Crude

Despite falling below 62.5 USD/bbl in intraday trading, the oil price eventually settled unchanged yesterday. Market thus largely ignored comments of Saudi Oil minister Naimi who said that the kingdom has pumped around 10 million barrels of oil per day in April; Naimi’s comments have reminded that Saudi’s decision to fight for its market share is still in place.

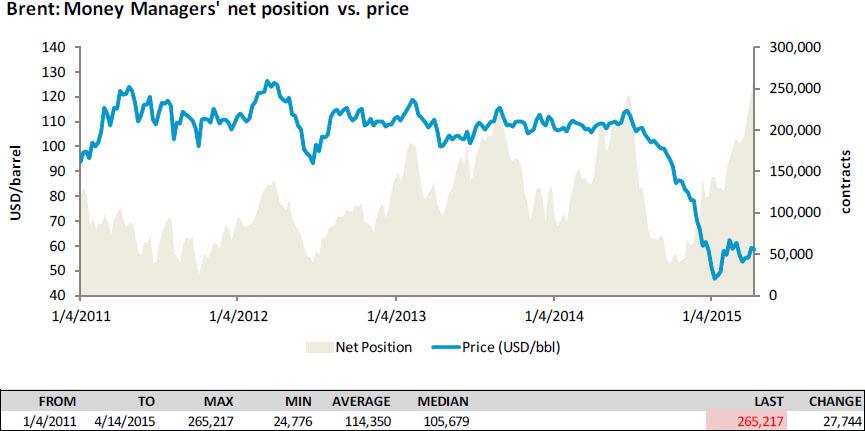

An interesting piece of data was released by the Intercontinental Exchange yesterday. The Commitment of Traders report showed that money managers’ net position in Brent futures hit an all-time high last week (see the chart below). The “headline” data thus suggest that speculators as a group bet quite heavily on an increase in oil prices.

On the other hand, the difference between a number of traders holding long positions and a number of traders holding short positions in Brent futures was relatively narrow (compared to the past episodes of high net position) which signals that though speculators as a group expect increase in oil prices, they are internally divided in their expectations. Clearly, some of them must have been betting quite heavily on an increase of oil prices. Tomorrow’s EIA data on US crude & products inventories will therefore certainly draw market attention (as well as similar API data released today) and could trigger quite a strong reaction, especially if the stocks figures surprised to the upside and some speculators unwound their long positions.

Chart of the day:

Net money managers’position in Brent futures (ICE) hit an all-time high last week. Report’s history dates back to the beginning of 2011.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.