Is the Spoo aboutto repeat September trick?

I don't think much needs tobe said with this chart. it is just an observation for now but Friday left anincredibly bearish candle after running up over the previous few weeks. This,coupled with the failure to get above the 61.8% of the years down move make mevery cautious going into this week. Today's close is likely to be important andbeing month end it could be fun and games all round. Watch this space.

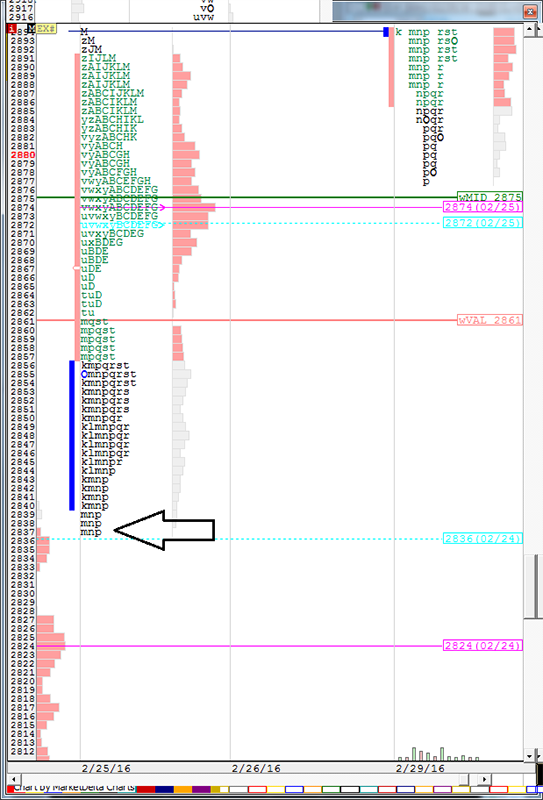

Stoxx poor lowunlikely to be left behind

Thursday saw the Eurostoxxleave an incredibly poor low before ramping. These lows are very rarely leftbehind and I expect this area to be revisted this week at some point. Whilethis doesn't give a trade opportunity right away, it is something to be awareof if you are long now. Any break of Friday's lows and I would expect this areato be the next target.

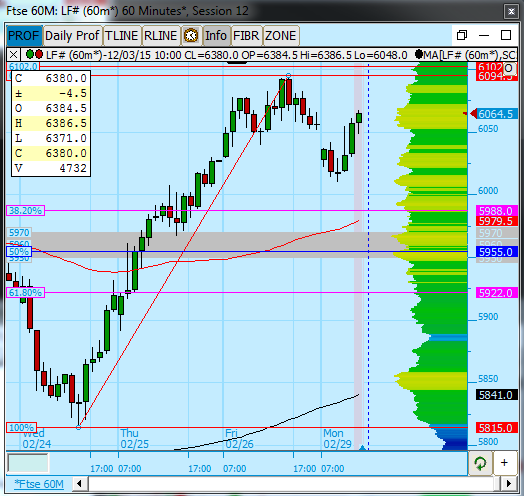

Watch for FTSEmonth end flows

FTSE is generally theequity market which has the most flow during the month end moves (typically inthe final 10 minutes of the cash hours and then the following five minutes ofsettlement). It has been outperforming in this recent leg higher so it could bethat we see a squeeze higher into the close I would argue that for this weeklongs are preferred until we break and hold below the 38.2% of the most recentmove. Targets above are at 6102, 6138 and the big one at 6182. That beingsaid, dont go into the final minutes blindly long. You'll see plenty of flow onther DOM (depth of market, or ladder) and this should give clues for fast moneymoves..

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.