Crude

The price of oil climbs towards 114 USD/bbl (a nine-month high) level today in early trading as worries of possible supply disruptions in Iraq continue to mount. Let us recall that Iraq become the second largest OPEC oil producer as it overtook Iran and in 2012 it was the world’s sixth exporter of oil.

Yesterday, anti-government rebels from ISIL (Islamist State in Iraq and the Levant) advanced further to the South and are reported to be seen about an hour’s drive away from Baghdad. Given the worsening security situation and inability of Iraqi government and army to stop them, market worries about possible supply disruptions are mounting, even though the majority of oil production takes place in the South of Iraq. Due to recent development, U.S. president Obama said he did not exclude military strikes against the jihadists.

Yesterday, Iraqi Kurdish forces who took advantage of the departure of the rebels took control of oil hub Kirkuk which - apart from being a home to a small oil refinery - is the origin of the Kirkuk-Ceyhan pipeline which leads oil from Iraq via Turkey to Mediterranean Sea. According to the EIA, the route consists of two parallel pipelines with a capacity of 1.65 million barrels of oil per day. Nevertheless, the EIA also notes that only one of the pipelines is fully operational and theoretical export capacity is thus lower, about 600 thousand barrels per day. However, main press agencies have not reported any disruption in oil flows so far. The main share of Iraqi oil (from southern oilfields) is nevertheless exported via Basrah Oil Terminal which is located on the Persian Gulf.

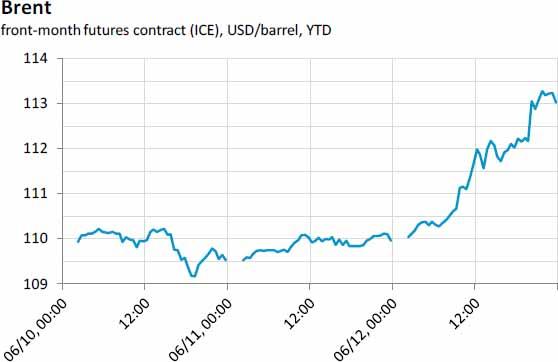

At the time of writing of this note, the July contract on Brent, which is expiring today, is trading at 113.60 USD/bbl (August contract is seen at 113.16 USD/bbl). The price of oil falls from a nine-month high of 114.69 USD/bbl as the International Energy Agency said that “the latest events in Iraq may not, for now, put additional Iraqi oil supplies immediately at risk”.

Chart of the day:

Brent price surged to a ninemonth high as a security situation in Iraq further deteriorated yesterday.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.