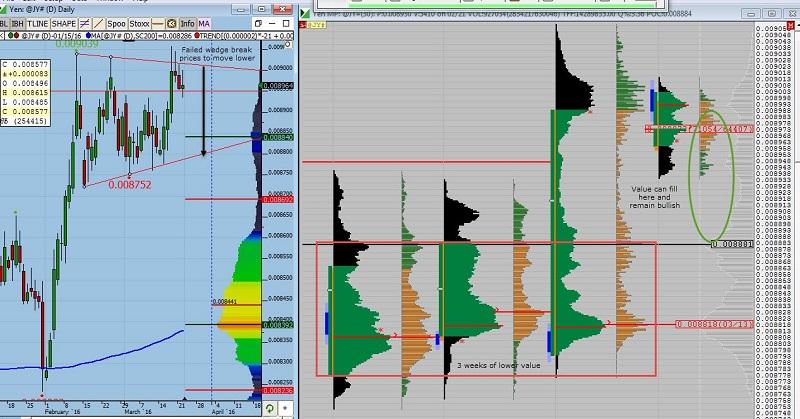

Yen Failed Wedge Break

A failure to extend higher after breaking the wedge should now bring about some downside as longs playing the break exit and shorts seeing this as a rejection of higher prices enter.The profile graphic also backs this up; the last three weeks have all left value lower and even the push higher could not shift it to the top of last week. There is a distinct lack of volume between .8993 and .8881 and with value lower, prices should get sucked back down to these areas, support at .8940-34 highs will be important. As long as value can be established above .8881 this week a move higher is still possible if less likely than a clear wedge break. A move back toward .8818 will look rather bearish.

Aussie - time for a pull back?

The commodity related strength in the Aussie has carried it a long way since breaking above .7350-98 resistance band, right up to key HVN (high volume node) at .7644. We will now be looking for a move lower to fill in some of the lower volume area back down to.7280, On a pull back attention needs to be paid to .7550, as volume drops notably below there, and LVN .7372, If either of these levels hold then bullish sentiment remains for a move higher; a second test of .7644 could trade quickly through, as the area has been well traded so does not need a great deal of time spent at it, leading the Aussie to .7746.

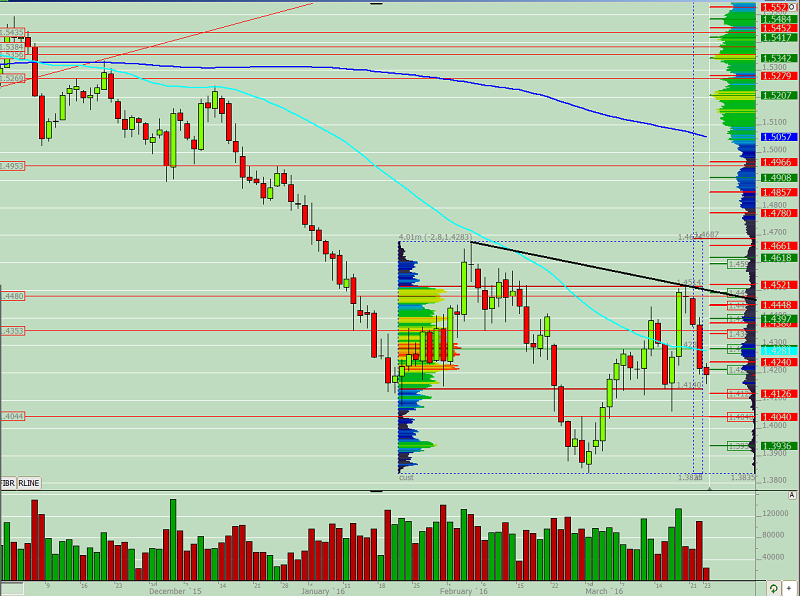

Cable - Terrorism increasing Brexit chances...

Following the shocking attacks in Belgium, the obvious expectation would be for Euro weakness however the weakest market has been Sterling partly due to the increased chance that a vote for Brexit is now more likely based on a fickle idea that it reduces the chance of similar attacks in UK. Key area now for Cable is 1.4060-40 LVN and previous high/low pivot a break below will signal a move towards 1.3835 lows. Any upturn and move back through he recent fall will look like an inverse Head and Shoulders with neckline break currently at 1.4480, a close above 1.4514 high would confirm a more sustained up move.

.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.