Crude

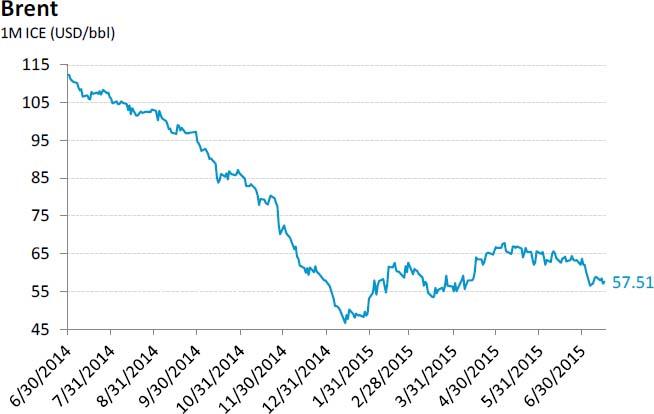

Oil has been under additional pressure since a deal on Iranian nuclear programme was reached on Tuesday. Price of the front-month contract on Brent fell well below 60 USD/bbl.

Though greater downward pressure on the prices occurs in the middle and at the longer segment of the forward curve as it is generally expected that the lifting of the sanctions could have more pronounced effects in the end of this year at the earliest and in medium to long-term in general, news that Iranian tanker is en route to Asia suggests that some oil may start leaking to the market soon. This is, of course, a downside risk factor for oil prices already in the short-term as more aggressive pricing strategy that would allow Iran to place more oil in the market may be expected. Let us recall that estimates suggest that Iran may store between 20 – 40 million barrels of oil in a floating storage.

As concerns our outlook for oil prices for quarters to come, fundamentals are in our view not yet indicating that the price will change its direction soon. As concerns demand, we believe that the risks tend to be skewed towards a decline in the price of oil (China, seasonally lower demand in the U.S. during autumn). Regarding oil production, U.S. ‘shale oil’ producers have resisted lower prices fairly well so far. Moreover, the agreement on Iran’s nuclear programme, unless it fails for some reason or another, suggests that production in that country may grow significantly in the years to come. This means that the period of relatively lower prices of oil may persist longer than it originally appeared.

Chart of the day:

The oil price has been under pressure since the deal on Iranian nuclear programme was reached.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.