Global Markets

President of New York Federal Reserve, William Dudley, came to the rescue yesterday as his hawkish tone renewed some bullish sentiment within the Dollar. In the trading weeks of August, the major currency has been exposed to extended periods of weakness due to concerns that the longawaited US interest rate hike might be postponed, but the Federal Reserve official was upbeat about the state of the US economy and reiterated that any interest rate rises would be data dependent. He did provide confirmation that it is very doubtful that the central bank would raise rates in September, but there were growing fears that the Federal Reserve would postpone raising rates altogether, or possibly unleash another round of Quantitative Easing.

While the Federal Reserve official was explicit in stating that the case for a US rate rise next month was “less compelling”, the overall speech from Dudley yesterday was positive. Dudley further pushed back interest rate expectations by stating that the rate hike in September was less compelling, but reiterated that a US rate hike was data dependent. The US economy is performing robustly on a consistent basis, and the USD gained across the board after his statement because market participants saw this as an inadvertent message that a rate hike may be conducted in December. There has been a volley of positive news from the States which support this point, such as Consumer confidence on Tuesday printing at 101.5, whilst Core durable goods orders at 0.6% were both above expectations and showed that momentum within the US economy is still strong.

Inflation was a topic which was also covered in the meeting. Concerns remain that the drop in commodity prices combined with the strong USD would lead to further low inflation in the United States, but Dudley was confident that this would not last in the longterm. I question whether inflation in the US will rise anytime soon, because not only will low commodity prices and the strong USD continue to weigh on inflation, but inflation expectations are likely to be further pulled lower by the devaluation of the Yuan which has made imports from China to the United States substantially less expensive.

Overall, the main driver for the USD appreciation was renewed hope that a US interest rate rise is still possible before the end of 2015 and it feels like the USD has been offered another lifeline. With the emphasis on data dependency being strong, US economic data releases and specifically NFP reports will act as major drivers behind whether the Federal Reserve will raise rates before the end of 2015. It still appears inevitable that the Federal Reserve are going to begin raising interest rates in the future and Dudley’s tone indicated that it is a matter of timing on when the central bank chooses to do so, rather than if a hike will be postponed following the recent financial market volatility.

EURUSD

The EURUSD experienced a hefty decline to the downside yesterday as bullish sentiment was reimbursed within the USD. Prices closed above the 1.1300 level in yesterday’s sessions and have created an intraday incline into the new trading day. Technical leading and lagging indicators still suggest that EURUSD remains bullish on the timeframe with this decline acting as a correction. The pair trades in a delicate region with 1.1300 acting as the temporary trend defining level. A move back below here may suggest bullish weakness at it will also be below the 61.8% Fibonacci retracement level.

GBPUSD

The induced USD strength following the upbeat tone from Dudley caused the GBPUSD to plummet. From the near twomonth high slightly above 1.58, the GBPUSD has dropped over 300 pips in two trading days. Due to optimism remaining strong that both the Federal Reserve and Bank of England can soon begin raising interest rates, this pair remains fundamentally flat but it is technically now bearish. The final confirmation for further declines may be a daily close below the sticky 1.5450 support. Prices have crossed below the daily 20 SMA and the MACD is about to move to the downside. Momentum has also taken the GBPUSD below the monthly pivot. If the pair moves below the 1.5450 support, the next relevant support will be 1.5330. If would require a complete reversal of yesterday’s losses to suggest the pair is losing bearish momentum.

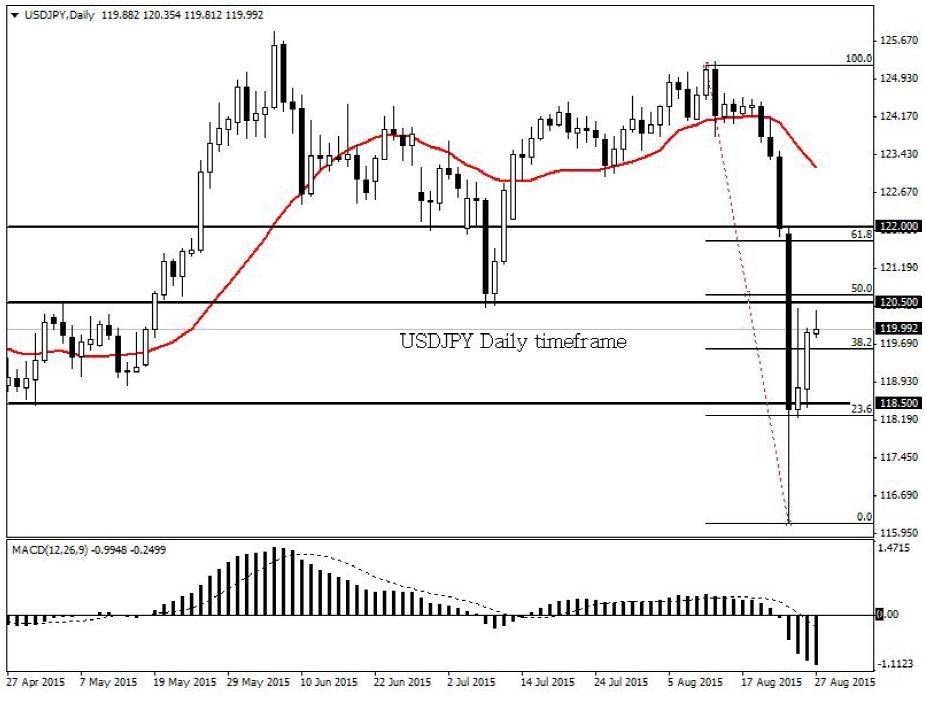

USDJPY

This week the USDJPY has experienced unfathomable levels of volatility which took prices to the near 116.0 level. I remain bearish on the USDJPY as long as prices can keep at least below the 120.50 pivotal levels. A Fibonacci retracement was drawn from the highs of 125.3 to the lows just above 116.0. As long as prices stay below the 50% Fibonacci, the bears can still take control once more. The lagging indicators such as the MACD and daily 20 SMA agree with this statement. If prices do breach 120.50, then the next relevant level holds at 122.0.

SILVER

An accelerated decline has been experienced on Silver this trading week. It looks like the issue of China, in addition to fears over global growth have taken its toll on this precious metal.

Silver is still technically bearish and a breakdown was experienced yesterday when prices broke through the 14.40 support. There may be a situation where previous support will become resistance which may entice Silver bears to take the metal all the way towards 11.50. It would require a move back above 15.00 to suggest the outlook is no longer bearish. With the MACD on the negative and prices below the daily 20 SMA, this is partially waiting game to see how prices react to 14.40.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.