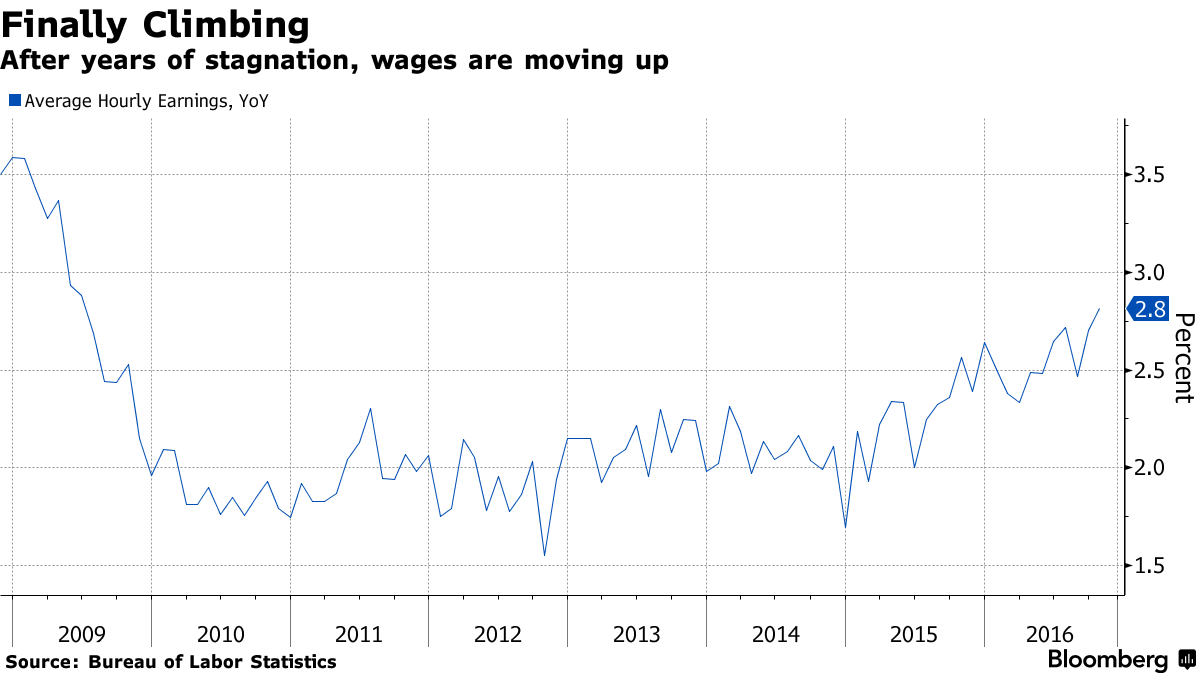

Wages are rising, good news for Trump-Yellen, or will increasing inflation and pressure for rate rises bring palpable discord out in the open? Source: Bloomberg

In terms of how the Yellen-Trump axis will impact the markets, there are four things to consider: interest rates, inflation, spending, and regulation of the Fed. Bond prices are likely to follow the news very closely with markets rising and falling inversely. The Trump stimulus ought to push up inflation, raise growth and consumer confidence, and be good news overall for market prices, the construction industry in particular, yet poses risks if rates rise too quickly in response. Any increased regulation of the Fed however, such as a previously proposed and now rumoured measure that would closely tie Fed changes to interest rates to changes in the economy, might lead to a decline in market confidence, and threaten the Feds longer-term ability to tackle potential crises. It's true of course that markets like predictability, but a set inflation-rate ratio might damage the impact of Trump's stimulus, and could in future stop the Fed from acting flexibly in times of difficulty.

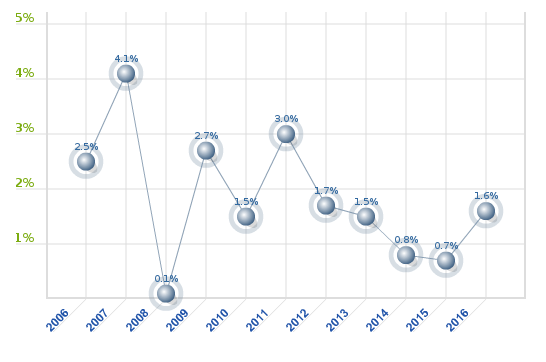

Flexible policy control, including the use of QE, kept inflation relatively stable, could regulation limit the Fed's effectiveness in dealing with the unexpected? Image: Us Inflation '06-'16. Source: usinflationcalculator.com

Regarding the Trump-Yellen relationship, now the dust has begun to settle, it seems clear that both will keep their powder dry, at least for now. With Trump still assessing the make-up of his own team, and Yellen focused on December's Fed meeting, now is not the time to knock over a potential hornets nest. Binyamin Appelbaum of the New York Times agrees that a truce, at least, will be the case for the immediate future. He even suggests that 'Trump could emulate Mr. Reagan and leave the central bank alone.

