The FED did not actually bring anything new to the table, saying that they will tapper QE when the economic situation improves, something we all already knew. But it was how market read the news, and not what was actually said what moves the market. Stocks had been under pressure ever since the Minutes, after posting record highs almost daily basis during May: investors are not so confident now on ad eternum QE, and therefore, dollar buyers are back to fight.

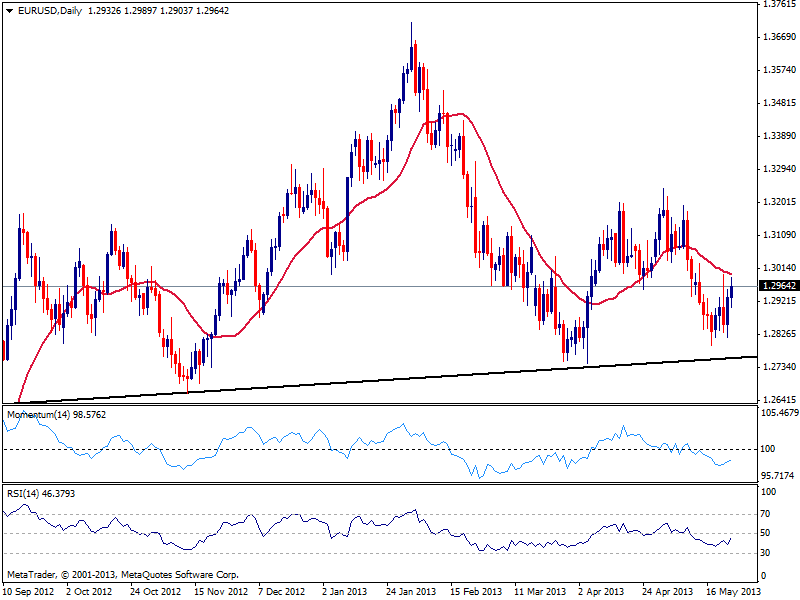

The EUR is one of the few majors that points to close the week positive against the greenback, with the EUR/USD daily chart showing sellers around 1.3000, 20 SMA in the mentioned time frame, and indicators trying to correct higher, still in negative territory. Further recoveries need to push price above 1.3040 area and with a weekly close above it, chances turn to the upside next week, towards 1.3200 price zone, top of its recent range.

The figure is not yet discarded, but is now on hold: as long as price stays above 1.2744, yearly low, there’s not enough technical signs of a bearish continuation, while a break below this last will likely trigger a stronger bearish rally, eyeing then 1.2660, November 2012 low, ahead of 1.2430/60 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.