INTRADAY CHART

22nd April:

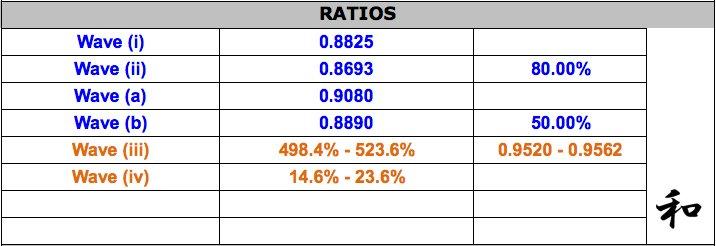

Within the adjusted bullish outlook we have either seen Wave -iv- or will between the 0.9281-0.9305 area (27%-33.3%) (max 0.9255 - 38.2%) for gains in Wave -v- too the Wave (iii) target between the 498.4%-523.6% projection at 0.9520 - 0.9562.

Once seen we should see Wave (iv) correct lower by around 14.6% - 33.3% retracement to the 0.9273 - 0.9435 area. This should then provide the basis for the uptrend to resume in Wave (v) to the daily target area.

RATIO TABLE

Good trading

Ian Copsey

Pro Commentary, FX-Strategy, FX-Strategy Pro Charts, and any related products or services, are analytical tools only and are not intended to replace individual research. The information provided here should not be relied on as a substitute for extensive independent research before making your trading/investment decisions. FX-Strategy is merely providing this service for your general information. No representation is being made that any software or training will guarantee profits or not result in losses from trading. The views are not necessarily those of FX-Strategy, its owners, officers, agents or employees. In addition any projections or views of the market provided may not prove to be accurate. FX-Strategy will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained in this service. Be sure to closely read and understand the risks of foreign currency trading as described on the FX-Strategy website.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.