Despite the Chinese continued intervention to support the offshore CNY exchange rate, the Asian major stocks indexes came under increasing downside pressure today, after the risk-off sentiment could contain the markets again during the US session sending S&P 500 to its lowest level since last Sep. 30 losing 2.5% yesterday closing at 1890.28.

The demand for safe haven sent the gold up to be trading near $1095, while the US treasuries prices were rising again with lower yields.

In the same time, The Japanese yen could be boosted across the broad by unwinding of the carry trades wave, as this low cost financing currency usually gains benefits during the dovish market sentiment which could push Nikkei 225 down to lose more than 650 points during today Asian session.

The Aussie which is sensitive to the Chinese developments has extended its falling with shanghai composite trading well below 3000 psychological level today, as the Australian economy depends mainly on exporting the raw materials especially to China which is looking now for soft landing of its economic expansion pace, after overheating years.

While Brent oil was coming under pressure to be traded below 30$ for the first time since April 2004 on spreading rumors about the probability of applying the Iranian nuclear deal by next Monday which can add daily 500k barrels initially, before increasing by 1m barrels within 6 months, as the Iranian national oil company has said.

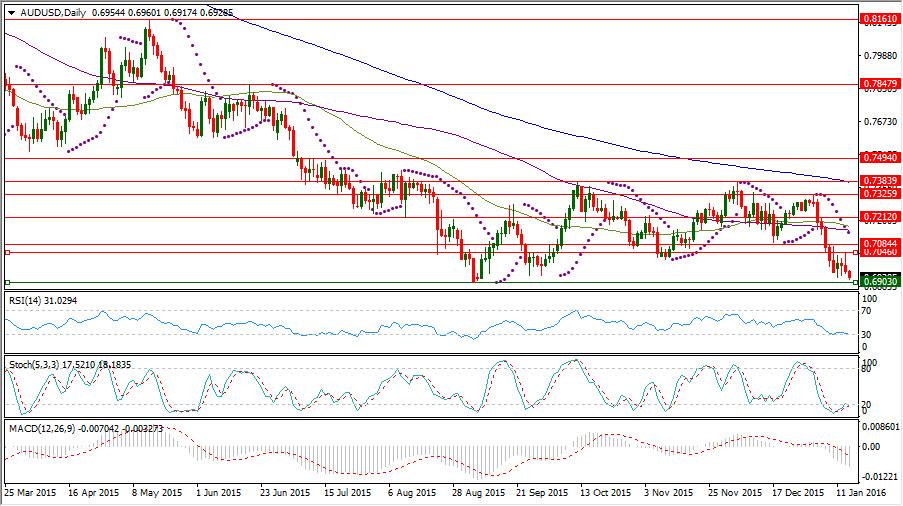

Instrument in Focus: AUDUSD

AUDUSD has fallen today to 0.6917 which has not been seen since last Sep. 7, despite the release of the Australian labor report of December which came today to show seasonally adjusted employment change retreating by 1k, while the market was waiting for losing 12.5k, after adding 75k in November with unchanged seasonally adjusted unemployment rate at 5.8% while the consensus was referring to rising to 5.9%.

AUDUSD came under pressure, after containing its rebound from 0.7095 following forming lower high at 0.7325 below 0.7383 resisting level.

The pair can be exposed to increasing of the downside momentum in case of breaking 0.6903 supporting level which could prop up the pair on last Sep. 4. AUDUSD daily Parabolic SAR (step 0.02, maximum 0.2) is now its ninth consecutive day of being above the trading rate reading today 0.7142.

AUDUSD daily Stochastic Oscillator (5, 3, 3) which is sensitive to the volatility is still having its main line in the oversold area below 20 reading 17.521 and also its signal line which is reading 18.183.

Important levels: MA50 @ 0.7172, MA100 @ 0.7152 and MA200 @ 0.7383

S&R:

S1: 0.6903

S2: 0.6769

S3: 0.6527

R1: 0.7046

R2: 0.7084

R3: 0.7120

AUDUSD Daily Chart:

Commodities: Brent FEB 16

On rumors about close implementing of the Iranian nuclear pact, Brent oil falling could outpace WTI slide yesterday shrugging off US EIA Oil stockpile of the week ending on Jan. 8 which came yesterday to show rising by only 0.234m barrels, while the market was waiting for adding 2.5, after gaining 5.085m in the week ending on Jan. 1.

Brent FEB 16 has been already under pressure by continued worries about the demand solidarity because of the economic slowdown signs from china and the weaker than expected manufacturing performance in US last month.

Brent FEB 16 capitalization on the Iranian Saudi tension was to form merely a peak at $38.97 just above its daily SMA20, before retreating acceleration could be extended for 9 days driving its daily Stochastic Oscillator (5, 3, 3) which is sensitive to the volatility to have its main line in the oversold area below 20 reading now 7.120 and also its signal line which is reading 6.435.

Important levels: Daily SMA20 @ $35.26, Daily SMA50 @ $40.50, Daily SMA100 @ $44.79 and Daily SMA200 @ $52.23

S&R:

S1: $29.63

S2: $29.02

S3: $28.09

R1: $32.37

R2: $34.70

R3: $38.97

Brent FEB 16 Daily chart:

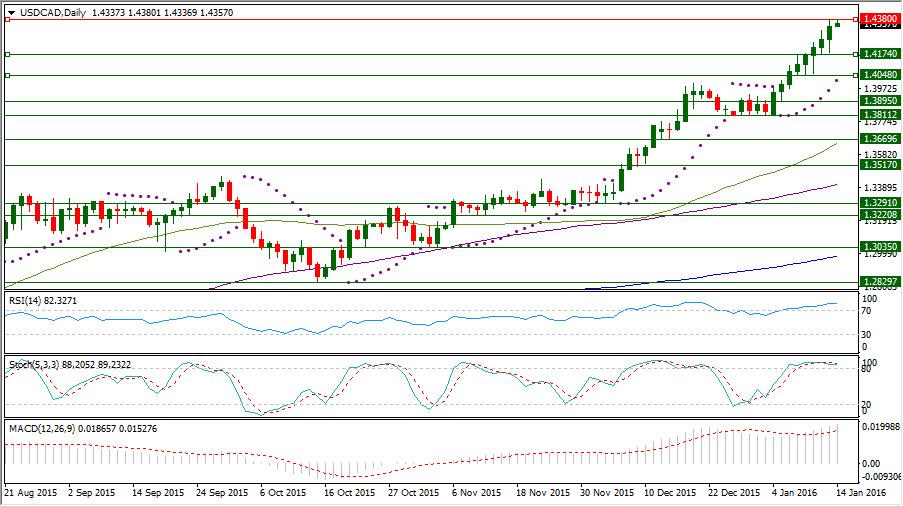

Hot instrument: USDCAD

CAD has been exposed to massive selling across the broad because of the aggressive oil falling which can erode the Canadian exports value causing financial pressure on the Canadian economy.

After ending consolidation between 1.40 and 1.3811 by getting over 1.40 psychological level, USDCAD could gain momentum to reach 1.4380 today having higher overbought parameters to be exposed to profit taken for fixing its current stance.

USDCAD daily RSI-14 is now in a higher place into the overbought area above 70 reading 82.327 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the its overbought area above 80 reading 88.205 and also its signal line which is reading now 89.232.

Important levels: Daily SMA50 @ 1.3646, Daily SMA100 @ 1.3405 and Daily SMA200 @ 1.2984

S&R:

S1: 1.4174

S2: 1.4048

S3: 1.3895

R1: 1.4380

R2: 1.4427

R3: 1.4491

USDCAD Daily chart:

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.