Global Markets

Sterling bulls gained some stability as Tuesday’s solid construction PMI announcement negated some of the fears regarding the potential slowdown in economic momentum within the UK economy. Despite economic data in October from the UK losing its robust touch, November has started strong and this secure construction PMI of 58.8 may add to the mounting expectations that growth in Q4 for the UK may exceed forecasts. This week’s focus for the Sterling will be the Bank of England (BoE) meeting on Thursday in which the possibility of a UK November rate hike remains slim. Sentiment for the GBP drifts towards bullish regions and a hawkish BoE Carney may invite GBP bulls to challenge the 1.5500 resistance on the GBPUSD.

Last week’s hawkish FOMC statement instilled WTI bulls with some upwards momentum. This commodity has enjoyed an appreciation of over $3 as expectations escalate that demand for oil may increase on the back of a hawkish Fed. Regardless of this upsurge, the central theme of oversupply will continue to enforce downwards pressures on the price of WTI in the long term. With Russia increasing oil output to post-Soviet highs of 19.78 million barrels a day and concerns of China growth lingering on in the global markets, sentiment for WTI remains bearish. WTI bulls are already threatened and prices will most likely remain depressed as the dominant theme of a reduction in demand for oil pulls prices back to the $44.00 support.

In the late part of Tuesday’s trading session, the focus may be directed to the dovish Mario Draghi. Market participants may use this evening’s speech to sift for any additional information concerning the decision the central bank may take in December. Even though the stance in the previous ECB conference suggested that the central bank may implement further QE in December, there could be a possibility that the ECB is in standby mode in wait for the Fed to act before moving forward in 2016.

CADJPY

The CADJPY is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breakout above the 92.50 resistance may open a path to the next relevant resistance at 94.20.

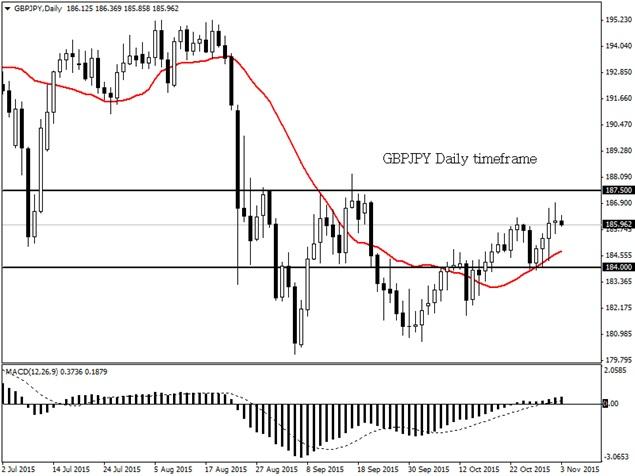

GBPJPY

The GBPJPY is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 184.00 support, there may be an incline to the next relevant resistance at 187.50.

GBPCHF

The GBPCHF is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 1.5100 support, there may be an incline to the next relevant resistance at 1.5400.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.