Historically rates are at their lowest point. Arguably this allowed for central banks globally to refinance cheaply. It is inevitable as we move out of a recession that the appetite for profit will return. In the 70's and 80's, US interest rates were between 10 and 20 percent. In the UK it was roughly the same, as the need for cheap money dominated central banking policy rates declined steadily as the world plunged into debt. The last time rates were close to above 5% was pre-financial crisis, that is nearly 10 years ago. It is no wonder traders are confused about how important rates are to interest rate bearing currencies. To date, a trader who is 26 years old would have been 16 years old the last time rates were above 5%. This means such a trader could have only traded perceived value of a currency, rather than value in real terms. Let's face it, an industry were the average age is that of the Arsenal football team, are we really qualified to have an opinion on rate hikes?

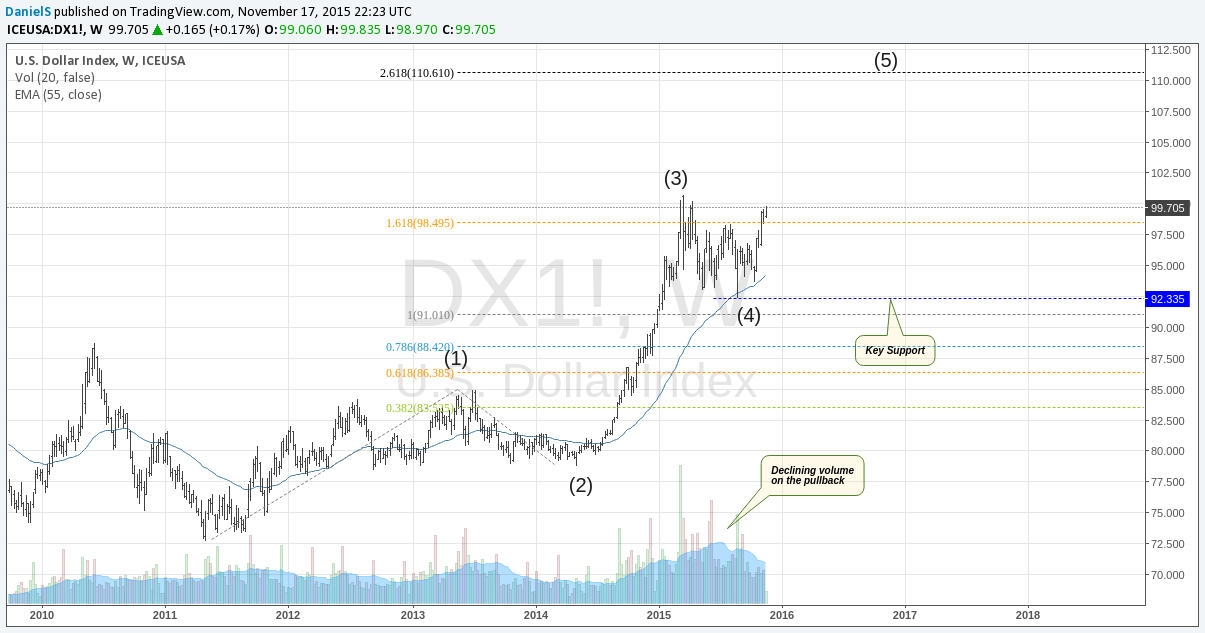

We believe that the FED is running out of time to decide on a rate hike. If they don't act now, they may have to raise rates faster and more aggressively and that could have serious consequences to home owners and those holding other types non-collateralized debt. The Dollar Index is near an all-time high but make no mistake the real value of a currency is in its interest rate, so a hike will likely send the Dollar Index past the 100 barrier. In the absence of technical volume, any pull back off the 100 level could be temporary. I guess we have to wait for the FED to decide. Roll on December...

Future stocks and stocks currently trending have large potential rewards but also large potential risk. You must be aware of the risk and be willing to accept them in order to invest in future stocks & FX markets. Don't trade with money you can't afford to lose. This video is neither a solicitation nor an offer to buy/sell future stocks or FX. No representation is made that any account will or is likely to achieve profits or losses similar to those discussed here. Past performace of indicators or methodology are not necessarily indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.