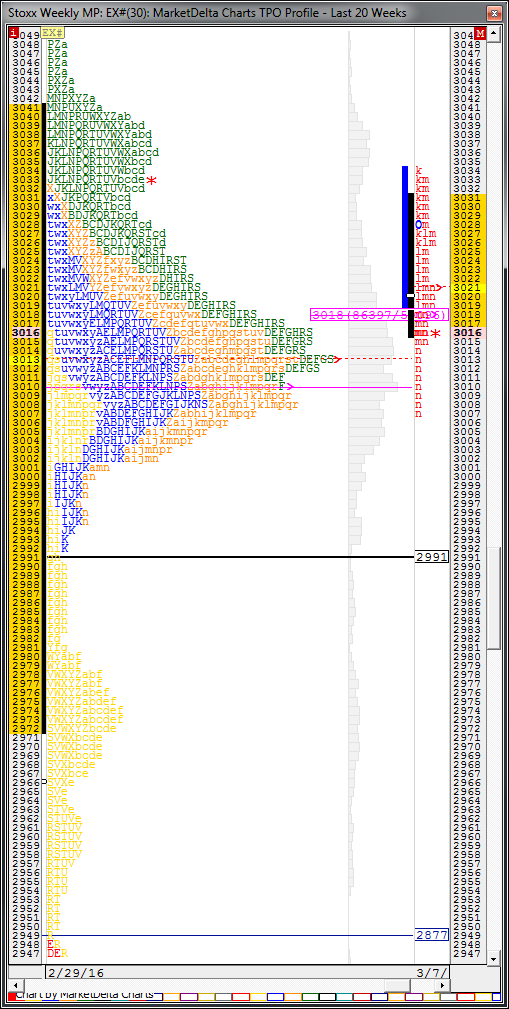

Stoxx balanced atthe highs

The Stoxx weekly profileshows plenty of balance at the highs which suggests participants building valueat higher prices. Normally this would point to some further upside but there issuch poor structure below that I think we may need a test lower before hand.remember there is that extremely poor low down at 2837 which in the long termstill needs repairing. In the short term however 2991 is key line in the sand.It;s the weekly Vn and also the lows of the 3 day balance area. A sustainedbreak below here will look towards 2966 and 2949. Any move through 91 thatdoesn't bring further follow through though and we'll have to start looking athigher prices again. Above 3042 is needed to for a look at 3062 and then3075-80.

200ma caps Spoo fornow

Friday saw a touch of the200dma in the Spoo for the first time since early January. Though it is prettyflat at the moment (indicating a lack of long term trend) the first touchesafter a longer period of time away from them generally provide good fadingopportunities for a scalp. Friday also left decent excess at the highs so fornow I'm expecting this to be the high for a few days at least. It has been alow volume squeeze higher which feels like it came to an end, at leasttemporarily on Friday. Whether it sticks longer term probably depends on Mr. Draghi.There is a very poor low which needs repairing at 1974.75 and through heretargets would be 1956-8 though this depends on 1964 not being defended onceagain. Through here and 1946 is likely to offer good support initially.

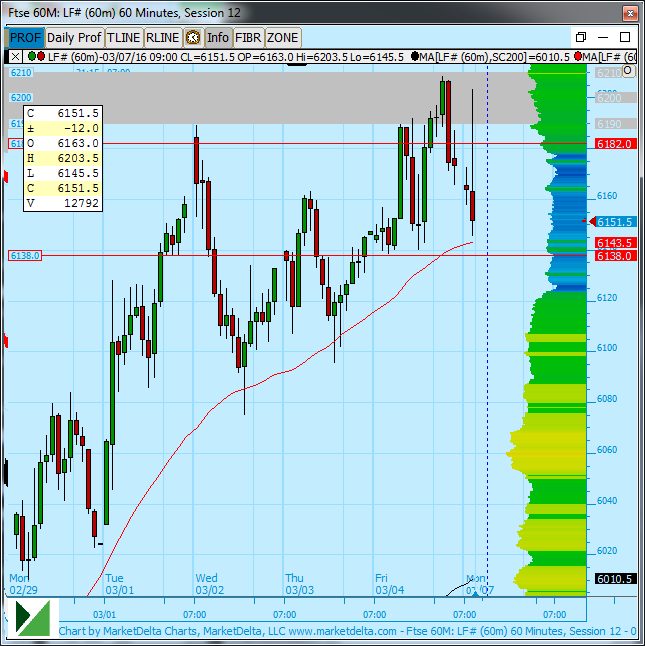

FTSE resistancestill holding

The grey shaded area in thechart is a zone I've had in all year and it looks like it's still working asresistance for now. The FTSE has tended to react to support and resistanceareas very well over the past few months, with levels often seeing multipletests and failures before finally breaking. As long as this area holds I'm inthe bear camp with eyes towards 6000-20 initially but ultimately a gap filldown at 6025. 6110-20 may offer some support on the first touch lower. A dailyclose above 6215 is needed to remove this bias.

.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.