"When the two men finally met, Mr. Reagan asked Mr. Volcker why the country needed a central bank. He apparently found the answer convincing. Like other presidents in recent decades, he decided the Fed was reasonably effective and useful as a scapegoat. And in 1983, he nominated Mr. Volcker for a second term."

As per Binyomin Appelbaum. Source: The New York Times

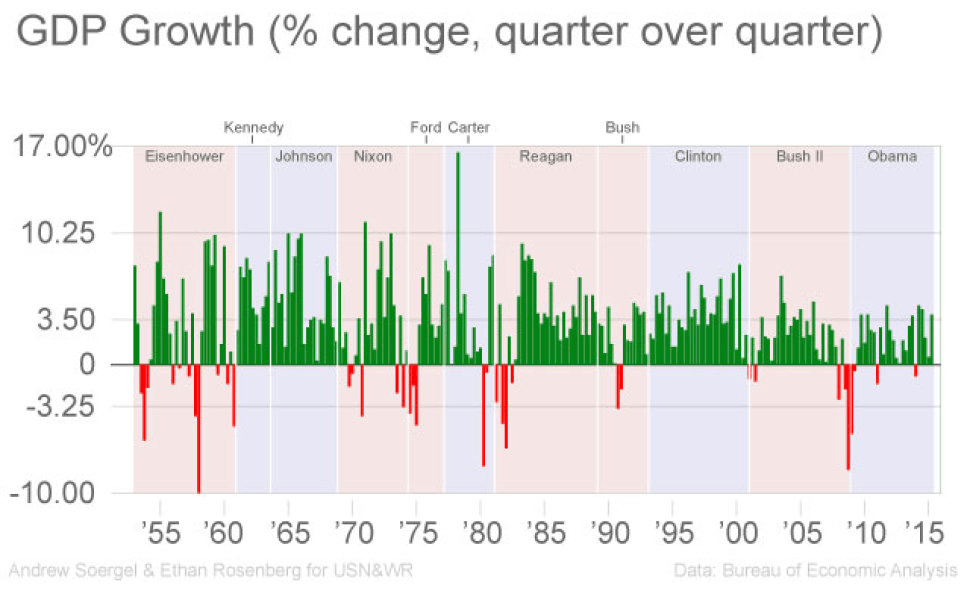

Reagan, the last celebrity President with an uncertain relationship with the Fed, didn't do too badly in terms of growth, will Trump? US GDP Growth per quarter, by President, '55-'15. Source: usnews.com

With discord between the leaders of two of the most important global institutions not a near term prospect, attention can instead be turned to policy. In the immediate future rate rises seem extraordinarily likely. Steady as she goes is the order of the day, and until something says otherwise, the American economy is doing rather well, so much so in fact that the Fed committee has judged that 'the case for an increase in the target range had continued to strengthen.' A rate rise is in the offing, with analysts from Bloomberg noting that federal funds futures markets indicate a 94 percent chance that the Fed will increase rates by 25 basis points at its December meeting. Bond prices will dip, but investors are likely to move their cash onto Wall Street, seeing share prices rise.

The longer term view is however more uncertain, given Trump's variable stance on interest rates, the Fed's likely response to his infrastructure proposals, and of course the change in the Fed's makeup during the next two years, with Trump able to appoint up to five new members in his first year and a half.

"Of course, the economic outlook is inherently uncertain, and, as always the appropriate path for the federal funds rate will change in response to changes to the outlook and associated risks."

Janet Yellen on the longer term view. Source: The Guardian.

At first glance, Trump's infrastructure spending will boost the Fed's ability to push up interest rates toward more “normal” levels, so that in the event of future recessionary trends, the Fed will have the ability to act conventionally, and will hopefully not need to rely on extraordinary measures such as QE. "They've been holding off [rate rises] until they see signs of inflation and inflation expectations," said John Cochrane, a senior fellow at the Hoover Institution at Stanford University, and Trump's stimulus may just give them the chance.

