Financials: June Bonds are currently 1’10 higher at 165’05, 10 Yr. Notes 11 higher at 129’08 and 5 Yr. Notes 5.2 higher at 120’12. This mornings ADP private sector job survey showed the creation of 189,000 non-farm payroll jobs, well under the pre-report estimate of 225,000. This is often a precursor to the Monthly Jobs Report (this Friday) and culd be an indication of a negative Report. We are currently on the sidelines. That being said, I will be looking to once again go long 5 Yr./short 10 Yr. spreads when/if the 10 Yr. trades above 129’20.

Grains: May Corn is currently fractionally higher at 377’0, May Beans 5’4 higher at 978’6 and May Wheat 1’4 lower at 510’4. Yesterday’s planting intention report was initially negative Corn and friendly Beans showing more than expected acreage for Corn. I want to go long either May or Dec. Corn on any further breaks as we start to near long term support 5-15 cents below the market.

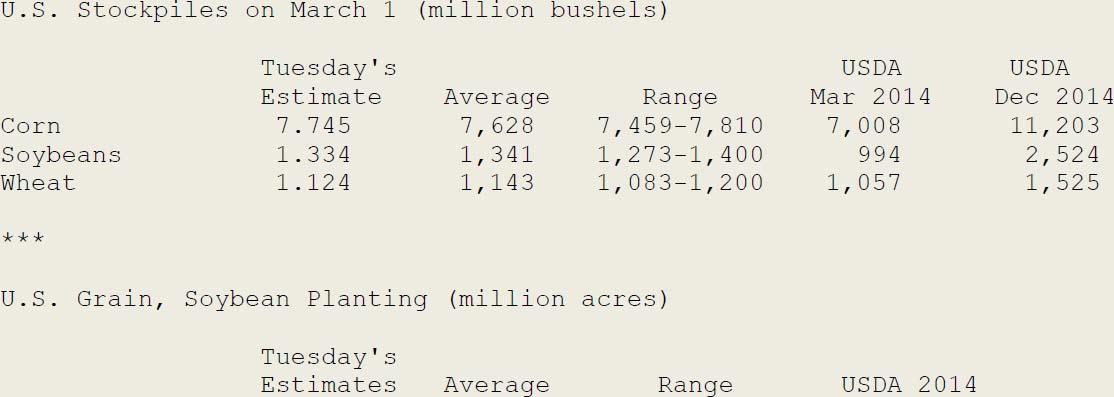

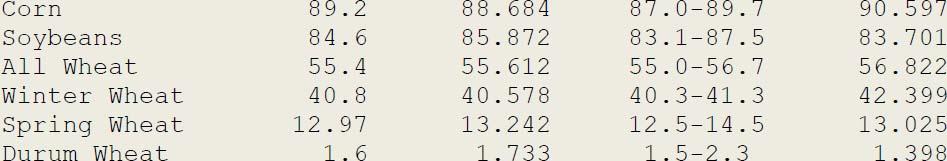

DJ USDA Report: Summary for Mar 1 Quarterly Grain, Soybean Stockpiles & U.S. 2015 Planting Reports

KANSAS CITY--The following table of analysts' estimates is provided as a service to The Wall Street Journal subscribers in conjunction with the U.S. Department of Agriculture's March 1 Quarterly Grain, Soybean Stockpiles and 2015 U.S. Grain, Soybean Prospective Planting reports.

Cattle: Live and Feeder Cattle closed moderately lower yesterday inspite of sharply lower feed grains after the Planting Intention Report. This encourages me to remain short for the moment with protective buy stops 250 points above the market. If Live and Feeder Cattle trade more than 100 lower today, lower your stop by a like amount or take profits. We remain long call spreads in June Hogs.

Silver: May Silver is currently 10 cents higher at 16.70 and June Gold 8.00 higher at 1191.00. We remain long.

S&P's: June S&P’s are currently 6.00 lower at 2055.00. The market has been quite volatile in the last 24 hours making an overnight low of 2033.50 when it appeared that talks with Iran could break down and rallied to 2060.75 when the Mar. 31 deadline was extended through today. Contine to treat as a trading affair between 2040.00 and 2080.00.

Currencies: AS of this writing the June Euro is currently 34 higher at 1.0788, the Swiss 61 higher at 1.0376, the Yen 6 higher at 0.8352 and the Pound 45 lower at 1.4792. I am currently on the sidelines. That being said, I feel that a positive outcome of talks with Iran will be initially friendly to the Euro as Europe will be a beneficiary of any signifcant lifting of sanctions. If you feel the need to trade these markets I recommend the long side of the Euro or the short side of the Dollar Index.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The Price Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this website is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

Recommended Content

Editors’ Picks

USD/JPY crashes below 157.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank below 157.00 on what seems like an FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.