EURUSD prints fresh multi-year lows as ECB to begin QE on Monday, making this a trend which is unlikely to change from domestic news any time soon.

Summary

- Rates remained on hold, as expected

- ECB confirm QE will begin on Monday

- ECB to purchase euro based publish sector from the secondary market

- This will continue until a sustained path towards 2% inflation has been achieved

- ECB upgraded growth forecast from 1% to 1.5% in 2015 and 1.5% to 1.9% in 2016

- However nominal growth will remain weak though as ECB downgraded their inflation

- Forecast, making it likely the QE program will be extended beyond 2016.

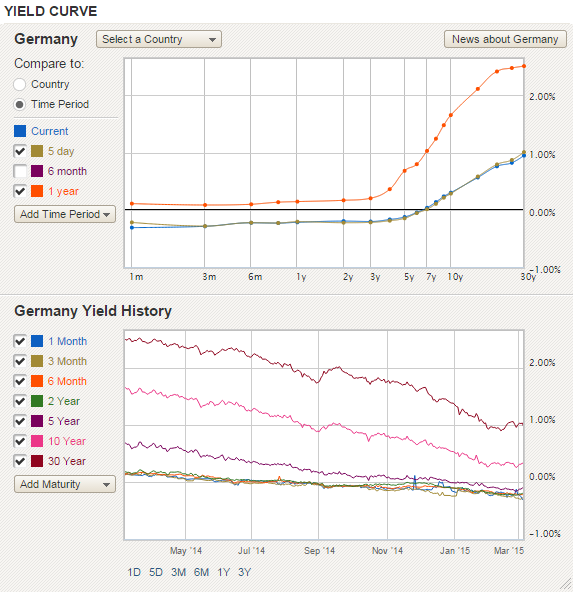

With bond yields across the Eurozone increasingly negative, across the yield curve, EURUSD is not a market I would want to be calling a bottom on any time soon. The decline from 1.40 highs is becoming increasingly bearish, so the only hope of pullbacks is if we see a weakening USD. Of course a delay in the June rate hike from FED may help with a sizeable retracement but not likely to change the tide, so to speak.

Nonfarm payroll data out could push Euro down further if over 200k jobs are created and at the current rate of decline the Euro could be below 1.0775 next week. Any tick higher is likely to attract bearish attention making it a case of assessing resistance levels to sell into.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.