Trump's own views on rate rises, as has been noted, are less certain. On May the 5th, to CNBC, Trump said: 'I am a low interest-rate person. If we raise interest rates and if the dollar starts getting too strong, we’re going to have some very major problems.' Yet on November 13th, Trump argued that 'Janet Yellen should have raised the rates.' He has suggested that interest rates are 'a tremendous problem for the country and we are talking about rates that are practically at zero', and that inflation is a problem resolved by interest rate rises. Such a mixed message causes uncertainty, not least when his own flagship policy is inflationary in nature. As Lars Christensen notes 'Trump does not - yet - control monetary policy and if the Federal Reserve is serious about its 2% inflation target, it sooner or later will have to offset the Trumpflationary policies by hiking interest rates potentially aggressively and allowing the dollar to strengthen significantly.' Thus any potential peace agreement between Trump and Yellen might find itself suffering in the new year as the Presidentelect might see the Fed as damaging a campaign trail pledge to boost jobs and growth.

Trump's trade policies might of course further complicate any potential Yellen-Trump axis, with tariffs likely to raise inflationary pressures, but at the same time reduce growth, putting the Fed in a difficult position with regard to rate rises. Furthermore, from the point of view of currency markets, Trump's policies and Yellen's likely responses will almost certainly push up the price of the dollar, further undermining any desire for a weaker dollar to spur exports. This doesn't mean however that there isn't a potential area round which a Trump-Yellen axis might coalesce, there is: investment. Monetary policy, according to Fed officials, might be at the limit of its effectiveness, with efforts by other branches of government potentially needed to pick up the slack.

Fed officials across the spectrum have said they felt the US and global economies might benefit from more public investment, particularly if targeted to projects that would have a long-term payoff in the form of higher productivity.

Fed Officials. Source: CNBC.

The parallels between Yellen and Trump with Reagan and Volcker drawn by Applebaum may come to ring surprisingly true. Trump, like Reagan, will push for tax-cuts and increased spending on infrastructure and the military; a very Republican stimulus. This growth ought to enable rate-rises without too much pain, and whilst Trump might react angrily if rate rises are aggressive and damage the economic boost he seeks, a more doveish set of rate rises, with Yellen widely regarded as a dove, might provide both Trump and the Fed Chair with plenty to smile about. According to Ed Yardeni, chief investment strategist of Yardeni Research, Yellen’s 'gradual approach to normalizing monetary policy would enable the Trump administration to fund a massive infrastructure spending program at relatively low rates.'

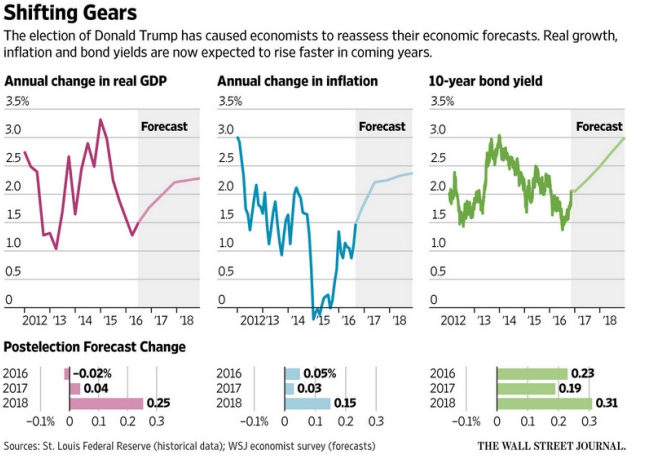

Changes in Forecasts post Trump. Source: The Wall Street Journal.

All things considered, it seems likely that in the short term the relationship between Trump and Yellen will be marked by a surprisingly peaceful coexistence. The longer-term perspective will be forged out of their mutual response to inflation, potential regulation, national spending plans, the price of the dollar, and rate rises. Whilst there remains significant potential for a furious clash of heads, there also seems to exist a strong possibility that pragmatism will rule the roost. The next two years, may yet see steady but doveish rate rises, and a large fiscal stimulus which will push up growth and boost markets.

The ticking time-bomb in terms of uncertainty may not after all be a Yellen-Trump fallout, but the likely high value of the dollar impacting the competitiveness of U.S. trade. What is clear however is that Trump watching brings to mind the phrase Kremlinology. Rumour has in fact become the news. Before he even takes office, what Trump might do seems set to continue to have strong consequences for what markets will do.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.