Global Markets

The global markets are anxiously awaiting the outcome of the Federal Reserve meeting tonight, in which the majority of investors anticipate that US interest rates will be increased for the first time in almost 10 years. Erratic movements continue to affect the currency markets as eager investors make the most of the incredible levels of volatility in the hope of being on the right side of one of the most anticipated financial events of 2015. While part of the unrestrained volatility in recent days could contribute towards the milestone lows found in the price of oil, there are still lingering concerns that the statement from the FOMC will be strictly dovish.

At the very least, it is highly expected that it will be reiterated once again that the pace of a US rate rise will be slow and controlled. Even though most equities have managed to claw back some losses from Monday, the firm expectations around the Federal Reserve raising US rates may spark a further selloff in global equities as speculations mount that higher US rates may trigger capital outflows from elsewhere.

The overflowing optimism around the likelihood that the Federal Reserve may raise US interest rates has limited how far Gold prices could advance and this has consistently threatened the bulls. This zero yielding metal is heavily bearish and with the Fed funds pricing an 80% chance of a US interest rate rise today, there is still a potential for Gold bears to install another round of selling momentum throughout metal trading in 2015. From a technical standpoint, prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The breakdown below 1063 may encourage sellers to send the metal towards 1046.

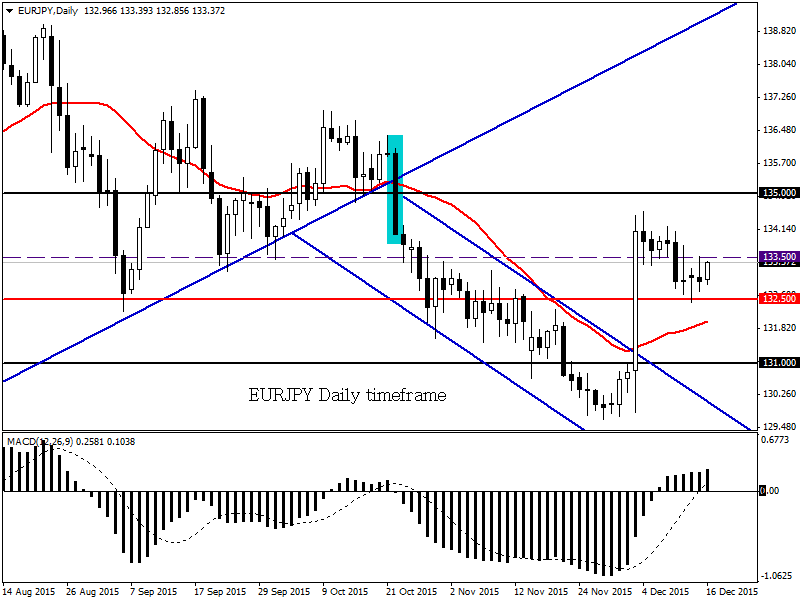

EURJPY

The EURJPY remains technically bullish on the daily timeframe as long as prices can keep above the 132.50 support. The impressive reaction around the ECB’s decision almost two weeks ago has created a flag pole for a potential bull flag formation. Prices are currently above the daily 20 and the MACD has crossed to the upside. An intraday breakout above 133.50 should encourage buyers to send prices towards 135.00.

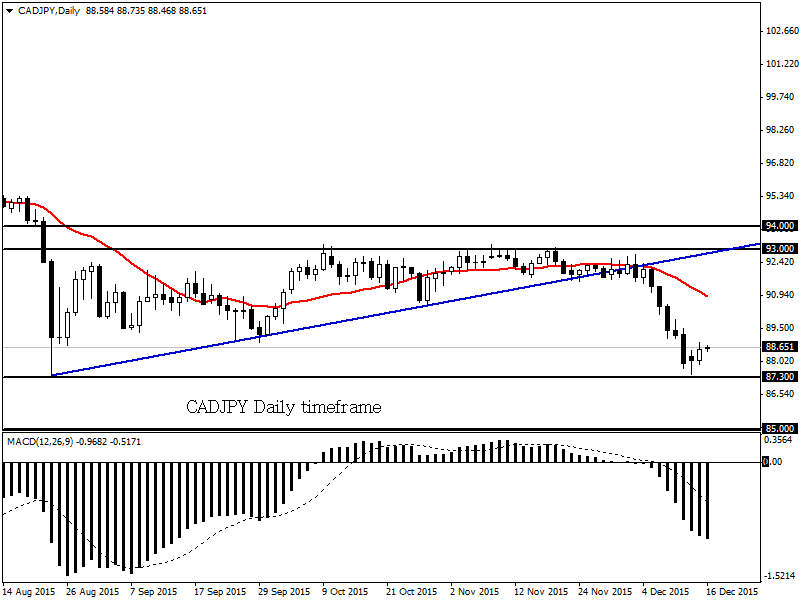

CADJPY

The CADJPY is technically bearish on the daily timeframe as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below 87.30 may invite an opportunity for a further decline towards 85.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.