Oil Finding Some Interim Sellers

After the break of the Falling Wedge pattern, we had 2 relatively strong weeks where the market pushed higher however last week the market topped out at 41.90 and closed back inside the range of the previous week. This setup is also know as a "Swing Rebound"which is technically a sign of at least a short term reversal in price action which has actually followed through this week with oil down on th week and trading below 38.39. With oil now losing some steam the real area for the bulls to hold is the 34.82 level. If we can hold here there is still a medium term bullish case in place with the double bottom staying in place.

Gold Stalling It's Rally But Holding the Falling Wedge

Gold in recent weeks has been struggling to hold a bid above the 1260.8 region with the last 7 weeks all closing at or below that level. With the strong bull run losing some steam, we have come back down to test the Falling Wedge pattern and still holding above the key area for the bulls at 1189. If we can remain above here in the short term the case still remains bullish with a target at 1307 area. If we break below here however, there could be some short term covering back into the 1147 level which was a strong pivot in the past.

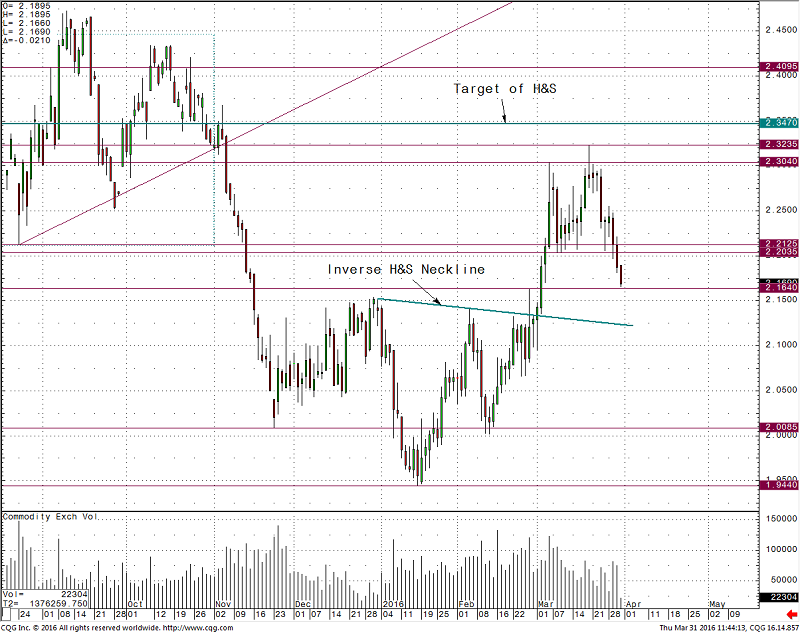

Copper Fails to Reach Inverse Head & Shoulders Target

Copper had broken a medium term bullish Inverse Head and Shoulders pattern at the beginning of March.This had sent the market higher as weak shorts were forced to stop out of their positions. After holding for some time above the 2.20-2.21 support, the market has broken below here this week and thus has failed to reach the measured target at 2.3470 above, leaving a top at 2.3235 in the interim. In the short term, the market has support at 2.1640 and to hold a short term bull bias,needs to hold above the neckline which comes in at about 2.12 at the moment.

.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.