USDCAD remains firmly within a correction but the data set from US and Canada tonight should at least shake things up a little.

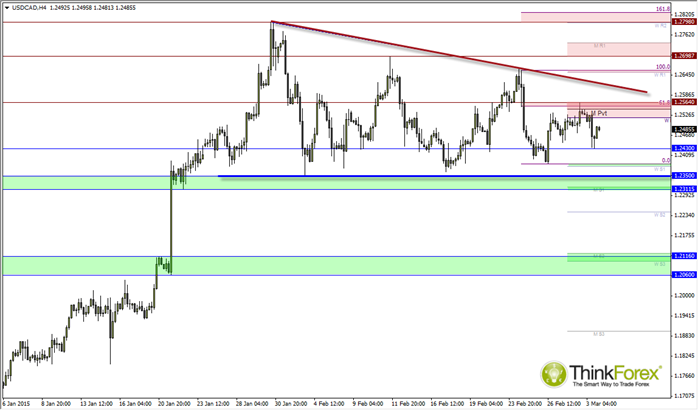

USDCAD continues to coil up within a corrective fashion but at this stage we cannot rule out a topping pattern. Of course any break below 1.2350 would likely signal a deeper correction (not an actual top) as the broader trend is clearly bullish across multiple higher timeframes.

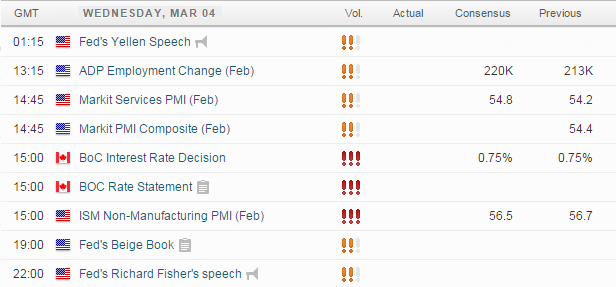

Tonight we have a host of data from both US and Canada which could provide some volatility but it now becomes a question of how much direction we can expect too. As we require a divergence between the data sets to establish cleaner trends we do stand a higher chance of whipsaws and U-turns before an eventual trend becomes established, if at all.

Canada's Rate Decision is at risk of providing downwards pressure on USDCAD if rates remain on hold and I beleive this to be the likely outcome, if recent comments from Gov Poloz are anything to go by. The statement may provide extra clues as to the likelihood or timing but, at the same time, the Central Bank has not provided clear forward guidance this year.

Yellen could also bring downside pressure on USDCAD if she continues to cast doubts on the June rate hike, which I also believe to be a strong possibility (especially as we get nearer to June).

Yesterday produced a Bullish Hammer but we do have several levels of resistance between 1.252 and 1.256 which may scupper any decent rally before recycling back towards the lower end of the correction pattern.

Overall my bias for tonight's session is down towards the 1.224 lows, albeit a choppy one.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.