EURGBP - weekly 200MA

The EURGBP inverse Head and Shoulders has not quite reached its target circled at .8039-65 having been stopped by the weekly 200MA. This maybe the top of the current up move as profit gets taken back towards .7756. Last week's Marabuzo comes in at .7845 and though it has been breached, we are now trading back above it, forthe 200MA to be broken this week Marabuzo needs to hold. Whichever side ofthe 200MA we close this week could give a good clue for trading Cable and EURUSD going forward...

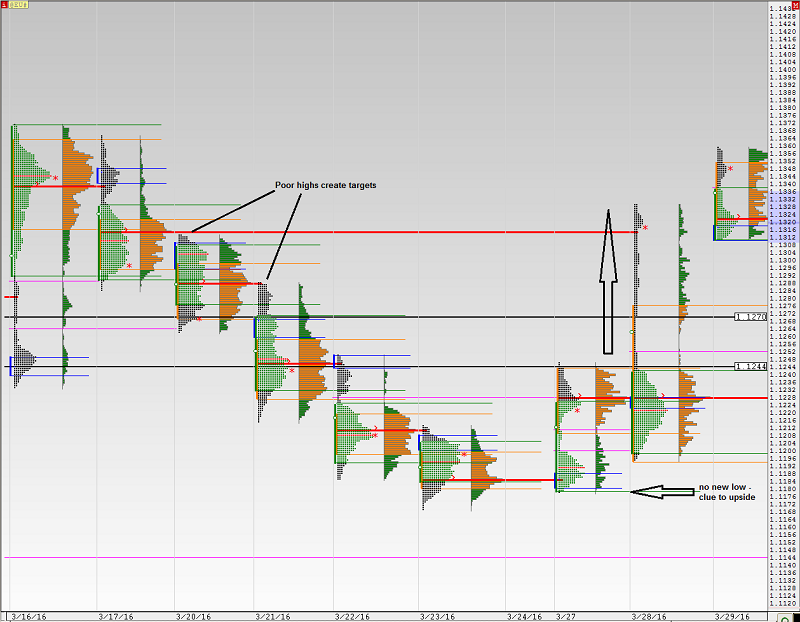

EURUSD dramatic end to 1-time-framing

The surge higher yesterday was definitely aided by Janet Yellen's extremely dovish remarks, however the clues to the move were already in place. Five days of one-time-framing whereby the prior day's high was not taken out whilst the low was, stopped. A new high and value shifting higher early this week, set up a move to target poor (multiple TPO) highs at 1.1288 and 1.1313. With the strong move higher and consolidation today, support is now found at 1.1270 and 1.1244either end of single print vacuum.

Commodity currency strength - AUD

Commodity currencies have surged this week despite modest dips in Oil and Copper. The Aussie found strength from first HVN support .7475 (mentioned in last week’s TNTV) and has moved higher to take the most recent swing high .7680, a close above here today will set the tone for further gains through the congested area (circled) to.7848. Those waiting for a deeper pull back to buy may now be forced to pay higher prices so .7595 old high should provide support. Only a failure below yesterday's low will bring a short term bearish bias.

.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.