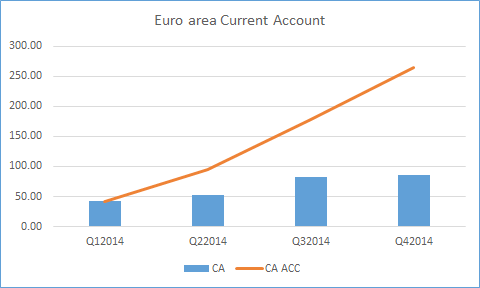

A major part of Balance of Payment is the Current Account Balance and throughout 2014 Euro area Current Account Balances accumulated a significant surplus as seen in the chart below.

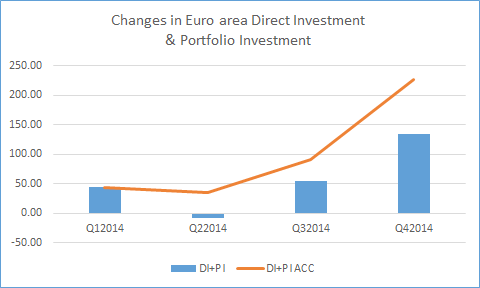

From the ECB’s monthly statistics we also receive details for Direct Investments and Portfolio Investments, showing the following development throughout 2014:

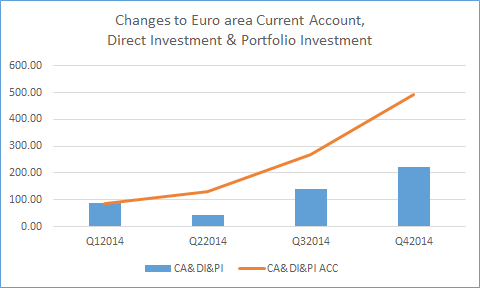

If we put the corporate sectors together with investment sectors, their net purchases of euros throughout 2014 amounted to almost € 500 billion.

This represented a massive support for the euro with those sectors being net buyers of euros to the average amount of € 2 billion per day.

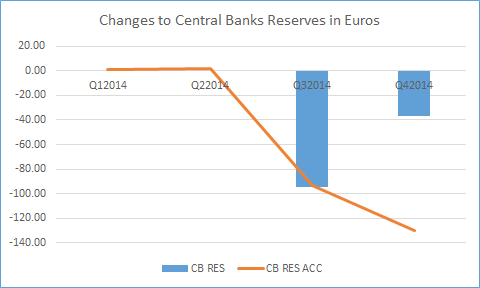

What some bought, others must have sold and earlier this month we got the IMF report on central bank members’ holding of different currencies. This is quarterly statistics and throughout 2014 central banks had trimmed their assets in euros as follows:

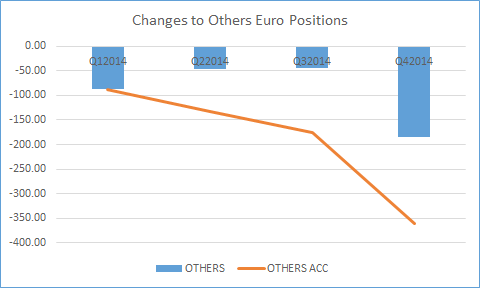

This leaves us with a balance of what “Others” must have sold throughout 2014, illustrated as follows:

Now – others can be several sources – but they are corporate sectors, classic investors or central banks – as illustrated above.

Adjusted for some “errors” or “adjustments” which are always part of the statistics, I claim that the bulk of “Others” are short-term, speculative positions in euros who have sold themselves down almost € 360 billion throughout 2014. They might not be this amount short, should they be long at the start of the year but the amount should illustrate the change to their overall euro position.

For the first three months of this year, current account balances have been in line with those seen throughout 2014. Direct Investments and Portfolio Investments are a bit down over the three-month period and for central banks’ reserves we do not have statistics yet. But from the figures we do know, the positions three months into this year should not be materially changed from those at the end of last year.

Now to the really interesting part.

There are reasons to believe that current account surpluses will be to the level of those seen last year. If so – that would mean net purchases of € 250+ billion from corporate sectors this year.

Investment portfolios might sell themselves further down – especially money market funds – should the low interest rate scenario continue. If they do, they will supply euros to corporate sectors.

What central banks will do in terms of trimming their euro assets is an open question – but given the size of what they did last year, I would guess there is a smaller amount to be done this year.

Let’s further assume Euro area inflation will pick up from both the low interest rate scenario and the low level of the euro and let’s assume Euro area growth will do the same. We have seen the first signals to this already.

Should such improved figures cause investment portfolios and central banks to stop trimming their euro exposure, we could be left with short-term speculative portfolios as the only source for corporate sectors to get their euros from. Such portfolios are classically vulnerable to most changes to data and especially to price movements.

Given the sizeable change such portfolios went through throughout 2014 and the rather predictable net amount corporate sectors will buy this year, the euro could be in for a significant appreciation in its value by the time the Euro area data start seeing the benefit of what the ECB is doing.

On top of the € 250 billion corporate sectors will buy, should those having sold the € 360 billion last year also start buying euros back, then the Fed might be the only one who could help them out. Without higher USD interest rates, I would think the position setup in the market - as illustrated above – could well take EURUSD back to 1.25-1.35 throughout the year.

It would be a surprise to man...

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.